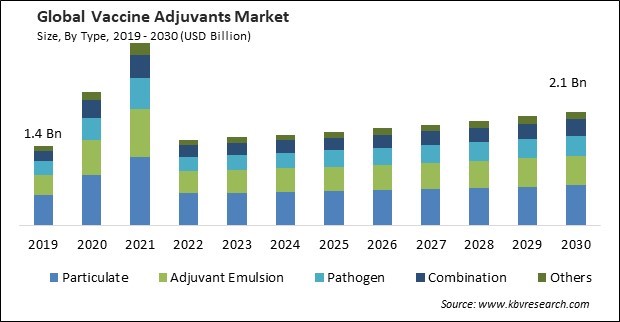

The Global Vaccine Adjuvants Market size is expected to reach $2.1 billion by 2030, rising at a market growth of 3.7% CAGR during the forecast period.

Infectious diseases impose a substantial financial and health burden on the international community. Vaccine adjuvants play a pivotal role in enhancing the efficacy of vaccines against infectious diseases by amplifying and directing the immune response. Consequently, the infectious diseases segment would acquire nearly 65% of the total market share by 2030. The factors that aid in the increasing prevalence of infectious diseases are rapid urbanization, unplanned human habitats in densely populated urban pockets inhabited by the poor, inadequate healthcare infrastructure, and insufficient vaccination. Several contagious diseases, including malaria, dengue fever, chikungunya, influenza, measles, tuberculosis, and coronaviruses, including SARS, MERS, and COVID-19, are rapidly disseminated between cities via international commerce and travel. Thus, rising frequencies of infectious diseases have a positive effect on the market.

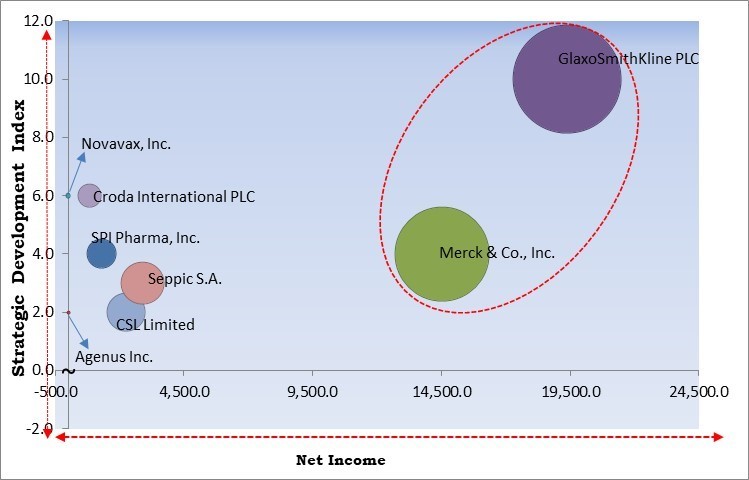

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, in October, 2023, SPI Pharma, Inc. signed a distribution partnership with Q-Vant Biosciences, Inc. The partnership involves the development of Q-Vant's Q-SAP saponin adjuvant technology. The partnership would provide saponin adjuvants to vaccine developers and manufacturers globally. Moreover, in May, 2023, Croda International PLC partnered with Botanical Solution Inc, to accelerate the production of pharmaceutical-grade vaccine adjuvant QS-21. The partnership would lead to the creation of a sustainable QS-21 supply chain.

Based on the Analysis presented in the KBV Cardinal matrix; GlaxoSmithKline PLC and Merck & Co., Inc. are the forerunners in the Market. In April, 2020, GlaxoSmithKline PLC partnered with Sanofi. Under the partnership, the two companies would combine their respective offerings to develop an adjuvanted vaccine for COVID-19. Companies such as Seppic S.A., CSL Limited and SPI Pharma, Inc. are some of the key innovators in Market.

The COVID-19 pandemic crisis had a predominantly positive effect on market expansion. The urgency to develop COVID-19 vaccines prompted advancements in adjuvant technologies. Researchers explored various adjuvant formulations to potentiate immune responses against the virus, leading to innovations and discoveries that had broader implications for future vaccines. As a consequence of the profitability and progress of innovative adjuvants, there was a surge in demand during the COVID-19 pandemic, and this upward trend is expected to persist for the foreseeable future.

As the demographic landscape shifts toward an older population globally, there's a corresponding increase in susceptibility to infectious diseases and a reduced immune response to conventional vaccines among the elderly. This demographic shift has necessitated the development of more effective vaccines, where adjuvants play a pivotal role. The confluence of a growing chronic disease burden and an aging population has resulted in an elevated need for vaccines that are not only more efficacious but also appropriate for populations at risk. Consequently, the positive impact of adjuvants in addressing the unique immunological challenges posed by an aging and chronically ill population has contributed significantly to the expansion and advancement of the market.

Biotechnology in the health sector is increasingly emerging as a catalyst for economic progress in developing nations and a crucial instrument in enhancing the effectiveness and availability of healthcare services for impoverished populations. Investing in and supporting research and development in the ever-evolving biotechnology field is crucial. Potentially addressing an even more significant number of healthcare challenges, the subsequent generation of biotechnology products offers brighter prospects for individuals around the globe. Consequently, the exponential advancement in biotechnology is driving the expansion of the market.

Adjuvanted vaccines may cause more local and systemic adverse effects than non-adjuvanted vaccines (e.g., injection site redness, pain, swelling, fever, shivering, and body aches). However, adjuvants can also be toxic in and of themselves, with numerous adverse environmental and human health effects having been documented. Due to the need for more data, the impossibility of conducting controlled studies in humans to establish causation, and the potentially lengthy time between vaccination and onset of symptoms, such evaluations are exceedingly challenging. Thus, the side effects and toxicity of these adjuvants are restraining market growth.

Based on type, the market is divided into pathogen, adjuvant emulsion, particulate, combination, and others. In 2022, the pathogen segment acquired a substantial revenue share in the market. The elicitation of protective immunity is facilitated by promoting appropriate immune system responses towards targeted pathogens at both the innate and adaptive stages through the careful and proper selection of adjuvants. Variable pathogens possess unique attributes that necessitate the host's ability to mount a corresponding immune response in opposition to them. Adjuvant selection aims to induce an immune response customized to pathogens by their distinct characteristics. Hence, the increasing rate of infectious diseases caused by pathogens drives the segment's growth.

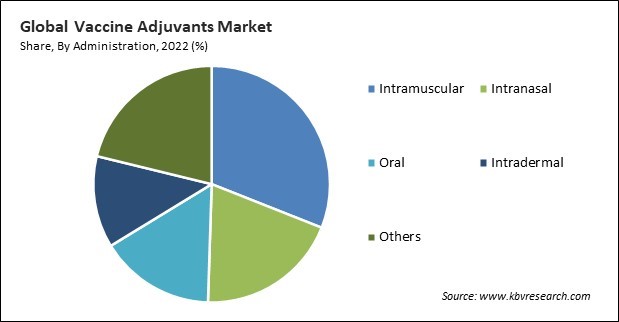

Based on administration, the market is divided into oral, intradermal, intranasal, intramuscular, and others. The intranasal segment held a remarkable revenue share in the market in 2022. Lymphatic tissue, also known as nasal-associated lymphoid tissue (NALT), is abundant in the nasal cavity. It combines cellular and humoral immune responses to stimulate systemic and mucosal immunity. Intranasal vaccines offer a needle-free, non-invasive method of vaccine administration. This mode of delivery is particularly advantageous in terms of ease of administration, especially in populations where needle phobia might be a concern.

On the basis of application, the market is categorized into infectious diseases, cancer, and others. In 2022, the cancer segment witnessed a considerable revenue share in the market. Extensive research has been conducted on the potential for developing cancer adjuvants using animal and human models. Many of these vaccinations are therapeutic, stimulating the immune system to identify and eliminate well-established tumors through prophylactic vaccination against human papillomavirus-associated malignancies. Patients who have undergone surgical resection, chemotherapy, or radiotherapy, all of which induce an immune response, are the optimal candidates for cancer vaccines.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.5 Billion |

| Market size forecast in 2030 | USD 2.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 3.7% from 2023 to 2030 |

| Number of Pages | 265 |

| Number of Table | 394 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Administration, Application, Region |

| Country scope |

|

| Companies Included | GlaxoSmithKline PLC, Novavax, Inc., SPI Pharma, Inc. (Associated British Foods PLC), Agenus Inc., CSL Limited, InvivoGen SAS, Croda International PLC, Seppic S.A. (L’Air Liquide S.A.), Merck & Co., Inc. and Riboxx GmbH |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed the maximum revenue share in the market in 2022. The expansion of these adjuvants in North America is fueled by increased investments allocated to the research and development of novel therapeutics and a rise in the incidence of catastrophic epidemic diseases. As a result, immunization for both chronic and acute illnesses becomes necessary. Additionally, the geographic reach of significant market participants in the United States enhances product penetration.

Free Valuable Insights: Global Vaccine Adjuvants Market size to reach USD 2.1 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include GlaxoSmithKline PLC, Novavax, Inc., SPI Pharma, Inc. (Associated British Foods PLC), Agenus Inc., CSL Limited, InvivoGen SAS, Croda International PLC, Seppic S.A. (L’Air Liquide S.A.), Merck & Co., Inc. and Riboxx GmbH

By Type

By Administration

By Application

By Geography

This Market size is expected to reach $2.1 billion by 2030.

Rising proportion of aging population and chronic diseases are driving the Market in coming years, however, Side effects and high toxicity of adjuvants restraints the growth of the Market.

GlaxoSmithKline PLC, Novavax, Inc., SPI Pharma, Inc. (Associated British Foods PLC), Agenus Inc., CSL Limited, InvivoGen SAS, Croda International PLC, Seppic S.A. (L'Air Liquide S.A.), Merck & Co., Inc. and Riboxx GmbH

The expected CAGR of this Market is 3.7% from 2023 to 2030.

The Intramuscular segment led the Market, by Administration in 2022; thereby, achieving a market value of $569.9 Million by 2030.

The North America region dominated the Market, by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $836.8 Million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.