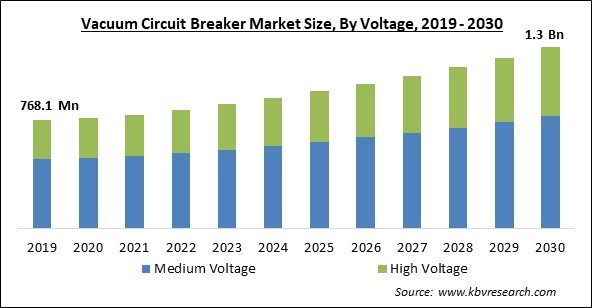

The Global Vacuum Circuit Breaker Market size is expected to reach $1.3 billion by 2030, rising at a market growth of 5.5% CAGR during the forecast period.

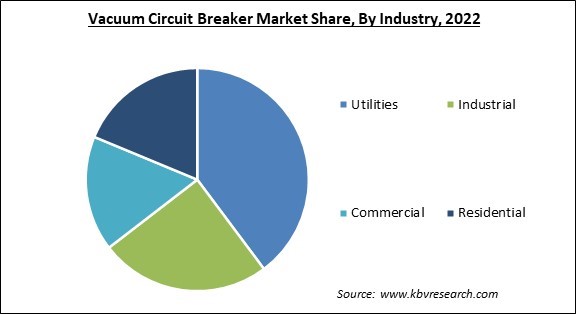

The vacuum circuit breakers are highly deployed in utilities sector, its need is growing with the increase in the number of construction activities, hence, the utilities generated $335.9 million revenue in the market in 2022. The German government claims that throughout the past few years, the construction sector has contributed to stabilizing the German economy. The total amount invested in the project increased by 3.2% in 2020 and 2021. Private investors own a large amount of this industry's output. Similarly, the National Association of Building Contractors (ANCE) predicted that the amount spent on construction in Italy would climb by 16.4% in 2021 compared to the year before.

Additionally, approximately 1.2 million men & women, or roughly 7% of the labor force, are employed in Canada's construction industry, which is constantly growing. In addition, there are large-scale construction investments planned around the country. For instance, the governments of Canada & Alberta dedicated more than 52.7 million USD to the completion of many infrastructure projects under the Investing in Canada Infrastructure Program, which was created by them.

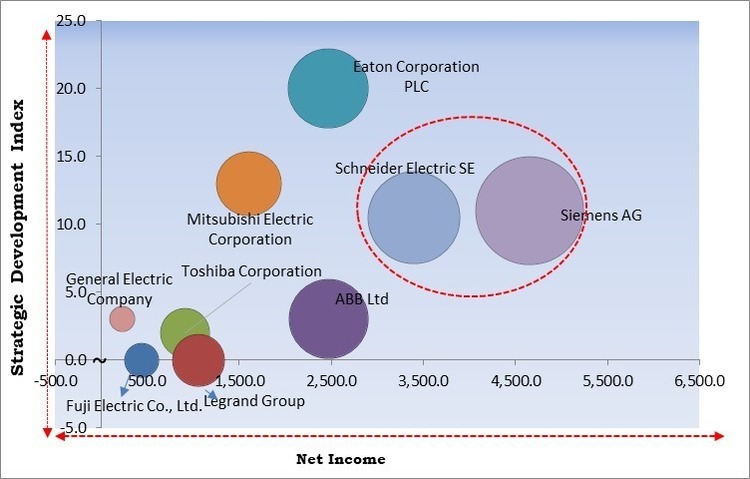

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2022, Eaton Corporation PLC entered into an agreement with Jiangsu Huineng Electric Co., Ltd. to acquire a 50% stake in its circuit breaker business. The alignments of both companies' products enable Eaton Corporation PLC to capitalize on opportunities in high-growth market segments. Additionally, In February, 2022, Mitsubishi Electric Power Products, Inc. signed an agreement to acquire Computer Protection Technology, Inc. to strengthen Mitsubishi Electric’s service capabilities in the critical power industry. Furthermore, the company would expand its footprints in the North American market by offering one-stop services-from installation to maintenance of UPS systems.

Based on the Analysis presented in the KBV Cardinal matrix; Siemens AG, and Schneider Electric SE are the forerunners in the Market. In January, 2020, Siemens AG took over C&S Electric Company, which specializes in switchgear. The addition of C&S Electric’s product complements and strengthens the company's offering. Additionally, the acquisition would support Siemens portfolio not only in India but also for export to competitive international markets. Companies such as Eaton Corporation PLC and ABB Ltd and Mitsubishi Electric Corporation are some of the key innovators in the Market.

Global power sector investment is anticipated to climb by around 5% in 2021 to reach more than USD 820 billion, up from a flat 2020, based on the International Energy Agency (IEA). 70% of the USD 530 billion estimated to be spent on all new generation capacity in 2021 will go toward renewables, which currently dominate investment in new power generation. A protective mechanism is necessary for renewable energy sources like solar and wind generators. Consequently, the circuit breaker is needed for connecting power-generating plants to switchyards and the electrical grid. During the projected period, this is anticipated to promote market growth overall.

"Smart city" refers to metropolitan areas with advanced general infrastructure, communications, transportation, and market viability. Enhanced energy efficiency, smart water management, a strong transit network, smart grids, and cutting-edge medical and educational facilities are some features of the "smart city." Nowadays, smart city projects are expanding rapidly across most regions. This has increased electricity usage in the home, commercial, and industrial sectors, increasing demand for electrical components. In residential & commercial buildings wherein installed electrical systems and equipment are not regularly checked, there is a heightened risk of electrical overload and short circuits. So, during the forecast period, an increase in electricity consumption will likely fuel market growth.

Vacuum circuit breakers (VCB)-related switching transients have long been documented. Recently, a substantial number of transformer failures have been attributed to this phenomenon due to the increasing use of vacuum circuit breakers for transformer switching. It is common knowledge that several restrikes in the circuit breaker can happen when switching highly inductive loads like transformers under certain circumstances. Multiple restrikes are brief voltage spikes that travel down the cable and arrive at the transformer terminals. A wave is reflected and absorbed at terminals due to various surge impedances. The risk of overvoltage while switching that is associated with vacuum circuit breakers could impede market growth over the projection period.

Based on voltage, the market is segmented into medium voltage, and high voltage. In 2022, the medium voltage segment held the highest revenue share in the market. Electric current can be cut off in an emergency using medium voltage (MV) vacuum circuit breakers. It is one of the most crucial parts of any electrical installation since it helps safeguard the machinery against short circuits, overvoltages, and high temperatures. The MV VCBs come in various ratings and varieties, including dry site protection and gaskets for protection against water, fire, and other hazards.

On the basis of installation location, the market is fragmented into indoor, and outdoor. In 2022, the indoor segment witnessed the largest revenue share in the market. In the indoor setting, the vacuum circuit breaker provides benefits like small size, light weight, suitability for frequent operation, and interrupting without maintenance. It is most commonly used in the 3kV-40.5kV distribution network. Also, when a part of the power system fails, it collaborates with protection devices and automatic devices to swiftly eliminate the faulty part from the system, decrease the scope of power outages, prevents accidents from escalating, and protect various electrical equipment in the system, ensuring the safe operation of the fault-free part of the system, which is aiding the segment’s growth.

By industry, the market is classified into residential, commercial, industrial and utilities. The residential segment garnered a significant revenue share in the market in 2022. This market segment is expanding due to growing disposable incomes, shifting consumer habits, and increasing demand for household appliances. In addition, vacuum circuit breakers are in high demand in this application area due to rising residential building construction as well as modernizing existing properties.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 843.9 Million |

| Market size forecast in 2030 | USD 1.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 5.5% from 2023 to 2030 |

| Number of Pages | 222 |

| Number of Table | 344 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Voltage, Industry, Installation Location, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia Pacific and LAMEA. In 2022, the Asia Pacific region led the market by generating the largest revenue share. The market for this region is primarily being driven by factors such as rising industrialization, electricity demand, urbanization, rising grid stability needs, expansion of renewable energy sources, rising power sector investment, and rising emphasis on transmission and distribution infrastructure.

Free Valuable Insights: Global Vacuum Circuit Breaker Market size to reach USD 1.3 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Ltd, Eaton Corporation PLC, Fuji Electric Co., Ltd., Legrand Group, Schneider Electric SE, Mitsubishi Electric Corporation, Siemens AG, General Electric Company, Toshiba Corporation (Toshiba Energy Systems & Solutions Corporation) and Arteche Lantegi Elkartea, S.A.

By Voltage

By Industry

By Installation Location

By Geography

The Market size is projected to reach USD 1.3 billion by 2030.

Growing consumption of electricity and growth in electric infrastructure are driving the Market in coming years, however, Possibility of overvoltage during switching restraints the growth of the Market.

ABB Ltd, Eaton Corporation PLC, Fuji Electric Co., Ltd., Legrand Group, Schneider Electric SE, Mitsubishi Electric Corporation, Siemens AG, General Electric Company, Toshiba Corporation (Toshiba Energy Systems & Solutions Corporation) and Arteche Lantegi Elkartea, S.A.

The expected CAGR of this Market is 5.5% from 2023 to 2030.

The Utilities segment is leading the Global Vacuum Circuit Breaker Market by Industry in 2022 thereby, achieving a market value of $463.1 Million by 2030.

The Asia Pacific market dominated the Global Vacuum Circuit Breaker Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $479.7 Million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.