USA Roadside Assistance Market Size, Share & Trends Analysis Report By Service, By Vehicle (Passenger Vehicles, and Commercial Vehicles), By Provider (Motor Insurance, Independent Service Provider, OEM, and Others), Outlook and Forecast, 2023 - 2030

Published Date : 26-Mar-2024 |

Pages: 63 |

Formats: PDF |

COVID-19 Impact on the US Roadside Assistance Market

The USA Roadside Assistance Market size is expected to reach $9.1 billion by 2030, rising at a market growth of 4.2% CAGR during the forecast period.

The roadside assistance market in the United States has experienced substantial growth and evolution, driven by various factors that reflect consumers' changing needs and preferences. One of the key drivers behind expanding the roadside assistance market in the U.S. is the increasing complexity and sophistication of modern vehicles. As automobiles become more technologically advanced, breakdowns or malfunctions often require specialized knowledge and equipment for repair. Roadside assistance services have adapted to this trend by providing traditional services like towing and tire changes and incorporating technical support for issues related to electronic systems and software.

Moreover, the rise of on-demand services and the sharing economy has contributed significantly to the growth of the roadside assistance market. With the popularity of ridesharing and car-sharing platforms, there is an increased need for prompt and reliable assistance in case of emergencies. This has led to innovative roadside assistance models that cater specifically to these new forms of mobility, offering tailored solutions for drivers participating in ridesharing services or utilizing shared vehicles.

Market Trends

Growing Number of Automotive Companies Providing Roadside Services

The automotive industry plays a pivotal role in the thriving roadside assistance market in the United States, offering essential services to drivers facing unexpected vehicle breakdowns or emergencies. Roadside assistance has become an integral part of the automotive ecosystem, providing peace of mind to motorists and ensuring their safety on the nation's vast road networks. One of the primary drivers of the roadside assistance market in the U.S. is the sheer size and complexity of the country's road infrastructure. With millions of vehicles traversing the extensive network of highways and byways, the likelihood of breakdowns or accidents is substantial.

In the U.S., major automotive manufacturers and service providers have recognized the increasing demand for roadside assistance, prompting them to offer comprehensive programs beyond traditional warranties. These programs often include services such as towing, battery jump-starts, tire changes, fuel delivery, and lockout assistance. The competitive landscape has led automotive companies to differentiate themselves by enhancing the scope and efficiency of their roadside assistance offerings.

Additionally, technological advancements have played a pivotal role in reshaping the roadside assistance landscape. Many automotive companies leverage mobile apps and telematics to streamline the request process, providing users with real-time assistance updates and improving the overall customer experience. These technological enhancements enhance service delivery efficiency and contribute to a more seamless and user-friendly interaction between drivers and roadside assistance providers.

According to the Alliance for Automotive Innovation, in the United States, the automotive manufacturing sector plays a significant role, contributing 11% to the country's Gross Domestic Product (GDP). The overall manufacturing economy of the U.S., ranked as the eighth largest globally, generated $2.64 trillion in value added in 2021. Within this robust manufacturing landscape, the production of motor vehicles and related parts accounts for 6% of the total manufacturing output and constitutes 11% of the durable goods subsector.

As the automotive industry continues to thrive, a parallel trend is emerging with the increasing number of automotive companies offering roadside services. This growth in the provision of roadside assistance aligns with the broader economic impact of the automotive sector, further enhancing its influence on the U.S. economy. Thus, the success of the automotive industry and the flourishing roadside assistance market in the U.S. are interconnected, both playing pivotal roles in ensuring a smooth and secure driving experience for the nation's diverse fleet of vehicles.

Rise of Insurance Companies Offering Roadside Assistance

In recent years, the roadside assistance market in the United States has witnessed a notable surge in the presence and prominence of insurance companies offering these services. Traditionally dominated by standalone roadside assistance providers and automobile clubs, this shift marks a significant evolution in the industry landscape. Insurance companies capitalize on their financial stability and vast networks to negotiate partnerships with towing companies, repair shops, and other service providers. This enables them to offer nationwide coverage, ensuring their customers receive timely assistance regardless of location.

The rise of insurance companies entering the roadside assistance market is attributed to several factors. The insurance companies recognize the value of diversification as they seek to expand their service offerings beyond traditional coverage plans. By incorporating roadside assistance into their portfolios, they enhance their product range and cater to the growing demand for comprehensive and all-encompassing coverage.

Moreover, insurance companies leverage their existing customer base and infrastructure to integrate roadside assistance services seamlessly. This approach allows them to cross-sell and bundle services, providing customers with a one-stop solution for their insurance and roadside assistance needs. This synergistic strategy enhances customer loyalty and fosters increased revenue streams for insurance companies.

Competition Analysis

The roadside assistance market in the United States is a crucial component of the automotive industry, providing services that range from towing to flat tire assistance. AAA (American Automobile Association) is among the roadside assistance industry's most well-known and established names. With a long history from 1902, AAA provides a wide range of automotive services, including emergency roadside assistance, towing, battery service, and flat tire assistance. The company is a federation of motor clubs throughout North America, serving millions of members.

As a subsidiary of Allstate insurance giant, Allstate Roadside Services leverages its parent company's resources to provide a wide range of roadside assistance solutions. Allstate's offerings often extend beyond traditional services, incorporating features such as trip interruption coverage and mobile app-based service requests.

Good Sam is a specialized provider of roadside assistance services for RVs and campers in the U.S. They offer towing, flat tire assistance, fuel delivery, and even coverage for travel interruptions. Good Sam is well-regarded among the recreational vehicle community for its comprehensive and tailored assistance programs.

Agero is a leading provider of roadside assistance and connected vehicle services. The company partners with automotive manufacturers, insurance companies, and fleet managers to deliver a range of roadside assistance solutions. Agero utilizes advanced technology to streamline the assistance process, ensuring timely and efficient support for drivers.

National General offers roadside assistance through its motor club. The company provides towing, flat tire assistance, lockout protection, and trip interruption coverage. National General's roadside assistance is available as an add-on to its auto insurance policies or as a standalone service.

Better World Club distinguishes itself by being an environmentally friendly alternative in the roadside assistance market. They offer towing, battery service, and flat tire assistance in the U.S. Additionally, they promote eco-friendly practices and provide discounts for hybrid and electric vehicle owners.

List of Key Companies Profiled

- Allstate Insurance Company

- Agero, Inc. (The Cross Country Group, LLC.)

- Falck A/S

- Paragone Motor Club, Inc.

- SOS International A/S

- Viking Assistance Group (P&C Insurance Holding Ltd.)

- ARC Europe SA

- Chubb Limited

- Allianze SE

- Prime Assistance Inc. (Sompo Holdings)

US Roadside Assistance Market Report Segmentation

By Service

- Towing

- Tire Replacement

- Fuel Delivery

- Jump Start & Pull Start

- Battery Assistance

- Lockout & Replacement Key Service

- Trip Routing & Navigational Assistance

- Winch

- Others

By Vehicle

- Passenger Vehicles

- Commercial Vehicles

By Provider

- Motor Insurance

- Independent Service Provider

- OEM

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Roadside Assistance Market, by Service

1.4.2 USA Roadside Assistance Market, by Vehicle

1.4.3 USA Roadside Assistance Market, by Provider

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.3 Porter’s Five Forces Analysis

Chapter 3. US Roadside Assistance Market

3.1 US Roadside Assistance Market by Service

3.2 US Roadside Assistance Market by Vehicle

3.3 US Roadside Assistance Market by Provider

Chapter 4. Company Profiles – Global Leaders

4.1 Allstate Insurance Company

4.1.1 Company Overview

4.1.2 Recent strategies and developments:

4.1.2.1 Partnerships, Collaborations, and Agreements:

4.1.3 SWOT Analysis

4.2 Agero, Inc. (The Cross Country Group, LLC.)

4.2.1 Company Overview

4.2.2 SWOT Analysis

4.3 Falck A/S

4.3.1 Company Overview

4.3.2 Financial Analysis

4.3.3 Segmental and Regional Analysis

4.3.4 SWOT Analysis

4.4 Paragone Motor Club, Inc.

4.4.1 Company Overview

4.5 SOS International A/S

4.5.1 Company Overview

4.5.2 Financial Analysis

4.5.3 Segmental and Regional Analysis

4.5.4 SWOT Analysis

4.6 Viking Assistance Group (P&C Insurance Holding Ltd.)

4.6.1 Company Overview

4.6.2 SWOT Analysis

4.7 ARC Europe SA

4.7.1 Company Overview

4.7.2 SWOT Analysis

4.8 Chubb Limited

4.8.1 Company Overview

4.8.2 Financial Analysis

4.8.3 Segmental and Regional Analysis

4.8.4 SWOT Analysis

4.9 Allianze SE

4.9.1 Company Overview

4.9.2 Financial Analysis

4.9.3 Recent strategies and developments:

4.9.3.1 Partnerships, Collaborations, and Agreements:

4.9.4 SWOT Analysis

4.10. Prime Assistance Inc. (Sompo Holdings)

4.10.1 Company Overview

TABLE 2 US Roadside Assistance Market, 2023 - 2030, USD Million

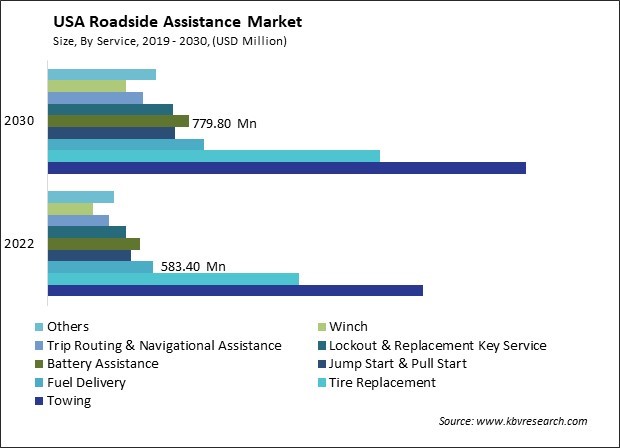

TABLE 3 US Roadside Assistance Market by Service, 2019 - 2022, USD Million

TABLE 4 US Roadside Assistance Market by Service, 2023 - 2030, USD Million

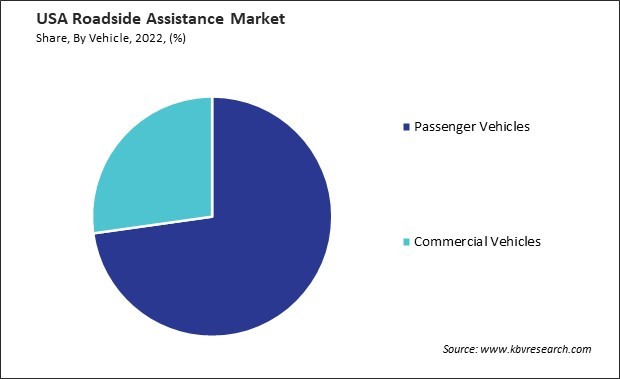

TABLE 5 US Roadside Assistance Market by Vehicle, 2019 - 2022, USD Million

TABLE 6 US Roadside Assistance Market by Vehicle, 2023 - 2030, USD Million

TABLE 7 US Roadside Assistance Market by Provider, 2019 - 2022, USD Million

TABLE 8 US Roadside Assistance Market by Provider, 2023 - 2030, USD Million

TABLE 9 Key Information – Allstate Insurance Company

TABLE 10 Key Information – Agero, Inc.

TABLE 11 Key Information – Falck A/S

TABLE 12 Key Information – Paragone Motor Club, Inc.

TABLE 13 Key Information – SOS International A/S

TABLE 14 Key Information – Viking Assistance Group

TABLE 15 Key Information – ARC Europe SA

TABLE 16 Key Information – Chubb Limited

TABLE 17 Key Information – Allianze SE

TABLE 18 Key Information – Prime Assistance Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 US Roadside Assistance Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Roadside Assistance Market

FIG 4 Porter’s Five Forces Analysis – Roadside Assistance Market

FIG 5 US Roadside Assistance Market Share by Service, 2022

FIG 6 US Roadside Assistance Market Share by Service, 2030

FIG 7 US Roadside Assistance Market by Service, 2019 - 2030, USD Million

FIG 8 US Roadside Assistance Market Share by Vehicle, 2022

FIG 9 US Roadside Assistance Market Share by Vehicle, 2030

FIG 10 US Roadside Assistance Market by Vehicle, 2019 - 2030, USD Million

FIG 11 US Roadside Assistance Market Share by Provider, 2022

FIG 12 US Roadside Assistance Market Share by Provider, 2030

FIG 13 US Roadside Assistance Market by Provider, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: Allstate Insurance Company

FIG 15 SWOT Analysis: Agero, Inc.

FIG 16 SWOT Analysis: Falck A/S

FIG 17 SWOT Analysis: SOS International A/S

FIG 18 SWOT Analysis: Viking Assistance Group

FIG 19 SWOT Analysis: ARC Europe SA

FIG 20 SWOT Analysis: Chubb Limited

FIG 21 SWOT Analysis: Allianz SE