The United States (US) Position Sensor Market size is expected to reach $2.1 Billion by 2030, rising at a market growth of 8.1% CAGR during the forecast period. In the year 2022, the market attained a volume of 3807.2 Thousand Units, experiencing a growth of 10.4% (2019-2022).

The position sensor market in the United States has been experiencing significant growth and evolution, driven by technological advancements, increasing demand for automation across various industries, and the rising adoption of Internet of Things (IoT) devices. One of the key drivers behind the growth of the position sensor market in the U.S. is the expanding automotive industry. As the automotive sector embraces electric and autonomous vehicles, the demand for advanced position sensing technologies has soared.

Another contributing factor is the adoption of position sensing technology in automotive applications. With the increasing integration of advanced driver assistance systems (ADAS), electric power steering, and autonomous vehicles, the demand for high-precision position sensors has surged. These sensors enable precise control of vehicle components such as throttle position, pedal position, steering angle, and transmission gear position, thereby enhancing vehicle performance, safety, and efficiency.

In terms of technology, magnetic position sensors, optical encoders, and capacitive sensors are among the widely used types in the U.S. position sensor market. The choice of sensor technology depends on factors such as accuracy requirements, environmental conditions, and cost considerations. As manufacturers continue to innovate and improve these technologies, the industry is expected to witness the introduction of more advanced and specialized position sensors tailored to specific applications. The COVID-19 pandemic significantly impacted the U.S. position sensor market, leading to disruptions in supply chains, production activities, and consumer demand.

The United States has witnessed a remarkable surge in the adoption of digital output technology within the position sensor market, reflecting a transformative shift in various industries. One key driver behind the increasing adoption of digital output in position sensors is the relentless pursuit of enhanced precision and reliability. Digital output technology offers superior accuracy compared to traditional analog alternatives, making it particularly attractive in applications where precise positioning is critical. Industries such as aerospace, automotive manufacturing, and robotics in the U.S. are embracing this technology to elevate the efficiency and performance of their systems.

The demand for real-time data and seamless integration with advanced control systems has further propelled the shift towards digital output in position sensors. With the ongoing Industry 4.0 revolution, where connectivity and data exchange are paramount, digital output sensors facilitate the seamless flow of information, enabling smarter decision-making processes. This is especially evident in the U.S. manufacturing sector, where the Industrial Internet of Things (IIoT) is becoming increasingly ingrained.

Moreover, the U.S. automotive industry is a significant contributor to the surge in digital output adoption. The integration of position sensors with advanced driver assistance systems (ADAS) and autonomous vehicles requires precise and instantaneous data, making digital output sensors the preferred choice.

According to Select US, the U.S. automotive industry substantially grew in 2020, with international automakers successfully producing 5 million vehicles. Furthermore, the sector experienced a noteworthy influx of foreign direct investment, reaching $143.3 billion in 2019. The expansion of this industry extended beyond domestic borders, as the United States exported 1.4 million new light vehicles and 108,754 medium and heavy trucks in 2020, with a combined value exceeding $52 billion. Additionally, automotive parts valued at $66.7 billion were exported to over 200 industries worldwide. This robust performance reflects the flourishing position sensor market within the U.S. automotive sector, showcasing its significant contribution to both domestic and global economic landscapes.

As industries in the U.S. continue to prioritize efficiency, automation, and connectivity, the adoption of digital output technology in position sensors is expected to maintain its upward trajectory. Thus, the surge in digital output adoption in U.S. position sensors, driven by the pursuit of precision and Industry 4.0 demands, is notably pronounced in industries like aerospace, automotive, and robotics, showcasing its pivotal role in advancing efficiency and connectivity.

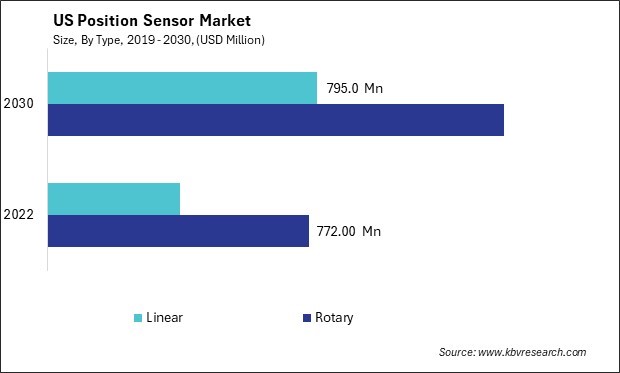

The United States is witnessing a significant surge in the demand for linear position sensors, thereby reshaping the landscape of the position sensor market. The rising emphasis on smart manufacturing and Industry 4.0 initiatives has propelled the integration of advanced sensing technologies, including linear position sensors in the U.S. The aerospace and defense industry in the U.S. is also a major contributor to the increased uptake of linear position sensors. These sensors find applications in critical areas such as aircraft control systems, where accuracy and reliability are paramount for ensuring the safety and functionality of aerospace equipment.

According to the International Trade Administration, the U.S. aerospace sector continues to produce the highest trade balance ($77.6 billion in 2019) and the second-highest level of exports ($148 billion) among all manufacturing industries. The growing prevalence of linear position sensors in the U.S. position sensor market reflects a notable trend.

The growing trend of electric mobility and the development of charging infrastructure for electric vehicles in the U.S. are additional factors contributing to the increased adoption of linear position sensors. Furthermore, the U.S. agricultural sector is undergoing a technological transformation, often called AgTech. Linear position sensors are crucial in modern agricultural machinery, enabling precision farming techniques. These sensors contribute to the accuracy of seed placement, crop monitoring, and other agricultural processes in the U.S., thereby optimizing resource utilization and increasing overall efficiency in the farming sector.

According to the U.S. Department of Agriculture, in 2021, the agriculture, food, and associated industries played a significant role in the U.S. economy, contributing approximately $1.264 trillion to the gross domestic product (GDP), representing a 5.4% share. Notably, the output from American farms alone accounted for $164.7 billion, comprising around 0.7% of the total U.S. GDP. The growing prevalence of linear position sensors in the U.S. position sensor market is transforming the landscape by providing enhanced accuracy and efficiency. This adoption parallels the intricate interdependencies within the agriculture sector, where various components work cohesively to contribute to the overall economic output.

The U.S. government's focus on infrastructure development, including smart cities and transportation systems, is another driver for the rising adoption of linear position sensors. Hence, the surge in linear position sensor adoption in the United States is driven by the convergence of factors such as Industry 4.0 initiatives, aerospace and defense applications, and the government's emphasis on infrastructure development in smart cities and transportation systems.

The position sensor market in the United States has been witnessing significant growth, driven by the increasing demand for automation and the integration of position sensing technology across various industries. One prominent player in the U.S. position sensor market is Honeywell International Inc. The company has a strong presence in manufacturing a wide range of sensors, including position sensors, which find applications in the aerospace, automotive, and industrial sectors. Honeywell's position sensors are known for their accuracy and reliability, making them crucial components in advanced control systems.

Curtiss-Wright Corporation is another notable participant in the U.S. position sensor market, particularly in the aerospace and defense sectors. The company's position sensors are crucial in mission-critical applications, providing accurate and reliable data for aircraft and military systems. Curtiss-Wright's expertise in rugged and reliable position sensing technology has positioned it as a trusted supplier in these demanding industries.

Another major contributor is T.E. Connectivity Ltd., a global technology company with a diverse product portfolio. T.E. Connectivity offers a variety of position sensing solutions tailored for different applications, such as automotive, industrial, and medical. With a commitment to innovation, T.E. Connectivity continues to play a pivotal role in shaping the landscape of position sensing technology in the U.S.

Allegro MicroSystems, LLC, is a key player specializing in developing high-performance position sensors. The company focuses on providing innovative solutions for automotive and industrial applications. Allegro's sensors are designed to meet the stringent requirements of modern systems, contributing to the overall efficiency and performance of various devices and machines.

Infineon Technologies AG, a semiconductor manufacturing company, is making significant strides in the U.S. position sensor market. With a focus on automotive and industrial applications, Infineon's sensors contribute to developing smart and connected systems. The company's technological advancements in sensor solutions cater to the growing demand for precise and reliable position sensing. As these companies continue to invest in research and development, the U.S. position sensor market will likely witness sustained expansion and evolution in the coming years.

By Type

By Contact Type

By Output

By Application

By Vertical

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.