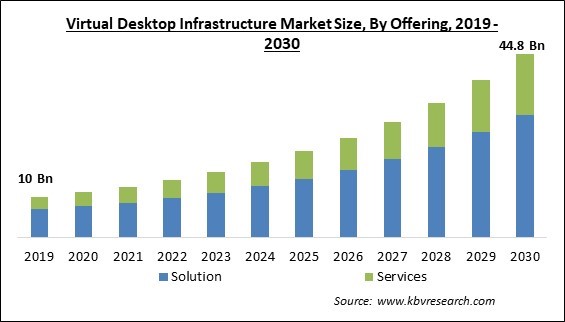

The Global Virtual Desktop Infrastructure Market size is expected to reach $44.8 billion by 2030, rising at a market growth of 15.8% CAGR during the forecast period.

The need for virtualized desktops in the education sector is increasing due to the significant challenges that students are experiencing in their learning and teaching. Thus, the education segment captured $822.9 million revenue in the market in 2022. These desktops help educational institutions reduce the communication gap between students and teachers by enabling remote access. Additionally, as more universities use DaaS to build new virtual learning labs, greater opportunities will arise for the market to flourish.

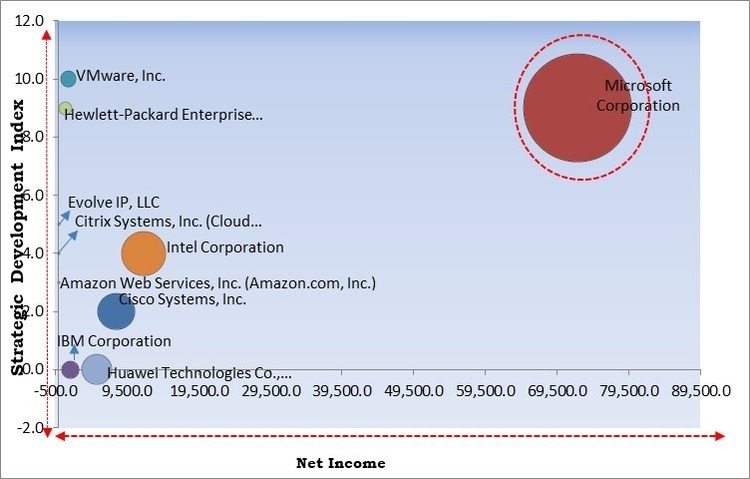

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In February, 2022, Cisco formed a partnership with Indosat Ooredoo Hutchison, to offer the best Managed SD-WAN solution to its enterprise customers. Additionally, In June, 2023, Hewlett Packard Enterprise collaborated with Applied Digital Corporation, to provide its powerful, energy-efficient supercomputers which are proven to support large-scale AI through Applied Digital’s AI cloud service.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunners in the Market. In April, 2022 Microsoft extended its partnership with Citrix, to offer their customers a secure, compatible, and better workspace experience and it also helps to modernize their applications. Companies such as Intel Corporation, Cisco Systems, Inc., VMware, Inc. are some of the key innovators in the Market.

Organizations urgently need to guarantee that employees have seamless access to operations data round-the-clock to maintain productivity, given the unexpected rise in remote working employees across most business sectors during the COVID-19 pandemic. Therefore, businesses must ensure employees have the same computing experience anywhere they go throughout the periods. Also, VDI clients permit employees to access specialized workplace software that they typically cannot access from their homes and offer a richer desktop experience than a standard mobile device. These elements encourage the growth of virtual desktop infrastructure solutions during this time.

With the increasing importance of cyber threats and data breaches, information security is one of the top issues for businesses and organizations. For instance, the 2022 Internet Crime Report created by the FBI's Internet Crime Complaint Center (IC3), published on March 22, 2023, stated that the reported complaints amounted to losses exceeding $10.3 billion. While the complaints fell by 5%, the financial losses increased by 49%. In addition, companies are vulnerable to various attacks, including targeted hacking, sophisticated phishing campaigns, theft of intellectual property, and infection of corporate networks with intellectual property malware. The rapid acceptance of virtual desktop infrastructure solutions and the expansion of the market are both fueled by the high level of security provided by these solutions.

Enterprises face IT infrastructure restrictions while running numerous virtual/images simultaneously, which lowers productivity because of an extended latency period and a decreased input/output per second (IOPS) throughput. The virtual desktop hosting servers must have sufficient CPU, memory, and GPU resources to handle the concurrent demands of many desktop instances. Application crashes, slow desktop performance, and user frustration can all be caused by a lack of resources. Enterprises are dealing with problems including delayed website access, cyberattacks, website traffic overload, etc. These infrastructure problems may hamper the development of the market throughout the forecast period.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

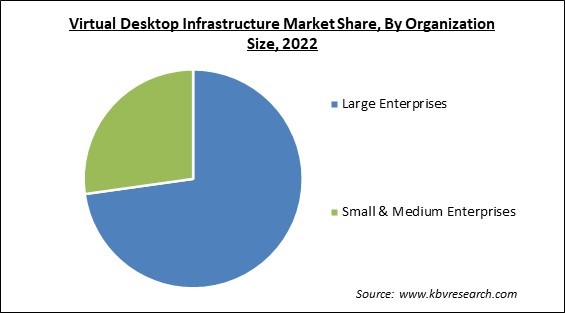

On the basis of organization size, the market is classified into large enterprises and SMBs. In 2022, the large enterprises segment generated the highest revenue share in the market. Large enterprises have significant demand for VDI solution and services due to their complex, extensive operations, prevalence of the remote work culture, and rapid adoption of cutting-edge technologies. Data security is critical for large enterprises. VDI improves security by storing data and applications in the data center rather than on endpoint devices.

By offering, the market is segmented into solution and services. The services segment acquired a substantial revenue share in the market in 2022. This is an outcome of large enterprises using virtual desktop infrastructure (VDI) services to optimize their IT infrastructure and distant operations requirements. Additionally, it is anticipated that rising desktop device demand in the contemporary business environment will boost the expansion of the segment.

Based on deployment model, the market is bifurcated into on-premise and cloud. In 2022, the cloud segment covered a considerable revenue share in the market. Cloud-based VDI is in huge demand compared to on-premise virtual desktop infrastructure. The cloud-based VDI systems are in more demand because these are less expensive and have a strong network infrastructure in developed countries. In order to reduce the risk of a cyberattack, cloud-based virtual desktop infrastructure manufacturers are also focusing on developing a high-level security patch.

By vertical, the market is categorized into IT & telecom, construction & manufacturing, BFSI, healthcare, government & public sector, retail, education, and others. The healthcare segment acquired a substantial revenue share in the market in 2022. VDI is essential to enabling secure and smooth access to patient data, medical records, and diagnostic applications as the healthcare sector undergoes a rapid digital transition.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 14.1 Billion |

| Market size forecast in 2030 | USD 44.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 15.8% from 2023 to 2030 |

| Number of Pages | 356 |

| Number of Table | 543 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, Organization Size, Deployment Type, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region dominated the market with the maximum revenue share. Due to numerous major corporations and the developing industrial sector, the regional market is booming. The market is also anticipated to expand because of the development of cloud computing and the expansion of VDI applications in the region's consumer electronics, gaming, and entertainment sectors.

Free Valuable Insights: Global Virtual Desktop Infrastructure Market size to reach USD 44.8 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Microsoft Corporation, Cisco Systems, Inc., Amazon Web Services, Inc. (Amazon.com, Inc.), VMware, Inc., Intel Corporation, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Evolve IP, LLC, Citrix Systems, Inc. (Cloud Software Group, Inc.) and Hewlett Packard Enterprise Company

By Offering

By Organization Size

By Deployment Type

By Vertical

By Geography

The Market size is projected to reach USD 44.8 billion by 2030.

Rising demand for increasing employee productivity are driving the Market in coming years, however, Negative impacts of infrastructure bottlenecks restraints the growth of the Market.

IBM Corporation, Microsoft Corporation, Cisco Systems, Inc., Amazon Web Services, Inc. (Amazon.com, Inc.), VMware, Inc., Intel Corporation, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Evolve IP, LLC, Citrix Systems, Inc. (Cloud Software Group, Inc.) and Hewlett Packard Enterprise Company

The Solution segment generated the maximum revenue in the Market by Offering in 2022; thereby, achieving a market value of $30 billion by 2030.

The On-premise segment is leading the Market by Deployment Type in 2022; thereby achieving a market value of $21.5 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $15.2 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.