Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 27-Mar-2024 |

Pages: 81 |

Formats: PDF |

The USA Wi-Fi Analytics Market size is expected to reach $6.4 billion by 2030, rising at a market growth of 20.5% CAGR during the forecast period.

The wi-fi analytics market in the United States is experiencing significant growth driven by the increasing adoption of networks across various industries and the growing need for actionable insights into customer behavior and preferences. In the United States, the demand for location-based services (LBS) has increased, driven by technological advancements, changing consumer behaviors, and the increasing integration of location intelligence into various industries. The widespread adoption of smartphones and other mobile devices has created a large user base capable of accessing location-based services. Mobile users rely on LBS for navigation, local business information, and location-aware applications.

The integration of LBS with the Internet of Things (IoT) has expanded the capabilities of location-based services. IoT devices can collect and transmit location data, enabling businesses to track assets, monitor operations, and optimize logistics in real-time. In healthcare and public safety sectors, LBS is used for emergency response, asset tracking, patient monitoring, and location-based analytics. These applications improve efficiency and safety by providing real-time location information.

Moreover, enhanced customer engagement and personalization have become increasingly important for U.S. businesses across various industries in recent years. Customers in the U.S. engage with businesses through multiple online and offline channels. Providing a seamless and consistent experience across these channels enhances customer engagement and delivers personalized interactions.

Technological advances like artificial intelligence (AI), machine learning, and automation have empowered businesses to scale their personalization efforts. These technologies enable real-time decision-making and automation of personalized experiences based on customer data. Therefore, the wi-fi analytics market in the U.S. is driven by the increasing need for data-driven insights, the proliferation of Wi-Fi-enabled devices, and the growing importance of digital transformation across industries. As businesses continue to recognize the value of wi-fi analytics in driving innovation and competitive advantage, the industry is expected to grow and evolve.

The retail sector in the United States has been experiencing expansion driven by various factors such as technological advancements, changing consumer preferences, and evolving industry dynamics. Retailers increasingly adopt omnichannel strategies, integrating online and offline channels to provide a seamless shopping experience. This includes initiatives such as buying online, shopping in-store (BOPIS), and technology to bridge the gap between physical and digital retail environments. Additionally, the rise of Direct-to-Consumer (DTC) brands has disrupted traditional retail models by bypassing traditional distribution channels and selling directly to consumers. This trend has led to increased competition and forced established retailers to adapt their strategies to remain competitive. Consequently, wi-fi analytics has become a powerful tool for retailers looking to understand their customers better, optimize their operations, and create personalized shopping experiences.

The need for deeper insights into customer behavior, preferences, and in-store experiences drives the expansion of wi-fi analytics in retail. Wi-fi analytics solutions enable retailers to gather data from wi-fi networks and use advanced analytics to derive actionable insights that can enhance operations, improve marketing strategies, and personalize the customer experience. Wi-fi analytics provide retailers with footfall analysis, which helps them understand the flow of customers into and out of their stores. This data can be used to optimize staffing levels, identify peak hours, and plan for promotions or events to drive foot traffic. Moreover, by tracking the movement of products within the store, retailers can optimize their inventory levels, reduce stockouts, and improve overall inventory accuracy.

In 2018, the National Retail Federation reported that the collective GDP impact generated by the 4.2 million retail establishments in the United States amounted to an impressive $3.9 trillion. This substantial economic contribution underscores the significance of the retail sector in the country. This robust retail landscape also correlates with the burgeoning growth of the wi-fi analytics market in the U.S. The rise of wi-fi analytics in the country indicates the increasing importance of technology-driven solutions within the retail industry, contributing to the overall economic landscape and reshaping how businesses operate.

Wi-fi advertising analytics can help businesses measure the effectiveness of their advertising campaigns. By tracking metrics such as click-through rates, conversion rates, and customer engagement, businesses can optimize their ad spend and refine their strategies for better results. Cloud-based wi-fi advertising analytics solutions offer scalability and flexibility, allowing businesses to scale their analytics infrastructure based on their needs. This is particularly beneficial for businesses with fluctuating demand or those looking to expand their operations. Many businesses in the U.S. already use cloud-based services for various aspects of their operations.

Moreover, cloud-based wi-fi advertising analytics solutions can easily integrate with other cloud services, such as customer relationship management (CRM) systems and marketing automation platforms, creating a seamless workflow. Cloud service providers often invest heavily in security measures and compliance certifications, which can provide businesses with peace of mind regarding the security of their data. This is particularly important in the U.S., where data privacy regulations such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA) are in place. Thus, the rising use of cloud-based wi-fi advertising analytics in the U.S. is driven by the need for scalable, cost-effective, real-time analytics solutions to provide advanced insights into advertising performance.

Several companies in the U.S. wi-fi analytics market offer solutions and services tailored to businesses seeking to leverage wi-fi data for insights, marketing, and operational improvements. Some of the prominent companies operating in this industry include Cisco Systems, Inc., Aruba Networks (HPE), Fortinet, Inc., Purple, Ruckus Networks (CommScope), Cloud4Wi, Aislelabs, Euclid (A part of WeWork), RetailNext, Extreme Networks, Mist Systems, a Juniper Networks company, etc.

Aruba Networks, a subsidiary of Hewlett Packard Enterprise (HPE), is known for its expertise in wireless networking and offers wi-fi analytics solutions focused on location-based services, user engagement, and network optimization. Aruba's analytics tools help businesses gain valuable insights into customer behavior and preferences within physical spaces, allowing for targeted marketing efforts and enhanced customer experiences.

Ekahau specializes in wi-fi network design and planning, providing wi-fi analytics solutions that offer insights into network performance, coverage, and capacity. Ekahau's tools are used by businesses to optimize their wi-fi infrastructure for improved performance and user experiences, making it a key player in the wi-fi analytics market.

RetailNext provides wi-fi analytics solutions tailored to the retail industry, offering insights into customer behavior, store performance, and in-store analytics. RetailNext's tools help retailers optimize their operations and improve the in-store shopping experience through data-driven decision-making, making it a significant player in the wi-fi analytics market.

Aislelabs is another notable player in the wi-fi analytics market, offering solutions that provide insights into customer behavior, demographics, and engagement within physical spaces. Aislelabs' tools help businesses optimize their marketing strategies and improve customer experiences based on wi-fi analytics data, contributing to its presence in the wi-fi analytics market. These companies, among others, are at the forefront of driving innovation and adoption of wi-fi analytics solutions in the U.S. industry, catering to the diverse needs of businesses across industries for actionable insights derived from wi-fi networks.

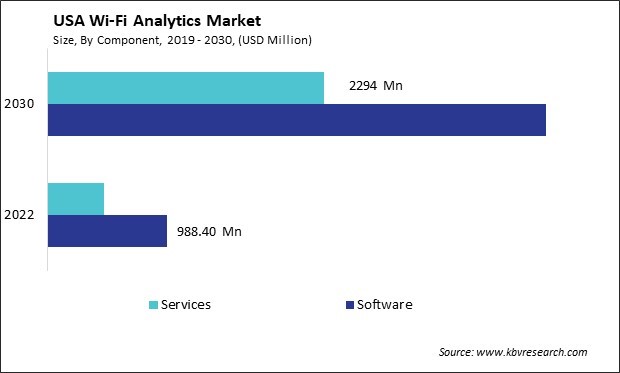

USA Wi-Fi Analytics Market, by Component

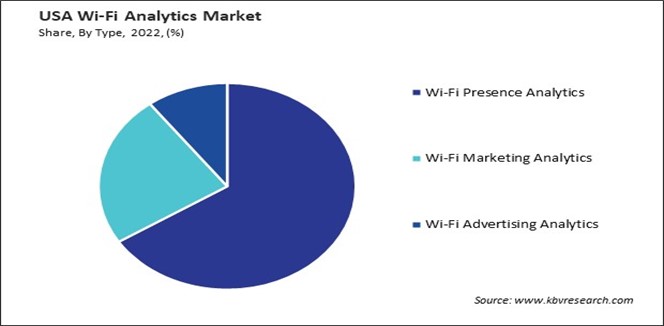

By Type

By Deployment

By End-use