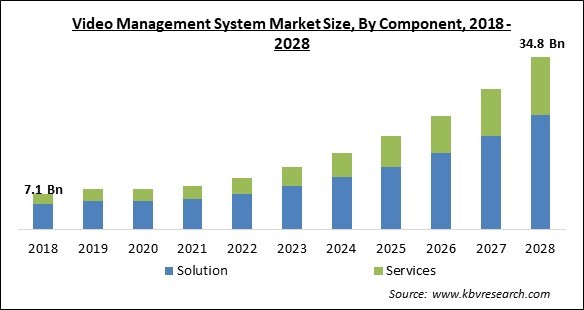

The Global Video Management System Market size is expected to reach $34.8 billion by 2028, rising at a market growth of 22.2% CAGR during the forecast period.

A vital element of a company's security framework is a video management system (VMS). It makes it possible for companies to gather, store, record, retrieve, examine, and analyses footage from their security cameras. Given that so numerous industries are already using surveillance cameras, a VMS is a useful tool to have. A VMS assists business in managing their security system cameras, keeping an eye out for suspicious activities, and reviewing and analyzing recorded video to gain insightful knowledge.

For instance, retail establishments may now watch consumer behaviour, lengthy checkout lines, and dwell time using video analytics data acquired by their VMS, improving their customer satisfaction and increasing their bottom line. While video monitoring is still frequently employed in safety-related situations, other departments are starting to see its worth. Systems for managing video content are useful for promoting both customer and employee safety. They enable businesses to keep an eye on suspicious or criminal activity taking place inside their facilities in real time.

In particular if an accident or injury occurs, businesses can use their VMS to make sure personnel are adhering to set safety and security requirements. A crucial tool for firms under investigation who might be dealing with legal accusations or workers' compensation claims is the ability to go back and review previous surveillance camera footage. Moreover, firms in particular industries are frequently mandated by law to maintain surveillance video for predetermined amounts of time in order to comply with compliance standards. They are able to achieve this because a VMS automates the policies for saving and retrieving video.

A VMS lowers the expense of purchasing and operating different systems by minimizing the quantity of physical hardware and/or software components required within a group's video surveillance workflow. Furthermore, video management solutions frequently assist companies in maximizing the storage of their video content. They assist in reducing storage expenses that an organization would otherwise incur if all of its video data was retained on more costly tiers of storage by only gathering and preserving the video what matters and shifting bigger, less frequently viewed files to cooler tiers of storage.

The imposition of various government regulations to curb the spread of the virus has motivated companies to opt to work from home culture and heavily invest in the digitalization of the company. Solutions that go far beyond security are progressively being implemented using video management software. More and more manufacturers are trying to find a way to combine their VMS with temperature screening, mask detection, and people counting solutions in light of the pandemic. In a post-COVID environment, all of these features will enable organizations to support their health and safety initiatives. Access control and video management software work together to produce a unified solution for effective safety risk management.

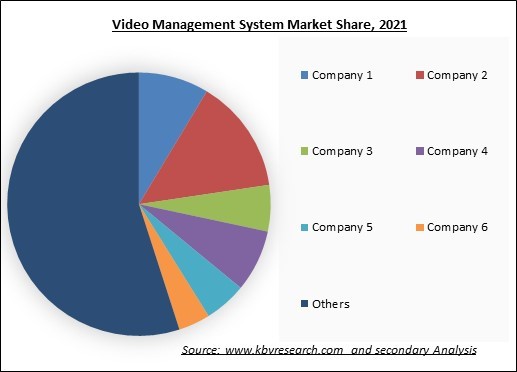

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches.

Security organizations continue to exercise caution when disclosing the scope of their monitoring operations for public review. There is no question that giving law enforcement more surveillance power aids in the prevention of some crimes, but there is also a chance for abuse or a risk to people' rights. Numerous significant terrorist acts over the past 20 years have sparked debate about the usage of various surveillance technology. Few studies have focused on the general people, despite the fact that the employment of emerging technology for proactive security and monitoring has been explored and condemned in academia.

When deciding where to place things in a store, video management software uses analytical data from cameras in the retail setting and presents it. It can also be used in conjunction with facial recognition technology powered by artificial intelligence (AI) to detect known offenders. Additionally, it can be utilized in access-controlled concerts to strengthen admission procedures or warn attendees of potential occurrences. It is frequently used by big businesses and academic institutions for a range of tasks like corporate training, event streaming, executive communication, and knowledge management.

With the accelerated advancement of technology, particularly the development of video management, ever more businesses are deciding to use video management software to offer their clients dedicated storage, uninterrupted streaming, and improved security surveillance. Due to rising content development costs, suppliers of video management services are under pressure to turn a profit. Businesses overspend on video capture because they are unaware of several aspects of the transmission of video material. Duplicating video content has become a common way of content generation worldwide.

Based on component, the video management system market is segmented into Solution and Services (Managed services and Professional services). The solution segment procured the highest revenue share in the video management system market in 2021. It is a result of the deployment of numerous security solutions like RFID monitoring and vehicle number plate tracking, which allow for the integration of text- or barcode-reading systems with video management software.

On the basis of technology, the video management system market is classified into Analog-based VMS and IP-based VMS. Analog-based VMS segment recorded the highest revenue share in the video management system market in 2021. For organizations with pre-existing coax connections, analogue cameras are the best option because they are simple to install. Although analogue cameras with a resolution of up to 8MP are available, 3-5MP is more typical. Analog cameras, though, can be less expensive than IP cameras.

By deployment type, the video management system market is bifurcated into On-Premises and Cloud. The cloud segment registered a significant revenue share in the video management system market in 2021. Offloading some administration responsibilities and maintenance costs to the service provider is possible with cloud deployment. Related to the scale, ownership, and access and the nature and function of the cloud, the cloud deployment model determines the particular sort of cloud environment.

Based on application, the video management system market is fragmented into Mobile Application, Intelligent Streaming, Security and Surveillance, Storage Management, Data Integration, Case Management, Advanced Video Management & Video Intelligent, Custom Application Management and Others. Intelligent streaming segment recorded a significant revenue share in the video management system market in 2021. The video monitoring system has taken on increased significance inside the VMS system as a result of technological improvements and cloud computing. End customers are seeking more adaptable and intelligent video solutions that will enable them to successfully employ video data for more advanced analysis.

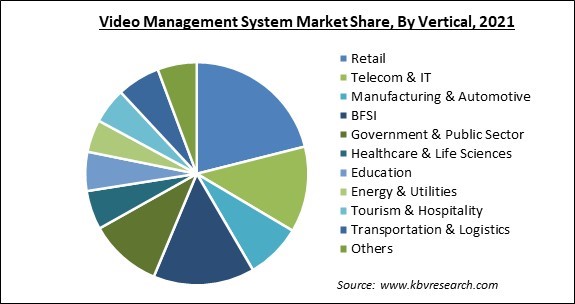

By vertical, the video management system market is categorized into BFSI, Healthcare and Lifesciences, Retail, Telecom & IT, Manufacturing and Automotive, Energy & Utilities, Travel & Hospitality, Government and Public Sector, Education, Media and Entertainment, Transportation and Logistics, and Others. BFSI segment procured a significant revenue share in the video management system market in 2021. Banking institutions can detect, detect, and solve financial crimes more quickly and efficiently with the aid of video surveillance. The next level of financial surveillance is possible with security solutions that have intelligent security analytics & intelligence.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 8.7 Billion |

| Market size forecast in 2028 | USD 34.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 22.2% from 2022 to 2028 |

| Number of Pages | 428 |

| Number of Tables | 713 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Market Share Analysis, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Vertical, Component, Deployment Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the video management system market is analyzed across North America, Europe, Asia Pacific and LAMEA. Asia Pacific procured a promising revenue share in the video management system market in 2021. Due to China's extensive installation of municipal surveillance networks to keep an eye on millions of citizens all across the country, the usage of security cameras in the area is anticipated to rise. New cities, manufacturing industries, and retail businesses have all grown as a result of the region's growing urbanization. The market for video management software is anticipated to be driven by the growing adoption of surveillance cameras in small and midsize enterprises, hospitality industries, airports, ATMs, banks, residential structures, and places of worship, among other locations.

Free Valuable Insights: Global Video Management System Market size to reach USD 34.8 Billion by 2028

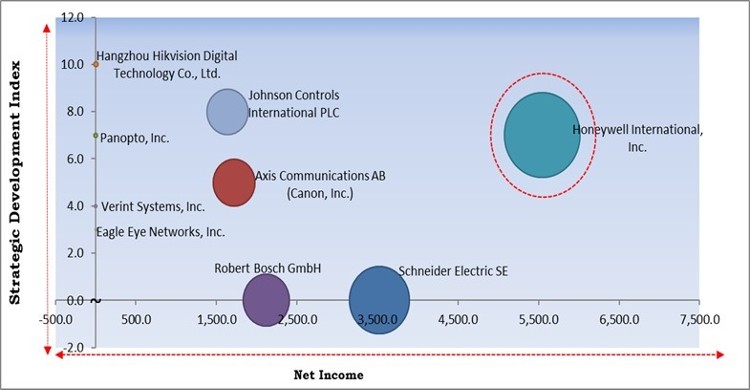

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Honeywell International, Inc. is the forerunners in the Video Management System Market. Companies such as Axis Communications AB (Canon, Inc.), Johnson Controls International PLC, Schneider Electric SE are some of the key innovators in Video Management System Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Robert Bosch GmbH, Honeywell International, Inc., Schneider Electric SE, Axis Communications AB (Canon, Inc.), Johnson Controls International PLC, Hangzhou Hikvision Digital Technology Co., Ltd., Verint Systems, Inc., Genetec, Inc., Panopto, Inc., and Eagle Eye Networks, Inc.

By Technology

By Vertical

By Component

By Deployment Type

By Application

By Geography

The global Video Management System Market size is expected to reach $34.8 billion by 2028.

Rising Need For Security Surveillance are driving the market in coming years, however, Huge Possibilities Of Content Duplicity restraints the growth of the market.

Robert Bosch GmbH, Honeywell International, Inc., Schneider Electric SE, Axis Communications AB (Canon, Inc.), Johnson Controls International PLC, Hangzhou Hikvision Digital Technology Co., Ltd., Verint Systems, Inc., Genetec, Inc., Panopto, Inc., and Eagle Eye Networks, Inc.

The expected CAGR of the Video Management System Market is 22.2% from 2022 to 2028.

The Retail segment acquired maximum revenue share in the Global Video Management System Market by Vertical in 2021 thereby, achieving a market value of $6.3 billion by 2028.

The North America market dominated the Global Video Management System Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $12.1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.