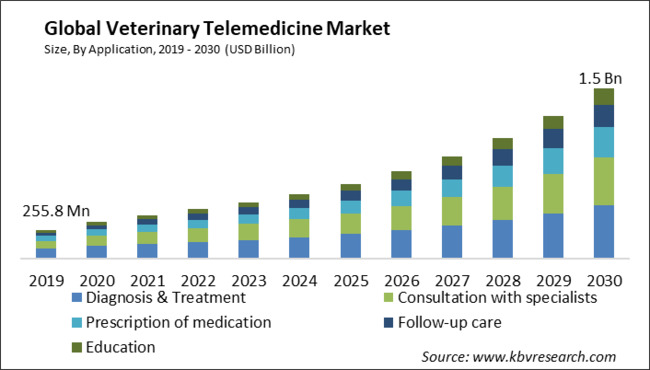

The Global Veterinary Telemedicine Market size is expected to reach $1.5 billion by 2030, rising at a market growth of 17.2% CAGR during the forecast period.

Veterinary telemedicine allows pet owners and general practice veterinarians to access specialized expertise that may not be readily available locally. Hence, the consultation with specialists segment generated $125.8 million revenue in the market in 2022. This is particularly important for complex or rare cases that require the knowledge and experience of a specialist. Specialist consultations can be scheduled more quickly through telemedicine, as there are fewer geographical and scheduling constraints. This speed is crucial for addressing urgent or time-sensitive health concerns in animals. Some of the factors impacting the market are developments in telemedicine technology, growing number of zoonotic illnesses, and exorbitant prices of telemedicine services.

Technological advancements greatly influence the development and evolution of veterinary telemedicine. These developments have raised the standard of treatment, broadened the scope of services, and widened accessibility for both veterinarians and pet owners. Veterinary treatment has been transformed by creating specialized telemedicine platforms and mobile applications. The market is also growing due to the increasing use of AI and ML in veterinary telehealth services to enhance the accuracy and speed of diagnostics, resulting in improved results for animals. The prevalence of livestock and zoonotic diseases is increasing due to the adverse effects of climate change and accelerating globalization. A zoonosis is any disease or infection that can be transmitted naturally from vertebrates to humans. There are more than 200 known zoonoses. Zoonoses cause a significant portion of newly emerging and chronic human diseases. Typically, ticks carrying the bacteria that causes Lyme disease are the cause. Because these infections can lead to diseases such as rabies and Lyme, the need for the market is expected to increase.

However, the high price of veterinary telemedicine may prevent it from being widely used. The expense of delivering telemedicine services can be a barrier to the market's expansion, even though telemedicine has several benefits in terms of convenience, accessibility, and less stress for both pets and their owners. Several factors influence the price of veterinary telemedicine services. These costs can accumulate, especially for ongoing medical conditions or complex conditions. Therefore, the exorbitant prices for the services may impede the market growth.

Furthermore, veterinarians had to restrict personal interaction with their clients due to the COVID-19 outbreak. This prompted federal governments to relax their telemedicine and VCPR legislation, making telemedicine more accessible to pet owners. It permitted veterinarians to prescribe treatment without examining or visiting pets, limiting intimate contact and the potential spread of COVID-19 within the community. The increased frequency of obesity in pets due to illnesses, including joint problems and osteoarthritis, drove the demand for more effective treatment alternatives. Zoonotic diseases are responsible for about 60% of emerging infections globally. Consequently, the rise in infectious diseases compelled pet and farm animal owners to implement telehealth services for enhancing and monitoring the health of their animals. Therefore, the pandemic had a moderate impact on the market.

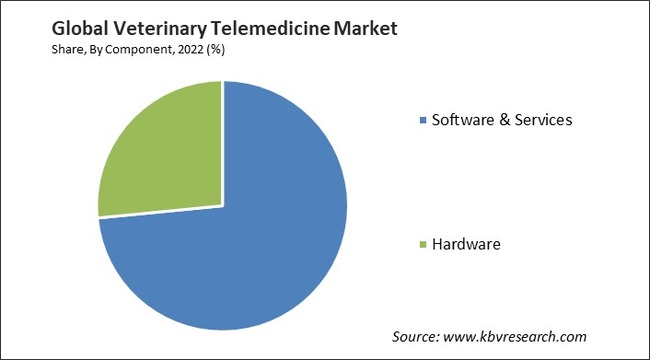

Based on component, the market is classified into software & services and hardware. In 2022, the software and services segment witnessed the largest revenue share in the market. Increasing demand for cloud-based and on-demand services accounts for a substantial portion of the software and services segment. Some telemedicine software can connect with devices that monitor a pet's health, such as wearable trackers, to provide ongoing health data to veterinarians. Additionally, many telemedicine software platforms often have features for secure messaging and video calls, improving communication between pet owners and veterinarians.

By animal type, the market is fragmented into companions, livestock, and others. The livestock segment projected a prominent revenue share in the market in 2022. Livestock farmers often have large numbers of animals that require healthcare. Access to veterinary care in rural or remote areas can be limited. Veterinary telemedicine allows farmers to consult with veterinarians without needing physical visits. This can lead to increased demand for telemedicine services in the livestock sector.

By type, the market is bifurcated into telephone and internet. The internet segment held the highest revenue share in the market in 2022. The internet segment enables the usage of live chat and video conferencing, which may offer pet owners a more engaging and intimate experience. Internet-based veterinary telemedicine is a useful resource for both pet owners and veterinarians. It is a more comprehensive and interactive method of providing veterinary care, and its popularity is growing.

On the basis of application, the market is divided into diagnosis & treatment, prescription of medication, follow-up care, consultation with specialists, and education. The follow-up care segment garnered a promising revenue share in the market in 2022. Telemedicine enables pet owners to communicate with licensed veterinarians remotely through various communication methods, such as video calls, phone calls, and online chat platforms. It allows pet owners to acquire guidance, prescriptions, and even follow-up care without making in-person visits.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 444.8 Million |

| Market size forecast in 2030 | USD 1.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 17.2% from 2023 to 2030 |

| Number of Pages | 268 |

| Number of Table | 440 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Type, Animal Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. The convenience of telemedicine is responsible for North America's significant market share globally. Telemedicine can be a less expensive option for pet owners, particularly those who live in rural areas or have difficulty traveling. Telemedicine enables pet owners to receive veterinary care from the comfort of their own homes. This can be particularly convenient for busy people.

Free Valuable Insights: Global Veterinary Telemedicine Market size to reach USD 1.5 Billion by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Teletails, Justanswer, Airvet, Inc., Firstvet, Vetster Inc., Otto, Animan Technologies Inc., Vitusvet, Whiskers Worldwide, LLC, and Askvet

By Application

By Component

By Type

By Animal Type

By Geography

This Market size is expected to reach $1.5 billion by 2030.

Developments in telemedicine technology are driving the Market in coming years, however, Exorbitant prices of telemedicine services restraints the growth of the Market.

Teletails, Justanswer, Airvet, Inc., Firstvet, Vetster Inc., Otto, Animan Technologies Inc., Vitusvet, Whiskers Worldwide, LLC, and Askvet

The Companion segment acquired the highest revenue in the Market, By Animal Type in 2022; thereby, achieving a market value of $1.2 billion by 2030.

The Diagnosis & Treatment segment is leading the Market, By Application in 2022; thereby, achieving a market value of $481.5 million by 2030.

The North America region dominated the Market, By Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $610.3 million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.