“Global v2x Cybersecurity Market to reach a market value of USD 5.7 Billion by 2031 growing at a CAGR of 19.9%”

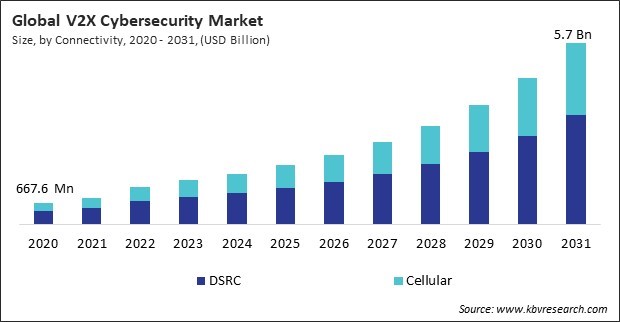

The Global V2X Cybersecurity Market size is expected to reach $5.7 billion by 2031, rising at a market growth of 19.9% CAGR during the forecast period.

Japan’s government has targeted all new car sales to be electric or hybrid by the mid-2030s as part of its carbon neutrality goals. Supported by policies like the "Green Growth Strategy," Japan fosters the transition to clean transportation. The Japan Automotive Research Institute has also highlighted the increasing integration of V2X technology in EVs, particularly vehicle-to-grid (V2G) systems, where EVs communicate with power grids for optimized charging and energy distribution. However, the increased connectivity of EVs also exposes them to cyber threats, necessitating robust cybersecurity solutions to ensure these systems' safe and secure operation. Thus, the Asia pacific region generated 27% revenue share in the market in the market.

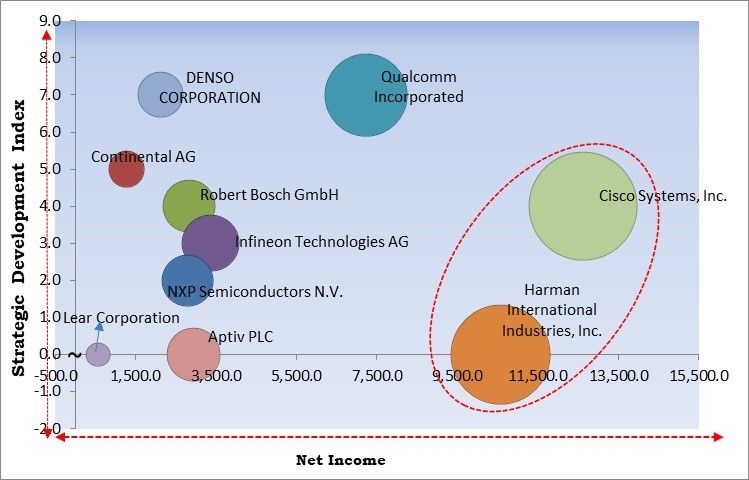

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2023, DENSO CORPORATION signed a partnership with Koito, an automotive lighting device manufacturer, to enhance night-time driving safety by improving the object recognition rate of vehicle image sensors through coordinated lighting and sensor technology. This partnership would reduce night-time traffic fatalities by combining Koito's lighting expertise with Denso's sensor technology for next-generation mobility safety. Additionally, In 2023, January, Continental AG came into partnership with Ambarella, an American semiconductor company, to to develop scalable AI-driven hardware and software solutions for assisted and automated driving. By Integrating Ambarella's CV3-AD SoCs with Continental's ADAS expertise, the two companies aim to enhance vehicle safety and performance.

Based on the Analysis presented in the KBV Cardinal matrix; Cisco Systems, Inc. and Harman International Industries, Inc. are the forerunners in the v2x Cybersecurity Market. Companies such as Robert Bosch GmbH, Infineon Technologies AG and NXP Semiconductors N.V. are some of the key innovators in v2x Cybersecurity Market. In September, 2020, NXP Semiconductors N.V. announced a partnership with AUTOCRYPT, a V2X and autonomous vehicle security solutions provider, to enhance secure V2X communication in automotive applications. By integrating AUTOCRYPT's IEEE 1609.2-compliant V2X security solutions with NXP's platforms, including the SAF5X00 modem chipsets and i.MX processors, the two companies aim to optimize secure message exchange and performance, supporting the growing need for secure connected vehicle infrastructure.

MaaS platforms require constant data exchange between vehicles, transport operators, users, and infrastructure. This data typically includes sensitive information such as real-time vehicle locations, payment details, and personal user data, making MaaS systems attractive targets for cyberattacks.

Additionally, Ensuring the security of both EVs and the energy infrastructure they connect to is critical as the adoption of electric mobility accelerates. Governments and regulatory bodies increasingly recognize cybersecurity's importance for the EV ecosystem. They introduce guidelines and regulations to protect V2X communication and EV infrastructure from emerging threats. Thus, the rising adoption of EVs necessitates efficient V2X cybersecurity tools, which, in turn, have proven beneficial for the market.

Automakers must invest in cybersecurity expertise, including hiring skilled engineers and developers who understand the intricacies of automotive cyber defense. These added expenses can strain budgets, particularly for smaller manufacturers who may struggle to absorb the costs associated with V2X cybersecurity implementation. Hence, high cost slows the overall growth of the V2X cybersecurity market, as cost concerns prevent widespread adoption and deployment across the automotive and infrastructure sectors.

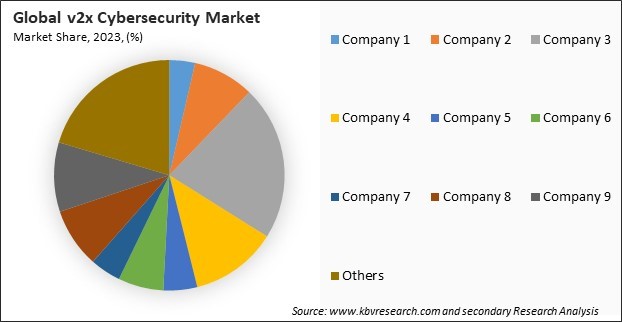

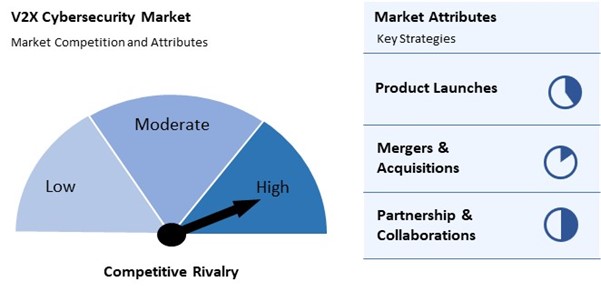

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on connectivity, the market is bifurcated into DSRC and cellular. The cellular segment procured 38% revenue share in the market in 2023. This segment is growing due to the emergence of cellular technologies like 4G LTE and the rollout of 5G networks as they began to gain traction within the V2X ecosystem.

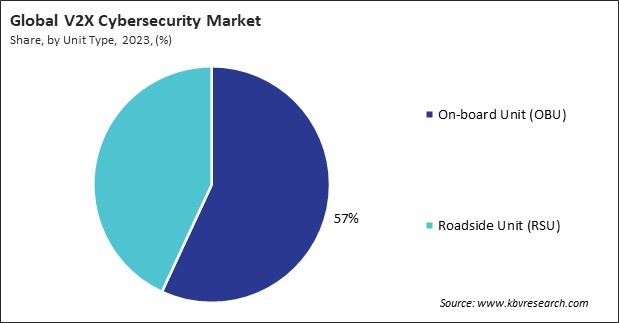

On the basis of unit type, the market is classified into on-board unit (OBU) and roadside unit (RSU). The on-board unit (OBU) segment acquired 57% revenue share in the market in 2023. OBUs are integrated directly into vehicles, enabling communication between the vehicle and other V2X entities such as infrastructure, other vehicles, and networks.

By communication, the market is divided into vehicle-to-vehicle (V2V), vehicle-to-cloud (V2C), Vehicle-to-infrastructure (V2I), and vehicle-to-pedestrian (V2P). The vehicle-to-vehicle (V2V) segment witnessed 47% revenue share in the market in 2023. V2V communication is pivotal in enabling vehicles to exchange real-time information such as speed, location, and road conditions to improve safety and prevent accidents.

Based on vehicle type, the market is segmented into passenger car and commercial vehicle. The commercial vehicle segment acquired 37% revenue share in the V2X cybersecurity market in 2023. Commercial vehicles, including trucks, buses, and delivery vans, are increasingly integrated with V2X communication technologies to enhance logistics, fleet management, and safety.

Free Valuable Insights: Global v2x Cybersecurity Market size to reach USD 5.7 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment witnessed 31% revenue share in the market in 2023. Europe has been at the forefront of implementing stringent regulations for connected vehicle security, such as the General Safety Regulation and UNECE WP.29 guidelines, which mandate vehicle cybersecurity measures.

The market is highly competitive, driven by the need to secure vehicle-to-everything communication. Key attributes include robust encryption protocols, real-time threat detection, and prevention mechanisms. Companies focus on developing solutions that ensure data integrity, confidentiality, and authentication across connected vehicles and infrastructure. Innovations in machine learning and AI for anomaly detection and rapid response capabilities further characterize the market's dynamic landscape.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 1.4 Billion |

| Market size forecast in 2031 | USD 5.7 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 19.9% from 2024 to 2031 |

| Number of Pages | 274 |

| Number of Tables | 423 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Connectivity, Unit Type, Communication, Vehicle Type, Region |

| Country scope |

|

| Companies Included | Infineon Technologies AG, Qualcomm Incorporated (Qualcomm Technologies, Inc.), NXP Semiconductors N.V., Continental AG, DENSO CORPORATION, Harman International Industries, Inc. (Samsung Electronics Co., Ltd.), Lear Corporation, Aptiv PLC, Robert Bosch GmbH and Cisco Systems, Inc. |

By Connectivity

By Unit Type

By Communication

By Vehicle Type

By Geography

This Market size is expected to reach $5.7 billion by 2031.

Rise of Mobility-as-a-Service (MaaS) are driving the Market in coming years, however, High Implementation Costs of V2X Cybersecurity Solutions solutions restraints the growth of the Market.

Infineon Technologies AG, Qualcomm Incorporated (Qualcomm Technologies, Inc.), NXP Semiconductors N.V., Continental AG, DENSO CORPORATION, Harman International Industries, Inc. (Samsung Electronics Co., Ltd.), Lear Corporation, Aptiv PLC, Robert Bosch GmbH and Cisco Systems, Inc.

The expected CAGR of this Market is 19.9% from 2024 to 2031.

The DSRC segment is leading the Market by Connectivity in 2023; thereby, achieving a market value of $3.5 million by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $1.9 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges