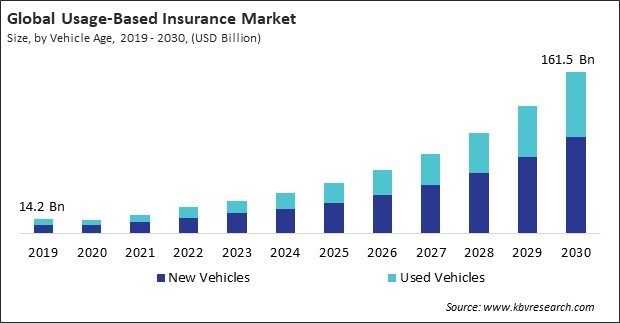

“Global Usage-Based Insurance Market to reach a market value of USD 161.5 Billion by 2030 growing at a CAGR of 25.5%”

The Global Usage-based insurance Market size is expected to reach $161.5 billion by 2030, rising at a market growth of 25.5% CAGR during the forecast period.

The rate of vehicle ownership in the Asia-Pacific region is among the highest globally. This significantly increases the number of prospective clients for UBI products. Numerous Asia-Pacific nations' UBI ecosystems have partnered with certain service providers to support the UBI initiative. Consequently, the Asia Pacific region would acquire nearly 30% of the total market share by 2030. The Asia Pacific region is also one of the fastest-growing regions regarding IoT technology. In the past few years, key countries like China, Japan, and India have rapidly adopted the IoT technology used by automotive OEMS present here. Additionally, some governing bodies, such as China, advocate using connected vehicles to enhance air quality and reduce traffic congestion. This number of initiatives to promote the adoption of connected cars and IoT technology has made the Asia Pacific region the fastest-growing market for UBI adoption.

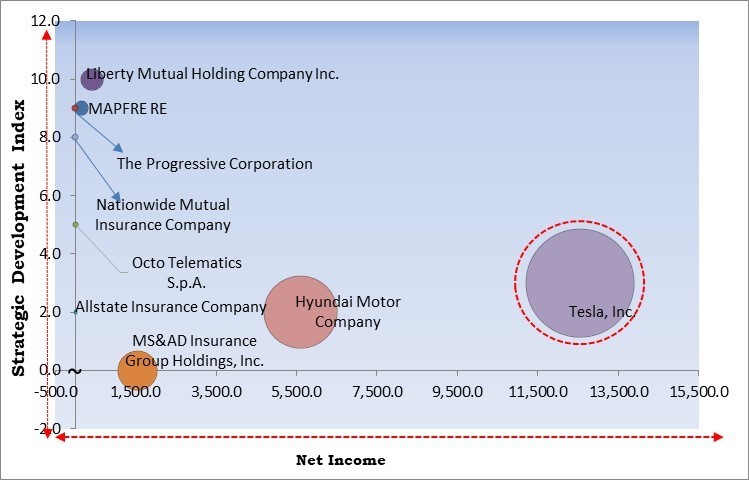

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, in October, 2023, Allstate Insurance Company came into partnership with CSAA Insurance Group, an American insurance company, to provide customers with Usage Based Insurance solutions. The partnership aids users in exercising greater control of their vehicle insurance by providing them with insights into their driving behaviour. Moreover, in December 2022, The Progressive Corporation announced a partnership with Motive, an automated operation solution provider, to integrate Motive’s AI-based safety solution into Progressive Commercial customers platform. The partnership allows customers to save costs on their insurance premiums by helping them gain insights into their driving behaviour.

Based on the Analysis presented in the KBV Cardinal matrix; Tesla, Inc. is the forerunner in the Market. Companies such as Hyundai Motor Company, Liberty Mutual Holding Company Inc. and MAPFRE RE, COMPAÑÍA DE REASEGUROS, S.A. are some of the key innovators in Market. In February, 2023, Hyundai Motor Company came into partnership with Verisk, a data analytics services provider. Under the partnership, Hyundai would integrate Verisk telematic data analysis platform with its vehicles with an aim for providing appropriate insurance premium pricing.

Telematics devices have become smaller and more compact, facilitating easy vehicle installation. This miniaturization has increased the accessibility of telematics technology, allowing insurers to deploy devices without significant modifications to vehicle structures. Advancements in machine learning and predictive analytics enhance the ability to analyze vast amounts of telematics data. Insurers can leverage these technologies to predict future driving behaviors, assess risk more accurately, and refine underwriting models for UBI. Thus, advancements in telematics technology have played a central role in expanding the market.

UBI allows for individualized risk assessment based on actual driving behavior. Instead of relying solely on traditional demographic factors, such as age and gender, insurers can use telematics data to assess risk at an individual level. For individuals who drive less frequently, UBI offers mileage-based premiums. This model allows low-mileage drivers to pay insurance premiums based on distance traveled. It aligns with the preferences of those who use their vehicles sparingly and seek cost-effective solutions. Therefore, the preference for personalization in insurance has expanded the market.

Different telematics devices and systems may generate data in varied formats. The lack of a standardized format makes it challenging for insurers, technology providers, and other stakeholders to ensure interoperability among diverse devices. Standardization issues hinder the smooth exchange of telematics data between insurers, technology providers, and other entities involved in the UBI ecosystem. Inconsistent data formats may lead to errors, misinterpretations, and delays in sharing information, impacting the efficiency of UBI programs. Due to the above factors, market growth will be hampered in the coming years.

By vehicle age, the market is categorized into new vehicles and used vehicles. The used vehicles segment recorded a remarkable revenue share in the market in 2022. Older vehicles often have lower annual mileage compared to newer ones. UBI can save costs for owners of older vehicles who drive less frequently. The pay-as-you-drive model, where premiums are based on actual mileage, benefits those who use their vehicles sparingly. UBI can take into account the environmental impact of driving habits. Older vehicles may have different emission levels, and UBI programs may consider factors such as fuel efficiency and emissions in the risk assessment. This aligns with broader environmental goals and encourages eco-friendly driving practices.

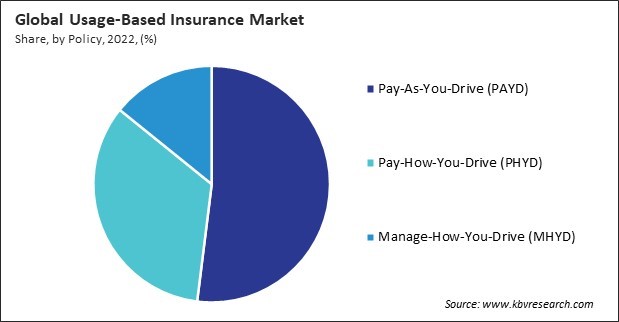

On the basis of policy, the market is segmented into pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and manage-how-you-drive (MHYD). The pay-how-you-drive (PHYD) segment acquired a substantial revenue share in the market in 2022. PHYD offers a more individualized risk assessment compared to traditional fixed-rate insurance models. Insurers can differentiate between high and low-risk drivers based on specific behaviors, allowing for more accurate pricing. PHYD provides strong incentives for policyholders to adopt safer driving practices. Drivers who exhibit safe behaviors, such as obeying speed limits and avoiding harsh braking, may enjoy lower premiums.

On the basis of vehicle type, the market is classified into light-duty vehicle (LDV) and heavy-duty vehicle (HDV). The heavy-duty vehicle (HDV) segment covered a considerable revenue share in the market. UBI programs for HDVs can include safety incentives for commercial fleets. By encouraging safe driving practices, such as adherence to speed limits and safe following distances, fleet operators may benefit from lower insurance premiums for their entire fleet. UBI for HDVs can contribute to preventive maintenance by monitoring the vehicle's health. Alerts can be sent to fleet managers for issues such as engine malfunctions or low tire pressure, facilitating timely maintenance and reducing the risk of breakdowns.

Based on technology, the market is fragmented into OBD (On-board diagnostics)-II, smartphone, hybrid, and black box. The smartphone segment garnered a significant revenue share in the market in 2022. Smartphone-based UBI solutions are scalable and cost-effective. Insurers can deploy UBI programs without the need for additional hardware installations, making it a more accessible option for both insurers and policyholders. GPS technology in smartphones enables location-based services. Insurers can use this information to understand drivers' typical routes and travel frequency and assess risk factors associated with specific geographic areas. Smartphone-based UBI models use the gathered data to calculate the insurance premiums. Safer driving behaviors are often rewarded with lower premiums, creating a direct link between individual behavior and insurance costs.

Free Valuable Insights: Global Usage-Based Insurance Market size to reach USD 161.5 Billion by 2030

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. The North America region acquired the largest revenue share in the market in 2022. There is an increasing awareness and acceptance of UBI among consumers in North America. As drivers become more familiar with the benefits of personalized pricing based on their driving habits, the demand for UBI policies has increased. Consumers increasingly seek personalized insurance solutions that align with their needs and behaviors. UBI caters to this preference by offering a pricing model that reflects the specific risk profile of each driver.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 26.1 Billion |

| Market size forecast in 2030 | USD 161.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 25.5% from 2023 to 2030 |

| Number of Pages | 262 |

| Number of Tables | 433 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Vehicle Age, Policy, Vehicle Type, Technology, Region |

| Country scope |

|

| Companies Included | Liberty Mutual Holding Company Inc., Allstate Insurance Company, MAPFRE RE, COMPAÑÍA DE REASEGUROS, S.A. (Cartera Mapfre, S.L.), The Progressive Corporation, Nationwide Mutual Insurance Company, MS&AD Insurance Group Holdings, Inc., Tesla, Inc., Hyundai Motor Company, Octo Telematics S.p.A. (Renova Group) and Zubie, Inc. |

By Vehicle Age

By Policy

By Vehicle Type

By Technology

By Geography

This Market size is expected to reach $161.5 billion by 2030.

Advancements in telematics technology are driving the Market in coming years, however, Lack of standardization in telematics data formats restraints the growth of the Market.

Liberty Mutual Holding Company Inc., Allstate Insurance Company, MAPFRE RE, COMPAÑÍA DE REASEGUROS, S.A. (Cartera Mapfre, S.L.), The Progressive Corporation, Nationwide Mutual Insurance Company, MS&AD Insurance Group Holdings, Inc., Tesla, Inc., Hyundai Motor Company, Octo Telematics S.p.A. (Renova Group) and Zubie, Inc.

The expected CAGR of this Market is 25.5% from 2023 to 2030.

The New Vehicles segment generated the highest revenue in the Market by Vehicle Age in 2022; there by, achieving a market value of $96 Billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $52.8 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges