Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 17-May-2024 |

Pages: 79 |

Formats: PDF |

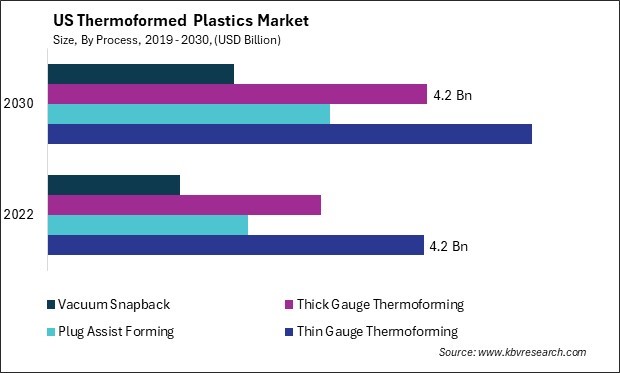

The United States (US) Thermoformed Plastics Market size is expected to reach $14.8 Billion by 2030, rising at a market growth of 4.0% CAGR during the forecast period. In the year 2022, the market attained a volume of 7535.2 Kilo Tonnes, experiencing a growth of 3.0% (2019-2022).

The thermoformed plastics market in the U.S. has witnessed steady growth over the past decade, driven by many factors, such as the increasing demand from end-user industries, including packaging, automotive, healthcare, and electronics. One of the key drivers propelling the industry forward is the burgeoning demand for lightweight and durable packaging solutions. Additionally, the automotive sector in the U.S. has embraced thermoformed plastics for interior components, exterior body panels, and under-the-hood applications, owing to their lightweight nature, design flexibility, and cost efficiency.

In addition to traditional applications, advancements in material science and manufacturing technologies in the U.S. have expanded the scope of thermoformed plastics into new sectors such as aerospace, consumer goods, and renewable energy. The development of high-performance thermoplastics, bio-based polymers, and recyclable materials has opened up opportunities for innovative applications and sustainable solutions.

The COVID-19 pandemic has had a mixed impact on the thermoformed plastics market in the U.S. While certain segments, such as packaging, experienced a surge in demand due to increased consumption of packaged goods and e-commerce activities, other sectors like automotive and consumer electronics witnessed a slowdown in production and sales amidst supply chain disruptions and economic uncertainties.

Furthermore, the pandemic prompted a heightened awareness of hygiene and safety, increasing demand for thermoformed plastics in healthcare applications such as medical packaging and protective equipment. However, the closure of manufacturing facilities and restrictions on movement imposed to curb the spread of the virus resulted in operational challenges for industry players, affecting production schedules and distribution networks.

In recent years, the healthcare and medical services sector in the United States has witnessed a significant rise in the utilization of thermoformed plastics, marking a transformative trend in the industry. One of the primary drivers behind the increasing adoption of thermoformed plastics in healthcare in the U.S. is their exceptional suitability for ensuring the safety and integrity of medical products. Thermoformed packaging solutions offer robust protection against contamination, moisture, and physical damage, safeguarding the sterility and efficacy of medical devices, pharmaceuticals, and diagnostic tools.

According to the National Health Expenditure Account (NHEA), in 2022, the United States witnessed a 4.1% increase in healthcare spending, totaling an astounding $4.5 trillion, equivalent to $13,493 per person. This surge in expenditure, representing 17.3 % of the nation's gross domestic product, underscores the growing prominence of healthcare costs in the economic landscape. As healthcare providers and institutions strive to manage costs without compromising quality, adopting thermoformed plastics for medical equipment, packaging, and other healthcare essentials is witnessing a notable uptick in the U.S. thermoformed plastics market.

The rising demand for healthcare services, coupled with the ongoing emphasis on infection control, patient safety, and cost containment, is expected to sustain the growth momentum of the thermoformed plastics market in the U.S. healthcare sector. As medical providers prioritize efficiency, sustainability, and patient-centric care, thermoformed plastics are poised to remain a preferred choice for addressing modern healthcare delivery's evolving needs and challenges. Thus, the increasing utilization of thermoformed plastics in the U.S. healthcare sector reflects a pivotal shift toward ensuring safety, efficiency, and cost-effectiveness in modern medical practices.

The adoption of polymethyl methacrylate (PMMA) in the thermoformed plastics market in the United States has been experiencing a significant uptick, driven by several key factors. PMMA boasts exceptional optical clarity and transparency in the U.S., making it an ideal choice for products where aesthetics are paramount. Whether used in consumer electronics, automotive components, or signage, PMMA provides excellent light transmission properties, enhancing the visual appeal of the final product.

Additionally, PMMA's ease of processing through thermoforming techniques further contributes to its growing adoption in the U.S. thermoformed plastics market. Thermoforming allows manufacturers to mold PMMA sheets into complex shapes and sizes with precision, enabling the production of custom-designed components for various industries. The versatility of thermoformed PMMA opens up opportunities for innovative product designs while reducing manufacturing costs and lead times.

Moreover, the recyclability of PMMA aligns with growing environmental awareness and sustainability initiatives in the U.S., further driving its adoption in the thermoformed plastics market. With an increasing emphasis on eco-friendly materials and processes, PMMA offers manufacturers a sustainable solution without compromising performance or aesthetics. Therefore, the surge in PMMA adoption in the U.S. thermoformed plastics market is propelled by its superior optical properties, ease of thermoforming, and alignment with sustainability trends.

The thermoformed plastics market in the United States is a significant segment of the country's plastics industry, encompassing a wide range of applications across various sectors such as packaging, automotive, aerospace, healthcare, and consumer goods. One of the prominent players in the U.S. thermoformed plastics market is Pactiv LLC, a leading manufacturer of packaging solutions for food service, food packaging, and consumer products. Pactiv specializes in thermoformed plastic containers, trays, and packaging films, offering a comprehensive range of products designed to meet the food industry's stringent quality and safety standards. Focusing on innovation and sustainability, Pactiv continuously develops eco-friendly packaging options to address the growing demand for environmentally responsible solutions.

Placon Corporation is also a notable participant in the U.S. thermoformed plastics market, specializing in custom packaging solutions for retail, food, medical, and industrial applications. The company's thermoformed plastic packaging products include clamshells, trays, and blisters, designed to meet the specific requirements of its customers while delivering superior performance and durability. With state-of-the-art manufacturing facilities and a commitment to quality and customer service, Placon has established itself as a trusted partner for packaging solutions in the United States.

Another key player in the U.S. thermoformed plastics market is Sonoco Products Company, a diversified packaging company with a significant presence in thermoforming technology. Sonoco offers various thermoformed plastic packaging solutions for various industries, including food and beverage, healthcare, and industrial products. The company's expertise in design, materials science, and manufacturing processes enables it to deliver innovative packaging solutions that optimize product protection, shelf appeal, and sustainability.

Brentwood Industries, Inc. is another significant player in the U.S. thermoformed plastics market, offering a wide range of thermoformed products for various industries, including water and wastewater management, transportation, and construction. The company's thermoformed plastic components, such as tanks, trays, and enclosures, are known for their durability, chemical resistance, and structural integrity, making them ideal for demanding applications. Brentwood's focus on engineering excellence and continuous innovation has earned it a reputation for delivering high-quality, reliable products to its customers.

Additionally, Prent Corporation is a leading manufacturer of custom thermoformed packaging solutions for the medical device, electronics, and consumer products industries. Prent's thermoformed plastic trays, blisters, and clamshells are designed to protect and showcase its customers' products while ensuring compliance with stringent regulatory requirements. Hence, the thermoformed plastics market in the United States is characterized by a diverse ecosystem of companies offering innovative solutions across a wide range of industries.

By Process

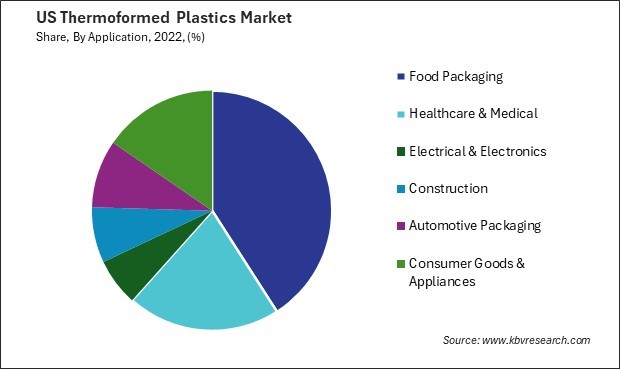

By Application

By Product