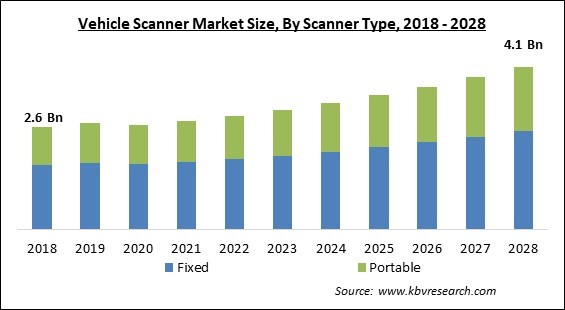

The Global Vehicle Scanner Market size is expected to reach $4.1 billion by 2028, rising at a market growth of 6.2% CAGR during the forecast period.

A computer system fitted inside a vehicle that monitors and controls the operation of the vehicle is known as a vehicle scanner. As the network of sensors in the car can sense and transmit data from the vehicle, it is known as a smart vehicle. A key factor driving this market's revenue expansion is the growing demand for sophisticated security systems that can conduct continuous inspections without irritating passengers. In addition, the demand for vehicles with improved safety systems and user-friendly functionality has grown in recent years.

As a result, manufacturers of vehicle scanners are also investing in developing new technology to enhance vehicle security and meet consumer needs. The availability of advanced security options that can offer continuous inspection without disturbing passengers, as well as expanding services for car diagnostic tools to stop activities like human trafficking and border breaking & entering, are all significant aspects accelerating demand.

In addition, there will be increasing demand for entire car body scanning throughout the forecasted period, creating new opportunities. The solutions provided by vehicle scanners include scanning, processing, sensing, and imaging of a vehicle. The technology significantly impacts a vehicle's overall safety, which explains why the demand for such scanners is gradually increasing. In addition, due to the rising number of hacking incidents as well as terrorist activities, among several other things, there is a significant demand for cars with extra security features.

Since toll booths nowadays are interconnected to integrated networks with the help of technologies like the Internet of Things (IoT) and employ car scanning to gather and store accurate data with minimal human inaccuracy, vehicle scanners are also highly helpful in toll booths. The cost of operation and scanning time are reduced when loT is used with vehicle scanning.

Vehicle scanner sales are directly correlated with demand from end-use industries, including the automotive, appliance, and other industries. The COVID-19 pandemic's import-export restrictions, restricted borders, as well as supply chain delays, however, had a significant impact on the demand in the automotive sector. The establishment of new vehicle scanner initiatives has been hampered by the economic slump as the overwhelming amount of government money was directed toward the healthcare industry, which had a significant negative influence on the market.

The purchase of vehicles with precise, improved, and speedy diagnosis equipment is increasingly popular in industrialized nations all over the world. Particularly, the demand for premium cars has been growing significantly worldwide due to a combination of factors, including a shift in customer preferences from sedans to SUVs and rising disposable incomes of consumers. In addition, the increasing demand for vehicles is attributable to the rising purchasing power of developing economies. As a result, Germany, France, Italy, and Spain are leading the use of more recent and cutting-edge scan techniques.

Vehicle scanners are in significant demand to prevent illegal operations such as border trespassing, trafficking, smuggling, and others. A crucial element that is boosting the rise of revenue is the increasing demand for enhanced security solutions. These solutions must give continuous inspection without inflicting any inconvenience on the passengers. Since a few years ago, the rise in the number of automobiles has necessitated an increased number of safety measures and functionalities that are easier to operate. Also, car manufacturers are increasing their investments in the research and development of cutting-edge technology to improve their products' safety and fulfill their consumers' requirements.

Automotive diagnostics incorporates extremely advanced technologies, which raises the overall cost. This is needed as autos need to comply with strict safety regulations. Therefore, every time new modifications to the regulations are introduced, the equipment also needs to be updated. Sophisticated vehicle scanners are pricey, and they frequently need an operating system, software, and other technological innovation upgrades, which could increase the overall cost of the equipment. Therefore, throughout the forecast period, development in the market will be constrained by the high installation as well as maintenance costs of the vehicle scanner.

Based on scanner type, the vehicle scanner market is bifurcated into portable and fixed. The fixed segment garnered the highest revenue share in the vehicle scanner market in 2021. The fixed vehicle scanners have a range of scanning speeds from 30 to 60 kmph (kilometers per hour) and are used to install continuously working vehicle scanner checkpoints. Also, fixed automobile diagnostic scanner systems are set up underneath. These systems' ability to recognize, scan, and compare photos makes security guard work easier, safer, and more efficient.

On the basis of structure type, the vehicle scanner market is divided into drive-through and under vehicle scanning systems (UVSS). The drive-through segment acquired recorded a significant revenue share in the vehicle scanner market in 2021. This segment is growing due to the rising trend of goods transported by road, air, and sea, creating a high demand due to growing security concerns. Frequently, full body scanners are also referred to as drive-through vehicle scanners. Drive-through scanners are installed in government buildings, military installations, and other highly restricted areas.

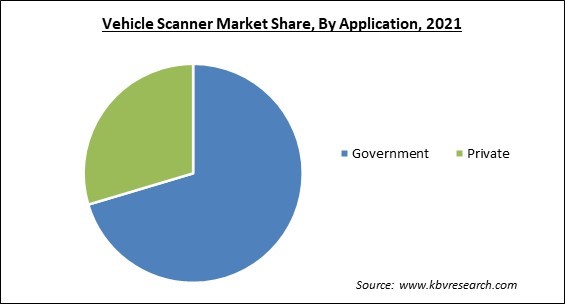

Based on application, the vehicle scanner market is segmented into government and private. The private segment garnered a remarkable growth rate in the vehicle scanner market in 2021. In the private or commercial sector, security scanner for vehicle and cargo inspection is used to screen persons, cargo, vehicles, as well as their contents. Additionally, professional mechanics employ scanning devices with a module and screen. Once the device is plugged in, they may evaluate the mechanical state of the car's parts, accessories, and critical engine components. As a result, repairs will be made to the car right away before the issue gets worse.

On the basis of component, the vehicle scanner market is categorized into camera, lighting unit, barrier, software, and others. The camera segment procured the highest revenue share in the vehicle scanner market in 2021. Using an under-vehicle examination camera, the under-vehicle automobile code reader system eliminates the need for physical instruments to locate hazardous and illegal objects. Instead, the relevant staff can examine the photographs to spot such items and alert others, preventing auto accidents. The inspection camera's accuracy and efficacy depend on the 3D images it captures.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 2.7 Billion |

| Market size forecast in 2028 | USD 4.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.2% from 2022 to 2028 |

| Number of Pages | 227 |

| Number of Table | 430 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Scanner Type, Structure Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the vehicle scanner market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded the largest revenue share in the vehicle scanner market in 2021. Since parking lots, naval ports, airports, and other professional and governmental environments have a strong demand for vehicle scanners, increasing usage of these tools in such places is propelling the segment's expansion. Due to the rise in terrorist attacks and concerns about community security in the region, there is a growing need for protection in both public and private institutions. Due to rising security & safety concerns, there is a high demand for vehicle scanners, expected to drive market expansion throughout the projection period.

Free Valuable Insights: Global Vehicle Scanner Market size to reach USD 4.1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Godrej & Boyce Mfg. Co. Ltd. (Godrej Security Solutions), International Road Dynamics, Inc. (WiLAN) (Quarterhill Inc.), Leidos Holdings, Inc., Gatekeeper Security, Inc. (OSI Systems, Inc.), Omnitec Group, Tescon Sicherheitssysteme AG, UVeye Ltd., Advanced Detection Technology, LLC (HWH Investments Ltd), VMI Security (Prime Holding Group), and SCANLAB GmbH (TecInvest Holding AG).

By Scanner Type

By Structure Type

By Application

By Component

By Geography

The global Vehicle Scanner Market size is expected to reach $4.1 billion by 2028.

Growing worries about the safety and security of the environment are driving the market in coming years, however, Advanced scanning tools have a high starting cost restraints the growth of the market.

Godrej & Boyce Mfg. Co. Ltd. (Godrej Security Solutions), International Road Dynamics, Inc. (WiLAN) (Quarterhill Inc.), Leidos Holdings, Inc., Gatekeeper Security, Inc. (OSI Systems, Inc.), Omnitec Group, Tescon Sicherheitssysteme AG, UVeye Ltd., Advanced Detection Technology, LLC (HWH Investments Ltd), VMI Security (Prime Holding Group), and SCANLAB GmbH (TecInvest Holding AG).

The Under-Vehicle Scanning Systems (UVSS) segment acquired maximum revenue share in the Global Vehicle Scanner Market by Structure Type in 2021 thereby, achieving a market value of $2.5 billion by 2028.

The Government segment is leading the Global Vehicle Scanner Market by Application in 2021, thereby, achieving a market value of $2.8 billion by 2028.

The North America market dominated the Global Vehicle Scanner Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.