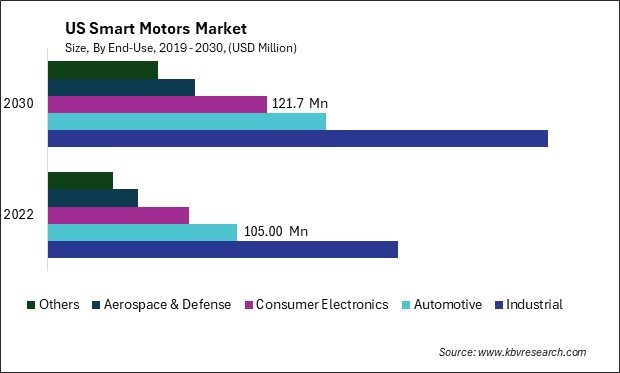

US Smart Motors Market Size, Share & Trends Analysis Report By End-use (Industrial, Automotive, Consumer Electronics, Aerospace & Defense, and Others), By Product, and Forecast, 2023 - 2030

Published Date : 17-May-2024 |

Pages: 81 |

Formats: PDF |

COVID-19 Impact on the US Smart Motors Market

The United States (US) Smart Motors Market size is expected to reach $695.5 Million by 2030, rising at a market growth of 5.3% CAGR during the forecast period.

The smart motors market in the United States has been witnessing significant growth in recent years, driven by advancements in automation, increasing demand for energy-efficient solutions, and the proliferation of Internet of Things (IoT) technology. One of the key drivers fueling the growth of the smart motors market in the U.S. is the rising adoption of automation in manufacturing processes. Manufacturers in the U.S. are increasingly investing in smart motor technology to automate their production lines, streamline operations, and improve productivity.

Furthermore, the growing emphasis on energy efficiency and sustainability is driving the demand for smart motors in the U.S. energy regulations and environmental concerns have prompted industries to seek more efficient motor solutions to reduce energy consumption and carbon emissions. Smart motors incorporate advanced control algorithms and energy-saving features that enable them to operate more efficiently than traditional motors, making them an attractive choice for American businesses looking to achieve their sustainability goals while reducing operating expenses.

The integration of IoT technology is another factor contributing to the expansion of the smart motors market in the U.S. IoT-enabled smart motors can communicate with other connected devices and systems within industrial environments, facilitating seamless integration and data exchange. This connectivity enables advanced analytics, real-time performance monitoring, and remote-control capabilities, empowering businesses to make informed decisions, optimize processes, and improve overall operational performance.

The COVID-19 pandemic has also significantly impacted the smart motors market in the U.S. While the initial outbreak led to disruptions in supply chains and manufacturing operations, the subsequent recovery and adaptation phase saw an accelerated adoption of automation and digitalization technologies, including smart motors. Industries sought to enhance resilience, minimize dependence on manual labor, and improve operational efficiency in response to the challenges posed by the pandemic. As a result, the demand for smart motors surged across various sectors, driving industry growth amidst the ongoing economic uncertainties.

Market Trends

Rising adoption in the aerospace sector

The aerospace sector in the United States is undergoing a significant transformation with the rising adoption of smart motors. One of the key drivers behind the increasing adoption of smart motors in the aerospace sector in the U.S. is the relentless pursuit of innovation and efficiency. Aerospace companies are constantly seeking ways to improve the performance of their aircraft, spacecraft, and related systems. Smart motors offer several advantages over traditional motors, including higher precision, better control, and increased energy efficiency.

According to the International Trade Administration, the robust performance of the U.S. aerospace sector, boasting the highest trade balance at $77.6 billion in 2019 and ranking second in exports with $148 billion, underscores its prominence in manufacturing. Over the years, there has been a significant surge in total shipments of U.S. aircraft and parts, soaring to an impressive $162 billion from 2010 to 2018. This trend parallels the rising adoption of smart motors within the aerospace sector, as they cater to the industry's demand for advanced technologies and efficient solutions.

Moreover, the aerospace industry's stringent safety standards require highly reliable components and systems. Smart motors are designed to meet these demanding requirements, with built-in diagnostic capabilities that enable proactive maintenance and troubleshooting. By continuously monitoring key parameters such as temperature, vibration, and operating conditions, smart motors detect potential issues before they escalate into serious problems, thus enhancing the overall safety and reliability of aerospace systems in the U.S.

Another factor driving the adoption of smart motors in the aerospace sector in the U.S. is the growing trend toward electrification and automation. As aircraft and spacecraft become increasingly electrified, there is a growing need for advanced motor systems that deliver the power, precision, and control required for next-generation propulsion, avionics, and auxiliary systems. Thus, the increasing adoption of smart motors in the U.S. aerospace sector is driven by a pursuit of innovation, efficiency, and the growing trend toward electrification and automation.

Growing demand for variable-speed drive

The United States' smart motors market is experiencing a notable surge in demand for variable speed drives (VSDs), driven by several factors shaping modern industrial and commercial landscapes. One significant driver of the growing demand for VSDs is the increasing emphasis on energy efficiency and sustainability across industries. With stricter regulations and a heightened awareness of environmental impact, businesses are turning to VSDs to optimize energy consumption by precisely matching motor speed to the required load, resulting in significant energy savings.

Furthermore, the proliferation of automation and digitalization in industrial processes is fueling the adoption of smart motor technologies, including VSDs. Smart VSDs offer enhanced monitoring, diagnostics, and predictive maintenance capabilities integrated with advanced control systems and IoT connectivity. By leveraging real-time data analytics, businesses in the U.S. optimize motor performance, detect potential faults early, and schedule maintenance proactively, minimizing downtime and maximizing productivity.

In sectors such as manufacturing, HVAC (Heating, Ventilation, and Air Conditioning), and water/wastewater treatment, where motors are ubiquitous, the demand for VSDs is particularly pronounced. These industries rely heavily on motor-driven equipment, and adopting VSDs enables precise control over processes, leading to improved product quality, operational flexibility, and overall system reliability. Therefore, the surge in demand for variable speed drives (VSDs) in the United States is driven by energy efficiency mandates, automation trends, and the need for enhanced performance across various industries.

Competition Analysis

The smart motors market in the United States is a rapidly evolving sector driven by technological advancements and the growing demand for automation and energy efficiency across various industries. Several key players are leading the charge in this dynamic industry, each offering innovative solutions to meet the diverse needs of customers. One prominent company in the U.S. smart motors market is Rockwell Automation, which specializes in industrial automation and control solutions. The company offers a comprehensive range of smart motor products, including servo motors, stepper motors, and integrated motion control systems. Rockwell Automation's smart motors are designed to optimize performance, reliability, and safety in manufacturing processes, helping customers achieve greater efficiency and competitiveness.

Another major player in the U.S. smart motors market is General Electric (GE), offering various innovative motor solutions for industrial and commercial applications. GE's smart motors feature advanced sensor technologies and embedded intelligence, enabling seamless integration with automation systems and cloud platforms. The company's portfolio includes smart variable-speed drives, synchronous motors, and brushless DC motors, which deliver superior performance and energy savings across diverse applications.

In addition to these major players, several niche companies are making significant contributions to the U.S. smart motors market. For example, Nidec Corporation is a leading manufacturer of precision motors and related components, serving various industries, including automotive, consumer electronics, and robotics. Nidec's smart motor offerings include brushless DC motors, geared motors, and motor drives with advanced control features and IoT connectivity.

Furthermore, companies like Schneider Electric and Emerson Electric Co. actively participate in the U.S. smart motors market, providing innovative solutions for industrial automation and energy management. Schneider Electric offers a diverse portfolio of smart motor control products, including variable speed drives, motor starters, and power monitoring systems. At the same time, Emerson Electric specializes in high-performance servo motors and drive systems for demanding aerospace, automotive, and robotics applications. Thus, the U.S. smart motors market is characterized by intense competition and continuous innovation, driven by the growing demand for automation, energy efficiency, and connectivity.

List of Key Companies Profiled

- Rockwell Automation, Inc.

- Moog, Inc.

- Fuji Electric Co. Ltd.

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Dunkermotoren GmbH (Ametek, Inc.)

- RobotShop Inc.

- Roboteq, Inc. (Nidec Motor Corporation)

US Smart Motors Market Report Segmentation

By End-use

- Industrial

- Automotive

- Consumer Electronics

- Aerospace & Defense

- Others

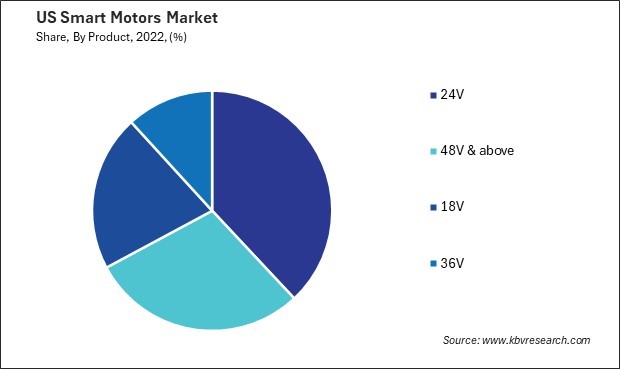

By Product

- 24V

- 48V & above

- 18V

- 36V

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Smart Motors Market, by End-use

1.4.2 US Smart Motors Market, by Product

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter Five Forces Analysis

Chapter 3. US Smart Motors Market

3.1 US Smart Motors Market, by End-use

3.2 US Smart Motors Market, by Product

Chapter 4. Company Profiles - Global Leaders

4.1 Rockwell Automation, Inc.

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental and Regional Analysis

4.1.4 Research & Development Expenses

4.1.5 Recent strategies and developments:

4.1.5.1 Acquisition and Mergers:

4.1.6 SWOT Analysis

4.2 Moog, Inc.

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Segmental and Regional Analysis

4.2.4 Research & Development Expense

4.2.5 SWOT Analysis

4.3 Fuji Electric Co. Ltd.

4.3.1 Company Overview

4.3.2 Financial Analysis

4.3.3 Segmental and Regional Analysis

4.3.4 Research & Development Expense

4.3.5 SWOT Analysis

4.4 ABB Ltd.

4.4.1 Company Overview

4.4.2 Financial Analysis

4.4.3 Segmental and Regional Analysis

4.4.4 Research & Development Expense

4.4.5 SWOT Analysis

4.5 Siemens AG

4.5.1 Company Overview

4.5.2 Financial Analysis

4.5.3 Segmental and Regional Analysis

4.5.4 Research & Development Expense

4.5.5 SWOT Analysis

4.6 Schneider Electric SE

4.6.1 Company Overview

4.6.2 Financial Analysis

4.6.3 Segmental and Regional Analysis

4.6.4 Research & Development Expense

4.6.5 SWOT Analysis

4.7 General Electric Company

4.7.1 Company Overview

4.7.2 Financial Analysis

4.7.3 Segmental and Regional Analysis

4.7.4 Research & Development Expense

4.7.5 SWOT Analysis

4.8 Dunkermotoren GmbH (Ametek, Inc.)

4.8.1 Company Overview

4.8.2 Financial Analysis

4.8.3 Segmental and Regional Analysis

4.8.4 Research & Development Expenses

4.8.5 SWOT Analysis

4.9 RobotShop Inc.

4.9.1 Company Overview

4.9.2 SWOT Analysis

4.10. Roboteq, Inc. (Nidec Motor Corporation)

4.10.1 Company Overview

4.10.2 SWOT Analysis

TABLE 2 US Smart Motors Market, 2023 - 2030, USD Million

TABLE 3 US Smart Motors Market, by End-use, 2019 - 2022, USD Million

TABLE 4 US Smart Motors Market, by End-use, 2023 - 2030, USD Million

TABLE 5 US Smart Motors Market, by Product, 2019 - 2022, USD Million

TABLE 6 US Smart Motors Market, by Product, 2023 - 2030, USD Million

TABLE 7 Key Information – Rockwell Automation, Inc.

TABLE 8 key information – Moog, Inc.

TABLE 9 Key Information – Fuji Electric Co., Ltd.

TABLE 10 Key Information – ABB Ltd.

TABLE 11 Key Information – Siemens AG

TABLE 12 Key Information – Schneider Electric SE

TABLE 13 Key Information – General Electric Company

TABLE 14 Key Information – Dunkermotoren GmbH

TABLE 15 Key Information – RobotShop Inc.

TABLE 16 Key Information – Roboteq, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 US Smart Motors Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Smart Motors Market

FIG 4 Porter’s Five Forces Analysis – Smart Motors Market

FIG 5 US Smart Motors Market share, by End-use, 2022

FIG 6 US Smart Motors Market share, by End-use, 2030

FIG 7 US Smart Motors Market, by End-use, 2019 - 2030, USD Million

FIG 8 US Smart Motors Market share, by Product, 2022

FIG 9 US Smart Motors Market share, by Product, 2030

FIG 10 US Smart Motors Market, by Product, 2019 - 2030, USD Million

FIG 11 SWOT Analysis: Rockwell Automation, Inc.

FIG 12 SWOT Analysis: Moog, Inc.

FIG 13 SWOT Analysis: Fuji Electric Co., Ltd.

FIG 14 SWOT Analysis: ABB ltd.

FIG 15 SWOT Analysis: Siemens AG

FIG 16 SWOT Analysis: Schneider Electric SE

FIG 17 SWOT Analysis: General Electric Company

FIG 18 SWOT Analysis: Dunkermotoren GmbH

FIG 19 SWOT Analysis: RobotShop Inc.

FIG 20 SWOT Analysis: Roboteq, Inc.