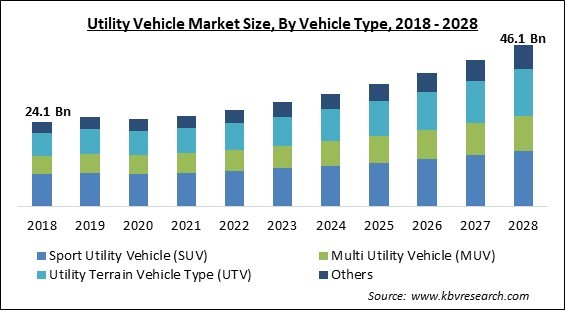

The Global Utility Vehicle Market size is expected to reach $46.1 billion by 2028, rising at a market growth of 9.0% CAGR during the forecast period.

A utility vehicle is a vehicle that is built to fulfill a certain duty while also being able to operate on tough terrain. Utility vehicles are used for both passenger & utility commutes and offer several advantages over passenger vehicles, comprising increased passenger capacity, increased cargo-carrying capacity, greater safety and comfort, and so on. To meet operational needs, the majority of utility vehicles are equipped with an all-wheel-drive (AWD) or four-wheel drive (4WD). Utility vehicles are used in a broad array of industries, including transportation of commodities, agricultural uses, passenger commuting solutions, and more. Electric-powered utility vehicles have gained popularity in recent years due to their fuel-efficient operations and great noise reduction.

A utility terrain vehicle is a motorized vehicle that is specially built to perform a specific task more efficiently than a general-purpose vehicle or a passenger vehicle. Side by side (S-X-S), recreational off-highway vehicle (ROV), & multipurpose off-highway utility vehicle are all terms used to describe utility terrain vehicles (MOHUV). A utility terrain vehicle (UTV) is an off-road vehicle with seating for two to six people. It's made for harder terrain, towing, and other work that requires a workhorse. In the forest services, utility terrain vehicles are becoming popular for leisure activities such as trail maintenance, planned burning operations, & pesticide applications. A roll-over safety system, along with windshields, hardtops, and cab enclosures, are standard on the majority of utility vehicles. UTVs are becoming more popular in sports as trailing adventures & racing events become more prominent.

The utility vehicle market is predicted to rise as a result of factors such as increased penetration of AWD & 4WD cars, as well as government policies to encourage the use of utility vehicles like as UTVs on the road. The market's growth is hampered by a drop in car production and sales, as well as the high maintenance costs of utility vehicles. On the other hand, the development of electric utility vehicles & the expansion of dealer networks to increase product reach is expected to provide profitable growth prospects for market players.

Due to commuting limits & predicted dismal financial performance of market players in 2021, the outbreak of the COVID-19 pandemic has had a detrimental impact on the utility vehicle industry. It has had an impact on the economy as a whole, as well as contributors, like market players who are developing smart cost-cutting initiatives. Supply chain execution, regulatory and policy changes, labor dependency, working capital management, liquidity, and solvency management are the primary risk considerations for utility vehicle industry participants. Due to commuting limits, personnel unavailability, and a shortage of raw materials caused by supply chain disruption, most utility vehicle manufacturing facilities were shut down during the pandemic.

SUVs (Sports Utility Vehicles) are vehicles that are meant to be taller and more upright. Taller windows and a higher seating position improve sight from the driver's (and passengers') seat in this style. Drivers have a greater vision of the road ahead as well as the vehicle's sides and back. Typical sightline impediments, such as the automobile next to a person that drew up too close at the stop signal, are often easily seen by drivers. This allows the driver to double-check that there isn't a car approaching before turning right. Clear sight also provides confidence when changing lanes on the interstate, finding open parking spaces, and spotting potholes in time to avoid them. Some SUVs have much more features to help drivers see better.

In nowadays, with the increasing inflation all over the world, the prices of fuels, like petrol and diesel, is on a rise. Due to this, preference of people is being shifted toward electric vehicles. It is a more affordable alternate of gasoline and diesel-based utility vehicles. In terms of technological evolution, all mobility options have undergone significant changes in recent years. Due to their output efficiency and lightweight, market players are depending on electrical components to meet changing consumer needs, resulting in the development of electric-driven utility vehicle solutions. Additionally, car emissions are a critical aspect since hazardous greenhouse gases are released due to it, raising environmental & health concerns.

Customers & OEMs are primarily concerned about passenger and vehicle safety. Vehicle safety is a priority for regulatory authorities around the world. Drivers of all-terrain vehicles are frequently required to monitor speed, navigation, and other data. Any operator distraction or ignorance could result in a major mishap. When an all-terrain vehicle flips or rolls over, the most common reasons of it are either ignorance or distraction. Accidents involving UTVs are becoming common across the world. They're not allowed to be used on public roads and highways in most cases. A UTV may reach speeds of up to 75 mph depending on the weather and where it is driven.

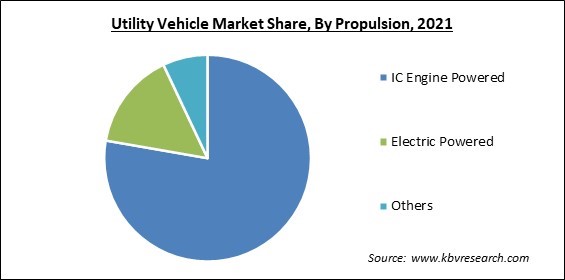

Based on Propulsion, the market is segmented into IC Engine Powered, Electric Powered, and Others. The IC engine powered segment acquired the highest revenue share in the utility vehicle market in 2021. The constantly rising growth of this segment is due to the availability of a fleet around the globe as well as its cost-effective solution. Moreover, the IC engine powered utility vehicles are observing higher demand due to the fact that these vehicles have robust power and can transport a significant amount of load in one go.

Based on Vehicle Type, the market is segmented into Sport Utility Vehicle (SUV), Multi Utility Vehicle (MUV), Utility Terrain Vehicle Type (UTV), and Others. The Multi-Utility Vehicle segment garnered a significant revenue share in the utility vehicle market in 2021. Multi-utility vehicles refer to vehicles that can be used for a variety of purposes. This vehicle is primarily intended to transport a large number of people. These utility vehicles are gaining popularity all across the world. It's primarily due to the convenience they provide in terms of carrying capacity, whether it's for people or freight. A Multi Utility Vehicle often features two or three rows of seats that may accommodate 6 to 8 passengers. This is the vehicle's most significant benefit. Moreover, they offer a flexible internal space that can be altered to meet the needs of the customer. A user can fold some of the seats if there is a need to transport more cargo. As a result, the passenger will have ample room to store all of their belongings. Additionally, the upright design style makes the inside feel wider and more open.

Based on Application, the market is segmented into Passenger Commute, Industrial, Agricultural, Sports, and Others. Passenger Commute segment acquired the highest revenue share in the utility vehicle market in 2021. The rising growth of this segment is owing to the rapidly rising prices of fuels across the world. Passenger Commute is when a person travels from their home to their workplace or school on a regular basis, leaving the confines of the place they live in. It can also refer to any regular or frequently recurring travel between areas, even if it is not tied to employment. Due to increased fuel prices, more people are preferring public commutes instead of private vehicles.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 25.9 Billion |

| Market size forecast in 2028 | USD 46.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9% from 2022 to 2028 |

| Number of Pages | 244 |

| Number of Tables | 384 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Propulsion, Vehicle Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia-Pacific emerged as the leading region in the utility vehicle market with the largest revenue share in 2021. Because of their changing transportation preferences, China and India are showcasing increased requirement for utility vehicles. The regional utility vehicle market is highly consolidated, with several companies controlling the majority of the market. The majority of market players are strategically active in activities such as product introduction, expansion, cooperation, and development.

Free Valuable Insights: Global Utility Vehicle Market size to reach USD 46.1 Billion by 2028

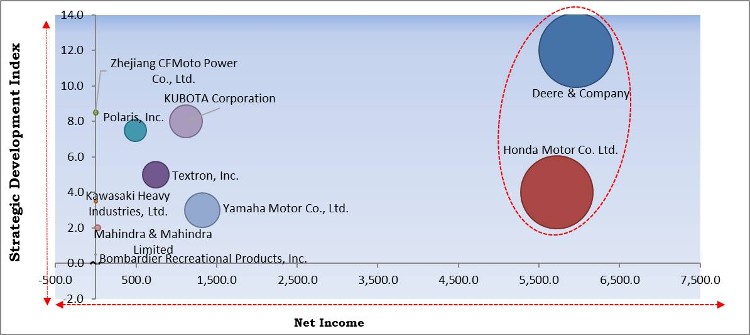

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Deere & Company and Honda Motor Co. Ltd. are the forerunners in the Utility Vehicle Market. Companies such as Zhejiang CFMoto Power Co., Ltd., KUBOTA Corporation and Polaris, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Textron, Inc., Polaris, Inc., Deere & Company, Honda Motor Co. Ltd., Yamaha Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., KUBOTA Corporation, Mahindra & Mahindra Limited, Zhejiang CFMoto Power Co., Ltd., and Bombardier Recreational Products, Inc.

By Propulsion

By Vehicle Type

By Application

By Geography

The global utility vehicle market size is expected to reach $46.1 billion by 2028.

Increasing demand for electric utility vehicles are increasing are driving the market in coming years, however, high accident rates & consequent legislation growth of the market.

Textron, Inc., Polaris, Inc., Deere & Company, Honda Motor Co. Ltd., Yamaha Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., KUBOTA Corporation, Mahindra & Mahindra Limited, Zhejiang CFMoto Power Co., Ltd., and Bombardier Recreational Products, Inc.

The Sport Utility Vehicle (SUV) segment acquired maximum revenue share in the Global Utility Vehicle Market by Vehicle Type in 2021, thereby, achieving a market value of $15.7 billion by 2028.

The Asia Pacific market is the fastest growing region in the Global Utility Vehicle Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.