US Smoke Detector Market Size, Share & Industry Trends Analysis Report By Installation Type (Hardwired, and Battery-operated), By Product Type (Photoelectric, Ionization, Dual Sensor, and Others), By End USer, Growth Forecast, 2023 - 2030

Published Date : 16-Feb-2024 |

Pages: 97 |

Formats: PDF |

COVID-19 Impact on the US Smoke Detector Market

The USA Smoke Detector Market size is expected to reach $893.8 million by 2030, rising at a market growth of 6.6% CAGR during the forecast period. In the year 2022, the market attained a volume of 16,834.5 thousand units, experiencing a growth of 6.5% (2019-2022).

The smoke detector market in the United States is experiencing steady growth, driven by an increased emphasis on fire safety in residential, commercial, and industrial sectors. Ongoing enforcement of stringent regulations and building codes mandating smoke detector installations continues to fuel demand in the industry.

In the United States, technological progress is of the utmost importance, as evidenced by the introduction of smart smoke detectors that permit remote monitoring and connectivity with home automation systems. The ongoing construction boom in both residential and commercial sectors continues to fuel industry expansion as new constructions and renovations routinely incorporate these safety devices.

Federal, state, and local legislation continue to shape the industry, dictating the type, placement, and quantity of smoke detectors required in various structures. Consumer awareness campaigns in the United States have contributed to an increased adoption rate, supported by insurance industry incentives, which offer discounts on homeowners' insurance premiums for properties equipped with smoke detectors.

There is a growing trend towards smart smoke detectors that offer connectivity features such as Wi-Fi or Bluetooth. These devices send alerts to homeowners' smartphones integrated with home automation systems. The increasing need for environmental friendliness and sustainability significantly impacts consumer decisions regarding smoke detectors. Consumers are more likely to opt for energy-efficient and environmentally conscious products. Smoke detector manufacturers are responding by incorporating energy-efficient features, such as low-power consumption and eco-friendly materials, aligning with the broader trend of eco-conscious living.

According to the U.S. Fire Administration, fires and losses in residential buildings in 2021 reveal a substantial impact on lives and property. The recorded 353,500 fires resulted in 2,840 tragic deaths, 11,400 injuries, and a staggering $8,855,900,000 in dollar losses. Alarming trends over the 10-year period from 2012 to 2021 underscore the severity of the situation, with a 5% decrease in the number of fires contrasted by an 8% increase in fatalities, a 7% reduction in injuries, and an 11% surge in dollar losses, even when accounting for inflation.

These numbers indicate a concerning pattern where the efforts to reduce the frequency of fires have not translated into a proportional decline in the overall impact, signifying a pressing need for comprehensive strategies aimed at enhancing both fire prevention and response measures to safeguard lives and property effectively.

Market Trends

Increasing demand in commercial and industrial constructions

The smoke detector market in the United States is undergoing significant growth, propelled by a notable increase in awareness of these devices' critical role in fire safety. This heightened awareness extends to both residential and commercial sectors. Compliance with these codes is crucial for obtaining construction permits, and this requirement continues to drive the demand for smoke detectors.

Public awareness campaigns, educational programs, and government initiatives have all been instrumental in educating the public about the significance of smoke detectors. These campaigns often emphasize early fire detection and smoke detectors' life-saving potential in reducing casualties and property damage. As a result, consumers have become more conscious of the need to install and maintain smoke detectors in their homes and businesses.

The insurance industry has also contributed to the surge in awareness as many insurance providers offer incentives, such as reduced premiums, to policyholders with smoke detectors installed in their properties. This approach encourages compliance with safety standards and reinforces the message that smoke detectors are integral to overall risk mitigation.

Installing smoke detectors is a standard practice in new residential and commercial construction projects. Commercial and industrial construction in the U.S., including office buildings, manufacturing facilities, and warehouses, typically requires sophisticated fire detection systems. Smoke detectors are essential components of these systems to ensure early detection and alerting in the event of a fire. For example, Kidde is a leading manufacturer of fire safety products, including smoke detectors. They offer various types of residential and commercial smoke detectors, as well as combination units with carbon monoxide detection. As construction activities increase, so does the demand for smoke detection systems, contributing to the industry growth. The construction of new residential housing developments fuels demand for smoke detectors, mainly as these projects aim to meet modern safety standards and comply with local building regulations.

Consumer preferences for wireless solutions

There has been a discernible shift in consumer preferences toward wireless solutions in the U.S. smoke detector market, marking a significant trend in recent years. A growing number of consumers are selecting wireless smoke detectors owing to their adaptability and simplicity of installation. Unlike traditional wired detectors that require intricate installation processes, wireless options offer a hassle-free setup, allowing homeowners to enhance the safety of their residences quickly and conveniently. This inclination is consistent with the wider consumer trend that values technological advances in smart homes and the need for interconnected devices that enhance an integrated and smooth living experience.

The demand for wireless smoke detectors in the U.S. is driven by the convenience they offer in retrofitting existing homes or installing detectors in locations where running wiring may be challenging. This adaptability is particularly appealing to consumers looking to upgrade their home safety systems without undergoing extensive renovations. Furthermore, wireless smoke detectors frequently include supplementary functionalities, including mobile alerts and remote monitoring, giving homeowners instant notifications in critical situations. The increasing significance that consumers attribute to home safety solutions that are connected, user-friendly, and technologically advanced is anticipated to drive the continued focus on wireless solutions as the market develops.

Competition Analysis

The competitive landscape is marked by continuous innovation among industry players, who strive to enhance their products and integrate smoke detectors into broader security systems. As the industry evolves, the integration of technology is expected to remain a key driver for the smoke detector market in the United States. Some prominent market players present in the nation include Universal Security, BRK Brands, Nest, etc. Universal Security Instruments is a U.S.-based company specializing in manufacturing smoke alarms, carbon monoxide alarms, and other safety products for residential and commercial use.

Likewise, Nest, a subsidiary of Google, is renowned for its smart home products, and it has made substantial contributions to the evolution of smart smoke detectors. Nest Protect is Nest's smart smoke and carbon monoxide detector. It incorporates advanced sensors, Wi-Fi connectivity, and a wide range of features, including voice alerts and mobile app integration for U.S. consumers.

BRK Brands, a subsidiary of Jarden Corporation, is a leading manufacturer of residential safety products in the United States, including smoke and carbon monoxide detectors. BRK Brands produces a variety of smoke alarms, including ionization, photoelectric, and combination models. They have also offered interconnected alarms in the U.S. for synchronized alerts throughout a home.

List of Key Companies Profiled

- Hochiki Corporation

- Honeywell International, Inc

- Ceasefire Industries Pvt. Ltd.

- Johnson Controls International PLC

- Google LLC (Alphabet Inc.)

- ABB Group

- Robert Bosch GmbH

- Secom Co. Ltd.

- Schneider Electric SE

- Siemens AG

US Smoke Detector Market Report Segmentation

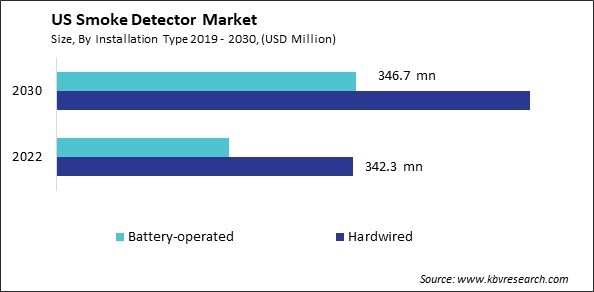

By Installation Type

- Hardwired

- Battery-operated

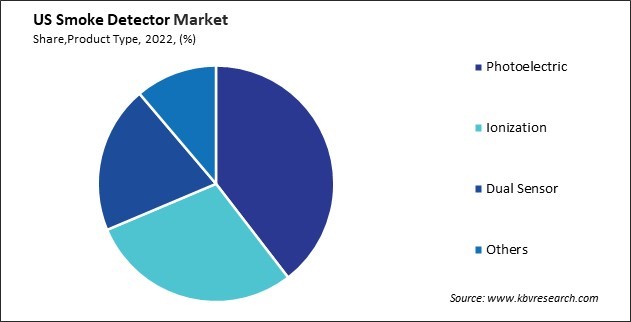

By Product Type

- Photoelectric

- Ionization

- Dual Sensor

- Others

By End User

- Commercial

- Oil & Gas

- Residential

- Manufacturing

- Telecom & IT

- Automotive

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Smoke Detector Market, by Installation Type

1.4.2 USA Smoke Detector Market, by Product Type

1.4.3 USA Smoke Detector Market, by End User

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Market Share Analysis, 2022

3.4 Top Winning Strategies

3.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

3.4.2 Key Strategic Move: (Product Launches and Product Expansions: 2019, Sep – 2023, Jul) Leading Players

3.5 Porter’s Five Force Analysis

Chapter 4. US Smoke Detector Market

4.1 US Smoke Detector Market by Installation Type

4.2 US Smoke Detector Market by Product Type

4.3 US Smoke Detector Market by End User

Chapter 5. Company Profiles – Global Leaders

5.1 Hochiki Corporation

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 Recent strategies and developments:

5.1.5.1 Product Launches and Product Expansions:

5.1.6 SWOT Analysis

5.2 Honeywell International, Inc.

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Partnerships, Collaborations, and Agreements:

5.2.5.2 Product Launches and Product Expansions:

5.2.5.3 Acquisition and Mergers:

5.2.6 SWOT Analysis

5.3 Ceasefire Industries Pvt. Ltd.

5.3.1 Company Overview

5.3.2 SWOT Analysis

5.4 Johnson Controls International PLC

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental & Regional Analysis

5.4.4 Research & Development Expenses

5.4.5 Recent strategies and developments:

5.4.5.1 Product Launches and Product Expansions:

5.4.6 SWOT Analysis

5.5 Google LLC (Alphabet Inc.)

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expense

5.5.5 SWOT Analysis

5.6 ABB Group

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expense

5.6.5 Recent strategies and developments:

5.6.5.1 Product Launches and Product Expansions:

5.6.6 SWOT Analysis

5.7 Robert Bosch GmbH

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expense

5.7.5 Recent strategies and developments:

5.7.5.1 Acquisition and Mergers:

5.7.6 SWOT Analysis

5.8 Secom Co. Ltd.

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 SWOT Analysis

5.9 Schneider Electric SE

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expense

5.9.5 SWOT Analysis

5.10. Siemens AG

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Research & Development Expense

5.10.5 Recent strategies and developments:

5.10.5.1 Product Launches and Product Expansions:

5.10.6 SWOT Analysis

TABLE 2 US Smoke Detector Market, 2023 - 2030, USD Million

TABLE 3 US Smoke Detector Market, 2019 - 2022, Thousand Units

TABLE 4 US Smoke Detector Market, 2023 - 2030, Thousand Units

TABLE 5 Partnerships, Collaborations and Agreements– Smoke Detector Market

TABLE 6 Product Launches And Product Expansions– Smoke Detector Market

TABLE 7 Acquisition and Mergers– Smoke Detector Market

TABLE 8 US Smoke Detector Market by Installation Type, 2019 - 2022, USD Million

TABLE 9 US Smoke Detector Market by Installation Type, 2023 - 2030, USD Million

TABLE 10 US Smoke Detector Market by Installation Type, 2019 - 2022, Thousand Units

TABLE 11 US Smoke Detector Market by Installation Type, 2023 - 2030, Thousand Units

TABLE 12 US Smoke Detector Market by Product Type, 2019 - 2022, USD Million

TABLE 13 US Smoke Detector Market by Product Type, 2023 - 2030, USD Million

TABLE 14 US Smoke Detector Market by Product Type, 2019 - 2022, Thousand Units

TABLE 15 US Smoke Detector Market by Product Type, 2023 - 2030, Thousand Units

TABLE 16 US Smoke Detector Market by End User, 2019 - 2022, USD Million

TABLE 17 US Smoke Detector Market by End User, 2023 - 2030, USD Million

TABLE 18 US Smoke Detector Market by End User, 2019 - 2022, Thousand Units

TABLE 19 US Smoke Detector Market by End User, 2023 - 2030, Thousand Units

TABLE 20 Key Information – HOCHIKI CORPORATION

TABLE 21 Key Information – Honeywell International, Inc.

TABLE 22 Key Information – Ceasefire Industries Pvt. Ltd.

TABLE 23 Key Information – Johnson Controls International PLC

TABLE 24 Key Information – Google LLC

TABLE 25 Key Information – ABB Group

TABLE 26 Key Information – Robert Bosch GmbH

TABLE 27 Key Information – Secom Co. Ltd.

TABLE 28 Key Information – Schneider Electric SE

TABLE 29 Key Information – Siemens AG

List of Figures

FIG 1 Methodology for the research

FIG 2 US Smoke Detector Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting the Smoke Detector Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2022

FIG 6 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 7 Key Strategic Move: (Product Launches and Product Expansions : 2019, Sep – 2023, Jul) Leading Players

FIG 8 Porter’s Five Force Analysis: Smoke Detector Market

FIG 9 US Smoke Detector Market share by Installation Type, 2022

FIG 10 US Smoke Detector Market share by Installation Type, 2030

FIG 11 US Smoke Detector Market by Installation Type, 2019 - 2030, USD Million

FIG 12 US Smoke Detector Market share by Product Type, 2022

FIG 13 US Smoke Detector Market share by Product Type, 2030

FIG 14 US Smoke Detector Market by Product Type, 2023 - 2030, USD million

FIG 15 US Smoke Detector Market share by End User, 2022

FIG 16 US Smoke Detector Market share by End User, 2030

FIG 17 US Smoke Detector Market by End User, 2019 - 2030, USD million

FIG 18 SWOT Analysis:. HOCHIKI CORPORATION

FIG 19 Recent strategies and developments: Honeywell international, inc.

FIG 20 SWOT Analysis: Honeywell international, inc.

FIG 21 SWOT Analysis: Ceasefire Industries Pvt. Ltd.

FIG 22 SWOT Analysis: Johnson Controls International PLC

FIG 23 SWOT Analysis: Google LLC

FIG 24 SWOT Analysis: ABB Group

FIG 25 SWOT Analysis: Robert Bosch GmbH

FIG 26 SWOT Analysis: Secom Co. Ltd.

FIG 27 SWOT Analysis: Schneider Electric SE

FIG 28 SWOT Analysis: Siemens AG