Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 27-Mar-2024 |

Pages: 91 |

Formats: PDF |

The Workforce Management Market size is expected to reach $3.8 billion by 2030, rising at a market growth of 8.2% CAGR during the forecast period.

The workforce management market in the United States is experiencing robust growth driven by several key factors that are reshaping the way organizations manage their employees. One of the primary drivers is the increasing adoption of digital technologies and automation to streamline workforce-related processes. Increasing productivity and efficiency across various industries involves deploying cutting-edge software solutions for scheduling, time and attendance monitoring, workforce optimization, and analytics.

The rising popularity of flexible work and remote arrangements is a major element driving the expansion of the workforce management market in the United States. The COVID-19 pandemic accelerated the shift towards remote work, leading organizations to invest in workforce management tools that effectively manage distributed teams and support flexible work schedules. As remote work becomes widespread, the demand for solutions that enable seamless collaboration, communication, and performance tracking across remote teams continues to rise.

Moreover, the increasing focus on employee experience drives a significant demand for workforce management tools in America. Employers increasingly recognize the importance of creating an engaging work environment for their employees, including providing them with tools and technologies that enhance their work experience.

Companies are shifting towards an employee-centric approach, focusing on creating a work environment that meets employees' expectations. Workforce management tools that offer features like self-service portals, mobile access, and user-friendly interfaces empower employees to manage their schedules, time off, and other aspects of their work, enhancing their overall experience. According to the U.S. Bureau of Statistics data published in November 2023, total nonfarm payroll employment increased by 199,000 in November, and the unemployment rate edged to 3.7 percent. Job gains occurred in health care and government.

With more employees, organizations face a greater need to comply with labor laws and regulations. Workforce management solutions ensure compliance by automating processes such as tracking work hours, managing leave requests, and generating accurate payroll reports. As employment numbers increase, the complexity of compliance also grows, making robust workforce management solutions increasingly necessary.

The expanding healthcare sector in the United States is driving significant demand for workforce management solutions due to several key factors reshaping the industry. One of the primary drivers is the need for healthcare organizations to manage their workforce efficiently in the face of growing demand for services. Healthcare becomes more complex as the aging population increases, and healthcare providers are under pressure to optimize their staffing levels, ensure adequate coverage, and maintain high standards of patient care.

According to the U.S. Bureau of Statistics, overall employment in healthcare occupations is projected to grow much faster than the average for all occupations from 2022 to 2032. On average, about 1.8 million openings are projected each year in these occupations because of the employment expansion and the need to replace workers who leave the occupations permanently.

Another significant factor driving the demand for workforce management solutions in the healthcare sector is the increasing focus on patient outcomes and safety. Healthcare organizations are under pressure to deliver high-quality care while managing costs and resources effectively. Additionally, the rise of digital health technologies and the rising use of electronic health records (EHRs) have created a need for integrated workforce management solutions that seamlessly integrate with other healthcare I.T. systems. As the healthcare industry continues to evolve, the demand for advanced workforce management solutions tailored to the specific needs of healthcare providers is expected to grow.

The United States has a rising demand for workforce management tools specifically tailored for time and attendance management. This trend is driven by several factors reshaping the modern workplace, including the growing prevalence of remote work and flexible schedules. Compliance with labor laws and regulations is another key driver of the demand for workforce management tools for time and attendance management. The U.S. has strict U.S. laws governing overtime pay, breaks, and record-keeping requirements. Workforce management tools that automate time tracking and attendance management help organizations ensure compliance with these laws by providing accurate records and audit trails, reducing the risk of non-compliance and associated penalties.

Integration with payroll systems also drives the demand for workforce management tools for time and attendance management. Seamless integration between time and attendance tracking tools and payroll systems is essential for accurate and efficient payroll processing. Automating time tracking and attendance data collection can streamline the payroll process, reduce errors, and guarantee that employees receive fair compensation. Overall, the rising demand for workforce management tools for time and attendance management in the U.S. reflects the U.S.'s need for accurate, compliant, and efficient solutions that can adapt to the evolving nature of work.

The workforce management market in the U.S. is served by various companies offering solutions tailored to workforce management. These companies provide a range of software and services aimed at helping organizations optimize their workforce operations. Some of the key participants in the U.S. workforce management market include ADP (Automatic Data Processing, Inc.), Kronos (now UKG), SAP SuccessFactors, Oracle Corporation, Workday, Inc., Ultimate Software (now UKG), Ceridian, Paychex, Inc., Infor, etc.

Among the prominent industry participants is Kronos Incorporated, a leading provider of workforce management. Kronos offers a comprehensive workforce management tool suite encompassing time and attendance tracking, scheduling, labor analytics, and compliance management.

Another key player in the U.S. workforce management market is ADP (Automatic Data Processing, Inc.), a renowned provider of H.R. management H.R.d payroll solutions. ADP offers workforce management tools that cover various aspects of workforce management, including time and attendance tracking, scheduling, and labor management. The company's solutions are widely used across industries to streamline workforce-related processes and enhance operational efficiency.

Oracle Corporation is also a significant participant in the U.S. workforce management market, offering various workforce management solutions as part of its Oracle Cloud HCM (Human Capital Management) suite. SAP SE is another major player in the U.S. workforce management market. The SAP SuccessFactors suite includes workforce management tools for time and attendance tracking, scheduling, and workforce planning.

Workday, Inc. is recognized for its cloud-based suite of H.R. and workforce management solutions, encompassing time tracking, attendance management, scheduling, and workforce planning tools. Other notable participants in the U.S. workforce management market include Ultimate Software (now part of UKG), Paychex, Inc., and Ceridian HCM, Inc., each offering various workforce management solutions tailored to businesses of varying sizes and industries. These companies contribute to the competitiveness and innovation within the U.S. workforce management market, offering diverse solutions to meet the evolving demands of organizations in managing their workforce effectively.

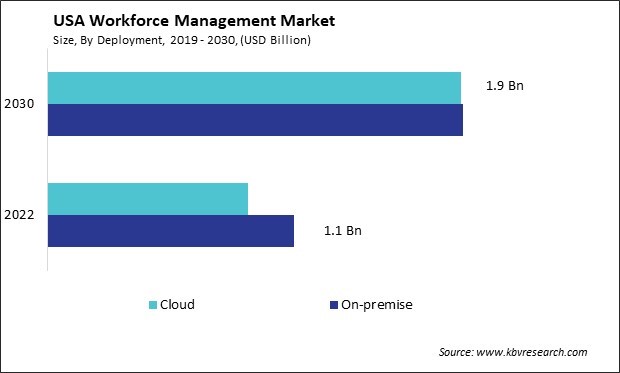

By Deployment

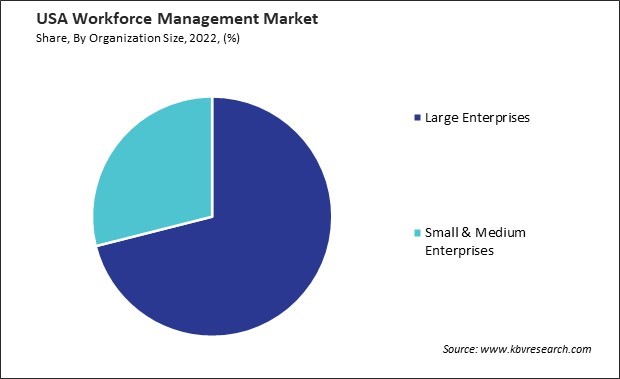

By Organization Size

By Solution

By Application