US Solid State Relay Market Size, Share & Trends Analysis Report By Type (AC, DC, and AC/DC), By End User, By Mounting Type (PCB Mount, Panel Mount, DIN Rail Mount, and Others), and Forecast, 2023 - 2030

Published Date : 29-Oct-2024 |

Pages: 99 |

Formats: PDF |

COVID-19 Impact on the US Solid State Relay Market

The US Solid State Relay Market size is expected to reach $364.5 Million by 2030, rising at a market growth of 5.3% CAGR during the forecast period. In the year 2022, the market attained a volume of 5,798.7 Thousand Units, experiencing a growth of 5.6% (2019-2022).

The solid state relay market in the United States has experienced significant growth in recent years. Solid state relays (SSRs) offer several advantages over traditional electromechanical relays, including faster switching speeds, longer lifespan, reduced electromagnetic interference, and enhanced reliability, making them a preferred choice for many applications. One of the key drivers fueling the growth of the solid state relay market in the United States is the rising adoption of SSRs in industrial automation applications. With the ongoing advancements in industrial automation technologies such as programmable logic controllers (PLCs) and supervisory control and data acquisition (SCADA) systems, the demand for SSRs is expected to continue growing.

The automotive industry is another major contributor to the growth of the solid state relay market in the United States. SSRs are extensively used in automotive electronics for lighting control, motor drives, and battery management systems. With the ongoing electrification and integration of advanced driver assistance systems (ADAS) in vehicles, the demand for SSRs is expected to rise further.

According to Select USA, international automakers produced 5 million vehicles in the United States in 2020. The United States exported 1.4 million new light vehicles and 108,754 medium and heavy trucks (worth over $52 billion) to more than 200 industries worldwide. As the automotive sector continues to evolve, the solid state relay market in the United States is poised for further expansion, contributing to the nation's technological prowess and economic competitiveness on the global stage.

The COVID-19 pandemic has significantly impacted the solid state relay market in the United States. The pandemic led to disruptions in global supply chains, affecting the production and distribution of SSRs. However, the pandemic has also accelerated the adoption of automation and remote monitoring solutions in response to the need for social distancing and minimizing human intervention in industrial operations. This has created new opportunities for SSR manufacturers in the U.S., offering solutions tailored to the needs of remote monitoring and control applications.

Market Trends

Rising adoption of wind turbines

The United States is witnessing a remarkable surge in the adoption of wind turbines, a trend that is significantly influencing the solid state relay market. Solid-state relays (SSRs), known for their reliability, durability, and efficiency in handling high power loads, are becoming increasingly vital in the renewable energy sector, especially in wind power generation. This uptick in wind turbine installations across the country is a testament to the growing commitment towards sustainable energy and a boon for the solid state relay market.

According to the U.S. Energy Information Administration, in 2022, the U.S. experienced a significant shift towards renewable energy, with wind turbines contributing approximately 10.2% to the nation's total utility-scale electricity generation. This category encompasses facilities capable of generating at least one megawatt (1,000 kilowatts) of power. This transition is evident from the substantial growth in wind energy production, which soared from around 6 billion kilowatt-hours (kWh) in 2000 to approximately 380 billion kWh by 2021. This increasing reliance on wind turbines indicates their growing influence within the solid state relay market in the U.S., highlighting a broader trend toward adopting renewable energy technologies.

Wind turbines require sophisticated control systems, including regulating power output and protecting electrical components. SSRs, with their ability to perform rapid switching without physical contact, minimal maintenance requirements, and resistance to environmental factors, are perfectly suited to meet these needs. They are used in various applications within wind turbines, such as pitch control, brake systems, and power conditioning, enhancing the efficiency and reliability of wind power generation in the U.S.

The rising adoption of wind turbines in the U.S. is driven by several factors, including governmental policies favoring renewable energy, technological advancements in wind power generation, and the decreasing cost of wind energy, making it more competitive with traditional fossil fuels. Therefore, the surge in wind turbine adoption in the United States is bolstering the solid state relay market, underscoring the pivotal role of SSRs in enhancing the efficiency and reliability of renewable energy generation.

Increasing need for energy efficiency

The U.S. solid state relay market is experiencing a rising need for energy efficiency driven by several factors. One of the primary drivers of the increasing demand for energy-efficient solid state relays (SSR) is the ongoing technological evolution within the electronics industry. As electronic devices become more prevalent across various sectors, there is a greater focus on reducing power consumption and improving overall energy efficiency. SSRs play a crucial role in this endeavor by providing reliable switching capabilities while minimizing energy losses compared to traditional electromechanical relays.

Furthermore, government regulations and initiatives aimed at reducing energy consumption and carbon emissions are driving the adoption of energy-efficient solutions in the U.S. SSRs offer advantages such as faster switching speeds, lower power dissipation, and longer lifespan compared to their electromechanical counterparts, making them an attractive option for industries seeking to comply with environmental standards and achieve sustainability goals.

The increasing awareness of the environmental impact of energy consumption also prompts businesses and consumers to prioritize energy efficiency in their operations and purchasing decisions. Moreover, the shift towards renewable energy sources such as solar and wind power creates additional demand for energy-efficient SSRs. Thus, the rising need for energy efficiency in the U.S., driven by technological advancements, regulatory pressures, and the shift towards renewable energy, is significantly boosting the demand for energy-efficient solid state relays.

Competition Analysis

The solid state relay market in the United States is a dynamic and competitive landscape driven by technological advancements, increasing automation across industries, and the growing demand for efficient and reliable switching solutions. One prominent player in the U.S. solid state relay market is Crydom, Inc. Founded in 1970, Crydom has established itself as a pioneer in solid-state relay technology. The company offers a comprehensive range of solid state relay (SSR) products catering to industries such as industrial automation, HVAC, medical equipment, and telecommunications. With a focus on quality, reliability, and innovation, Crydom continues to expand its industry presence and meet the evolving needs of its customers.

Another key player in the U.S. solid state relay market is Opto 22. Since its inception in 1974, Opto 22 has been at the forefront of developing innovative automation and control solutions. The company's SSR offerings include a diverse portfolio of products designed for industrial applications, process control, and energy management. Leveraging its hardware and software integration expertise, Opto 22 remains a trusted partner for businesses seeking reliable and cost-effective SSR solutions.

Sensata Technologies is also a significant player in the U.S. solid state relay market. With a rich history dating back to the early 20th century, Sensata has evolved into a global leader in sensing, control, and electrical protection solutions. The company's SSR product line encompasses various options tailored to meet the stringent requirements of automotive, aerospace, and industrial customers. Sensata's commitment to innovation and customer satisfaction positions it as a formidable competitor in the solid state relay market.

Another notable player in the U.S. solid state relay market is Omega Engineering, Inc. Established in 1962, Omega Engineering has built a reputation for delivering high-quality instrumentation and control solutions to diverse industries worldwide. With a strong emphasis on customer support and application expertise, Omega Engineering continues to attract customers seeking reliable SSR solutions for their critical applications.

Teledyne Relays is also a significant player in the U.S. solid state relay market. The company's product portfolio includes a variety of SSRs tailored to meet the needs of aerospace, defense, and telecommunications customers. With a focus on quality assurance and technological innovation, Teledyne Relays remains a trusted partner for demanding applications. With increasing emphasis on efficiency, reliability, and performance, companies in this sector continue to innovate and evolve, driving growth and shaping the future of solid-state relay technology.

List of Key Companies Profiled

- Vishay Intertechnology, Inc.

- Panasonic Holdings Corporation

- Omron Corporation

- Infineon Technologies AG

- TE Connectivity Ltd.

- Fujitsu Limited

- Sharp Corporation

- Sensata Technologies Holdings PLC

- Littelfuse, Inc.

- Carlo Gavazzi Automation S.p.A. (Carlo Gavazzi Holding AG)

US Solid State Relay Market Report Segmentation

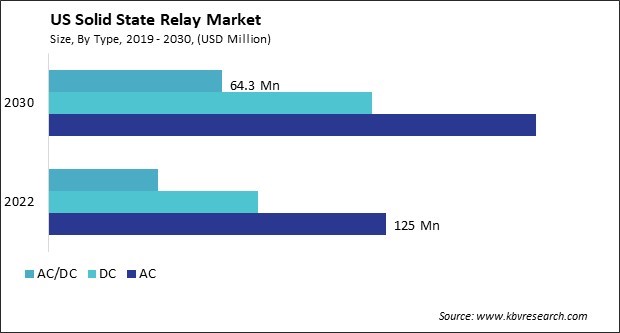

By Type

- AC

- DC

- AC/DC

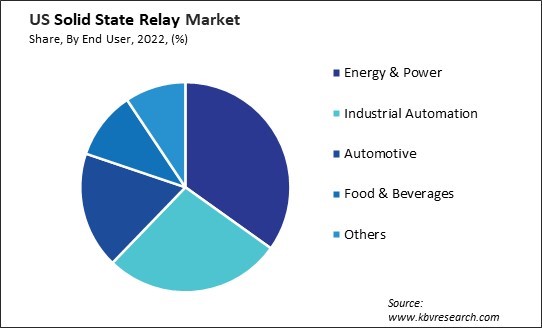

By End User

- Energy & Power

- Industrial Automation

- Automotive

- Food & Beverages

- Others

By Mounting Type

- PCB Mount

- Panel Mount

- DIN Rail Mount

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Solid State Relay Market, by Type

1.4.2 US Solid State Relay Market, by End User

1.4.3 US Solid State Relay Market, by Mounting Type

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. Recent Strategies Deployed in Solid State Relay Market

Chapter 4. US Solid State Relay Market

4.1 US Solid State Relay Market by Type

4.2 US Solid State Relay Market by End User

4.3 US Solid State Relay Market by Mounting Type

Chapter 5. Company Profiles – Global Leaders

5.1 Vishay Intertechnology, Inc.

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research and Development Expense

5.1.5 SWOT Analysis

5.2 Panasonic Holdings Corporation

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Product Launches and Product Expansions:

5.2.6 SWOT Analysis

5.3 Omron Corporation

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Product Launches and Product Expansions:

5.3.6 SWOT Analysis

5.4 Infineon Technologies AG

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expense

5.4.5 Recent strategies and developments:

5.4.5.1 Product Launches and Product Expansions:

5.4.5.2 Acquisition and Mergers:

5.4.6 SWOT Analysis

5.5 TE Connectivity Ltd.

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expense

5.5.5 Recent strategies and developments:

5.5.5.1 Acquisition and Mergers:

5.5.6 SWOT Analysis

5.6 Fujitsu Limited

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expenses

5.6.5 SWOT Analysis

5.7 Sharp Corporation

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental & Regional Analysis

5.7.4 Research & Development Expense

5.7.5 SWOT Analysis

5.8 Sensata Technologies Holdings PLC

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 Research & Development Expense

5.8.5 Recent strategies and developments:

5.8.5.1 Product Launches and Product Expansions:

5.8.5.2 Acquisition and Mergers:

5.8.6 SWOT Analysis

5.9 Littelfuse, Inc.

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expenses

5.9.5 Recent strategies and developments:

5.9.5.1 Product Launches and Product Expansions:

5.9.5.2 Acquisition and Mergers:

5.9.6 SWOT Analysis

5.10. Carlo Gavazzi Automation S.p.A. (Carlo Gavazzi Holding AG)

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Regional Analysis

5.10.4 Research & Development Expenses

5.10.5 SWOT Analysis

TABLE 2 US Solid State Relay Market, 2023 - 2030, USD Million

TABLE 3 US Solid State Relay Market, 2019 - 2022, Thousand Units

TABLE 4 US Solid State Relay Market, 2023 - 2030, Thousand Units

TABLE 5 US Solid State Relay Market by Type, 2019 - 2022, USD Million

TABLE 6 US Solid State Relay Market by Type, 2023 - 2030, USD Million

TABLE 7 US Solid State Relay Market by Type, 2019 - 2022, Thousand Units

TABLE 8 US Solid State Relay Market by Type, 2023 - 2030, Thousand Units

TABLE 9 US Solid State Relay Market by End User, 2019 - 2022, USD Million

TABLE 10 US Solid State Relay Market by End User, 2023 - 2030, USD Million

TABLE 11 US Solid State Relay Market by End User, 2019 - 2022, Thousand Units

TABLE 12 US Solid State Relay Market by End User, 2023 - 2030, Thousand Units

TABLE 13 US Solid State Relay Market by Mounting Type, 2019 - 2022, USD Million

TABLE 14 US Solid State Relay Market by Mounting Type, 2023 - 2030, USD Million

TABLE 15 US Solid State Relay Market by Mounting Type, 2019 - 2022, Thousand Units

TABLE 16 US Solid State Relay Market by Mounting Type, 2023 - 2030, Thousand Units

TABLE 17 key Information – Vishay Intertechnology, Inc.

TABLE 18 Key Information – Panasonic Holdings Corporation

TABLE 19 Key Information – Omron Corporation

TABLE 20 Key Information – Infineon Technologies AG

TABLE 21 Key information –TE Connectivity Ltd.

TABLE 22 Key Information – Fujitsu Limited

TABLE 23 Key Information – Sharp Corporation

TABLE 24 Key Information – Sensata Technologies Holdings PLC

TABLE 25 Key Information – LITTELFUSE, INC.

TABLE 26 Key Information – Carlo Gavazzi Automation S.p.A.

List of Figures

FIG 1 Methodology for the research

FIG 2 US Solid State Relay Market, 2019 - 2031, USD Million

FIG 3 Key Factors Impacting Solid State Relay Market

FIG 4 Porter’s Five Forces Analysis – solid state relay market

FIG 5 US Solid State Relay Market share by Type, 2022

FIG 6 US Solid State Relay Market share by Type, 2030

FIG 7 US Solid State Relay Market by Type, 2019 - 2030, USD Million

FIG 8 US Solid State Relay Market share by End User, 2022

FIG 9 US Solid State Relay Market share by End User, 2030

FIG 10 US Solid State Relay Market by End User, 2019 - 2030, USD Million

FIG 11 US Solid State Relay Market share by Mounting Type, 2022

FIG 12 US Solid State Relay Market share by Mounting Type, 2030

FIG 13 US Solid State Relay Market by Mounting Type, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: Vishay Intertechnology, Inc.

FIG 15 SWOT Analysis: Panasonic Holdings Corporation

FIG 16 SWOT Analysis: Omron Corporation

FIG 17 Recent strategies and developments: Infineon Technologies AG

FIG 18 SWOT Analysis: Infineon Technologies AG

FIG 19 SWOT Analysis: TE Connectivity Ltd

FIG 20 Swot analysis: Fujitsu Limited

FIG 21 SWOT Analysis: Sharp Corporation

FIG 22 Recent strategies and developments: Sensata Technologies Holdings PLC

FIG 23 SWOT Analysis: Sensata Technologies Holdings PLC

FIG 24 Recent strategies and developments: Littelfuse, Inc.

FIG 25 SWOT Analysis: Littelfuse, Inc.

FIG 26 Swot Analysis: Carlo Gavazzi Automation S.p.A.