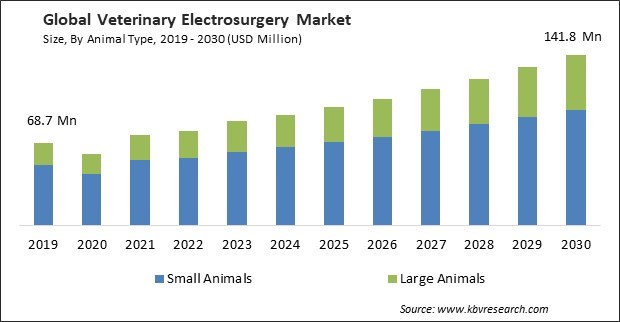

The Global Veterinary Electrosurgery Market size is expected to reach $141.8 million by 2030, rising at a market growth of 7.3% CAGR during the forecast period.

General surgery encompasses a broad spectrum of procedures, including abdominal surgeries, wound management, gastrointestinal surgeries, and more. Thus, the General surgery segment acquired $30,583.2 million in 2022. In general surgery, electrosurgery can minimize postoperative complications, such as excessive bleeding, infection, and extended recovery times. Ultimately, this results in improved patient outcomes and faster recovery times. Electrosurgical instruments are versatile and can be used in various types of general surgery, making them a valuable asset in the veterinarian's toolkit. Owing to these factors, the segment will grow rapidly in the coming years. Some of the factors impacting the market are the rising number of veterinary practitioners in developed economies, growing number of pet owners worldwide and higher cost of veterinary electrosurgery equipment.

The increased number of veterinary practitioners in developed economies can be linked to the rising expectations for pet care. Pet owners in these regions are more willing to invest in the health and well-being of their animals. As a result, veterinarians are under pressure to provide the highest quality care, including advanced surgical techniques like those enabled by electrosurgery. Additionally, Furthermore, many pet owners seek specialized care for their animals. Electrosurgical equipment is particularly valuable in specialized practices, such as surgical oncology or ophthalmology, where precision and tissue control are critical. The emphasis on high-quality veterinary care extends to preventive measures. Electrosurgery is used in procedures like spaying and neutering, which are important for pets' long-term health. As more pets undergo these procedures, the demand for electrosurgical devices increases. These factors will help in the expansion of the market.

However, economic constraints can result in longer purchasing cycles for smaller practices, delaying the adoption of electrosurgery equipment. Smaller budgets may also limit the ability to invest in the necessary training and education for these devices' safe and effective use. The emphasis on cost can shift the focus from innovation to more affordable electrosurgery solutions. Manufacturers may concentrate on producing advanced, high-end devices, while the demand for more budget-friendly options may not be as robust. This could limit the growth of the market in the upcoming years.

Furthermore, the veterinary electrosurgery market, like many others, faced disruptions in the supply chain. Various factors, including lockdowns, restrictions on international trade, and factory closures, caused these disruptions. Many electrosurgical device manufacturers faced production delays due to lockdowns and reduced staffing. This led to delays in the availability of equipment for veterinarians. Shipping and transportation were also affected, leading to delays in the delivery of electrosurgical devices and related supplies. Many veterinary practices adopted telemedicine for consultations and follow-ups to mitigate the risks of in-person contact during the pandemic. While telemedicine cannot replace surgical procedures that require electrosurgery, it did impact how veterinary care was delivered. Therefore, the COVID-19 pandemic had a disruptive impact on the market.

Based on animal type, the market is bifurcated into small animals and large animals. In 2022, the large animals segment witnessed a substantial revenue share in the market. Large animals are economically important in agriculture and various industries. Owners and stakeholders in these industries recognize the importance of veterinary care to maintain the health and productivity of their herds and livestock. Electrosurgery can be a valuable tool in treating large animals with surgical conditions. Large animal veterinary medicine has seen significant advancements in surgical techniques and tools. Electrosurgery equipment has become essential to large animal surgical procedures with its precision and ability to control bleeding.

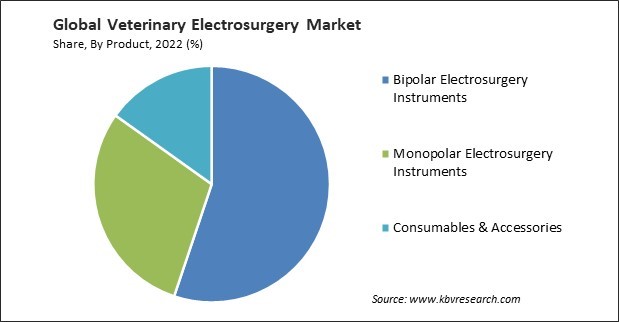

Based on product, the market is segmented into bipolar electrosurgical instruments, monopolar electrosurgical instruments, and consumables & accessories. The bipolar electrosurgical instruments segment held the largest revenue share in the market in 2022. Bipolar electrosurgical instruments offer a higher level of precision compared to monopolar instruments. In monopolar electrosurgery, the electrical current flows from the active electrode through the patient's body to a dispersive electrode, which can result in a broader tissue effect. In contrast, bipolar instruments work by conducting the electrical current directly between two closely spaced electrodes, minimizing the risk of unintentional damage to adjacent tissues. These factors are expected to boost the demand in the segment.

On the basis of end user, the market is divided into veterinary hospitals, veterinary clinics, and others. The veterinary hospitals segment recorded the maximum revenue share in the market in 2022. Veterinary hospitals are equipped to handle complex surgical procedures, including soft tissue, orthopedic, and ophthalmic surgeries. Electrosurgery offers precise tissue cutting and hemostasis, which is especially valuable in these advanced procedures, leading to improved patient outcomes. As veterinary medicine becomes more specialized, veterinary hospitals often cater to specific types of patients or medical conditions. Electrosurgery allows for customized and specialized treatment plans, making hospitals catering to different animal species and conditions essential. Owing to these factors, the segment will expand rapidly in the coming years.

On the basis of application, the market is divided into general surgery, gynecological & urological surgery, dental surgery, ophthalmic surgery, orthopedic surgery, and others. The orthopedic surgery segment attained a promising revenue share in the market in 2022. As pets, particularly dogs, continue to live longer due to improved healthcare and nutrition, age-related orthopedic issues such as osteoarthritis, ligament injuries, and degenerative joint diseases increase. This has driven the demand for orthopedic procedures, including surgeries that utilize electrosurgery for precision and efficiency. Therefore, the segment will expand rapidly in the upcoming years.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 78 Million |

| Market size forecast in 2030 | USD 141.8 Million |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.3% from 2023 to 2030 |

| Number of Pages | 313 |

| Number of Table | 460 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Animal Type, Product, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the market in 2022. North America is known for its strong focus on technological advancements in healthcare. The availability of cutting-edge electrosurgical equipment and constant innovation in the field have made North America a hub for advanced veterinary care. The North American region has one of the highest rates of pet ownership globally. As more families in the United States, Canada, and Mexico adopt pets, there is a growing need for comprehensive veterinary care, including surgical procedures, where electrosurgery plays a crucial role. As a result, the segment will witness increased growth in the future.

Free Valuable Insights: The Global Veterinary Electrosurgery Market size to reach USD 141.8 Million by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Covetrus, Inc., Medtronic PLC,Integra LifeSciences Holdings Corporation, Olympus Corporation, KeeboVet Veterinary Ultrasound Equipment, Eickemeyer – Medizintechnik für Tierärzte KG, KLS Martin Group, XcelLance Medical Technologies Pvt. Ltd, KENTAMED Ltd., B. Braun Melsungen AG

By Animal Type

By Product

By End User

By Application

By Geography

This Market size is expected to reach $141.8 million by 2030.

Rising number of veterinary practitioners in developed economies are driving the Market in coming years, however, Higher cost of veterinary electrosurgery equipment restraints the growth of the Market.

Covetrus, Inc., Medtronic PLC,Integra LifeSciences Holdings Corporation, Olympus Corporation, KeeboVet Veterinary Ultrasound Equipment, Eickemeyer – Medizintechnik für Tierärzte KG, KLS Martin Group, XcelLance Medical Technologies Pvt. Ltd, KENTAMED Ltd., B. Braun Melsungen AG

The expected CAGR of this Market is 7.3% from 2023 to 2030.

The Small Animals segment gained highest revenue in the Market by Animal Type in 2022; thereby, achieving a market value of $96.3 million by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $59.1 million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.