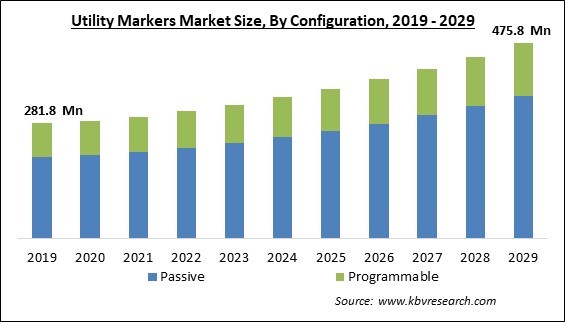

The Global Utility Markers Market size is expected to reach $475.8 Million by 2029, rising at a market growth of 6.5% CAGR during the forecast period.

Utility markers adhere to the uniform color codes prescribed by the relevant Public Works Association authorities of the location for temporarily designating their facilities because it might be challenging to keep track of exactly what is buried beneath on a worksite. These colors aid in identifying hidden dangers that must be considered during excavation. However, the color-coding scheme serves to alert employees to the specific danger. With the implementation of the universal color code, other utility marking codes were used to correctly identify underground conduits, cables, and pipelines, as well as the owners and descriptions of the corresponding facilities.

The public utility includes lines for water mains, street lighting, fiber optics, storm drains, traffic signals, telecommunication, electricity distribution, and water mains. The bulk of essential national security communication lines, oil and gas pipelines, public transportation, and road and rail networks are also competing for underground space in other places. The concern for the safety and security of underground services is credited with driving the rapid expansion of utility markers.

In addition, the strict government laws and regulations requiring the location of underground utilities prior to construction and excavation are considerably fueling the expansion of the utility markers market globally. While these "high impact" marks give excavators essential short-term visual cues, low-impact solutions keep these utility marker sites out of the public's view while offering significant practical advantages. The locations of buried utilities and other assets are frequently inaccessible for the use of standard signage.

Utility markers let excavators know to call for a complete set of markings prior to continuing, or they clearly designate underground assets to ensure that proper marking is done before each job. Flexible plastic utility markers offer the best of both worlds: eye-catching caution and location markings that blend in with the background, preventing complaints from neighbors while offering a long-lasting alternative to spray paint and other temporary methods now in use.

Due to the pandemic, ongoing international projects like high-speed rail lines were also impacted. Due to the lockdown brought on by COVID-19, the manufacture of several products in the utility marking industry has been halted. As a result, the market's expansion during the lockdown has been limited. Before the emergence of the coronavirus, the market for utility markers was experiencing a significant increase in demand from large manufacturing nations, but this need has since decreased. However, the demand for utility markers is expected to return to its prior level following the pandemic's upsurge and help the market recover from its initial decline.

Due to sophisticated techniques, the owners of the underground utilities can analyze those facilities in real-time. Fleet telemetry systems, GIS data devices, GPS devices, and GPR devices composed of multiple GPR antennas, referred to as "GPR Arrays," have all started to be used by utility locating and marking equipment and service providers. These devices allow surveying the areas more quickly by collecting several GPR profiles and providing utility locating services. Thus, it is projected that the demand for real-time utility locating and marking during the forecast period will fuel the market for utility markers.

All public and private economic sectors can access these cables for telephony and internet services. Any interruption to telecom services could result in significant financial losses for the public and private sectors. In order to find, map, and designate underground telecom infrastructure, it is essential. Hence, with the telecommunications industry expanding, there will likely be a greater requirement for finding and mapping underground telecom networks, increasing the demand for underground utility markers and providing growth opportunities for the utility markers market.

The field inspector must know the policies, practices, and methods for building and maintaining subsurface utility distribution and collection systems. To learn the precise physical details and location of the utility, the field inspector should also be an expert in computer and software-related activities. The task of utility locating is less appealing for the field officer due to a lack of information regarding electronic or manual utility locator equipment, field survey, and awareness regarding utility maps and construction drawings. Thus, the absence of proper regulations and awareness regarding utility marking, especially in underdeveloped regions, hinders the growth of the utility marker market.

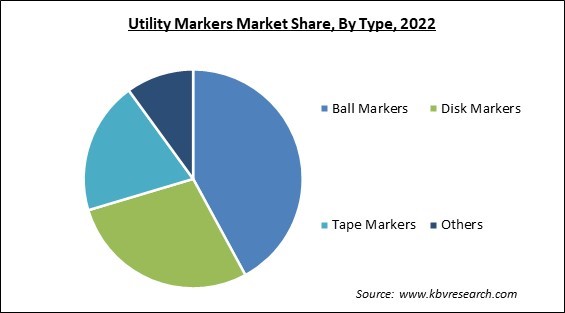

Based on type, the utility markers market is segmented into ball markers, disk markers, tape markers and others. This is because when buried below, ball markers are formed like a ball and contain several components inside, shielding them from water, chemicals, and dirt. These markers have a self-leveling mechanism that makes sure they stay horizontal no matter where they are positioned in the ground. Companies, for instance, supply an electronic marker ball that positions the buried items precisely.

On the basis of configuration, the utility markers market is divided into passive and programmable. The passive segment witnessed the largest revenue share in the utility markers market in 2022. This is owing to the fact that they are accurate, practical, and durable means of identifying underground facilities at depths of up to a few feet. For greater workplace safety, passive markers are perfect for marking the locations of utilities.

By utility type, the utility markers market is classified into gas, power, telecommunications and water & wastewater. The gas segment garnered a prominent revenue share in the utility markers market in 2022. The growth is attributed to gas being one of the main industries where utility markers are used. Pipe pathways, conduit stubs, valves, tees, road crossings, meter boxes, and installations that are covered in snow are a few crucial locations where utility markers can be installed in gas lines.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 310.3 Million |

| Market size forecast in 2029 | USD 475.8 Million |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 6.5% from 2023 to 2029 |

| Number of Pages | 196 |

| Number of Table | 360 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Configuration, Utility Type, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the utility markers market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the utility markers market by generating the maximum revenue share in 2022. The primary reasons driving the growth of the utility markers market in North America are the deteriorating infrastructure and the ongoing building of new infrastructure. Utility markers are being adopted as investments in the water, electricity grid, and internet networks increase. The government of North America is progressively sponsoring projects to enhance infrastructure.

Free Valuable Insights: Global Utility Markers Market size to reach USD 475.8 Million by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include 3M Company, Radiodetection Ltd. (SPX Technologies, Inc.), Dura Line ltd. (Orbia Advance Corporation, S.A.B. de C.V.), Tempo Communications, Inc., Komplex s.r.o., Hexatronic Group AB, RYCOM Instruments, Inc., Berntsen International, Inc., Trident Solutions, Inc., and National Marker Company (Justrite Safety Group).

By Configuration

By Utility Type

By Type

By Geography

The Market size is projected to reach USD 475.8 Million by 2029.

The constant growth of the telecommunication sector are driving the Market in coming years, however, Limited knowledge and standards regarding utility markers in emerging economies restraints the growth of the Market.

3M Company, Radiodetection Ltd. (SPX Technologies, Inc.), Dura Line ltd. (Orbia Advance Corporation, S.A.B. de C.V.), Tempo Communications, Inc., Komplex s.r.o., Hexatronic Group AB, RYCOM Instruments, Inc., Berntsen International, Inc., Trident Solutions, Inc., and National Marker Company (Justrite Safety Group).

The Telecommunications segment is leading the Market by Utility Type in 2022 thereby, achieving a market value of $164.2 Million by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $175.6 Million by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.