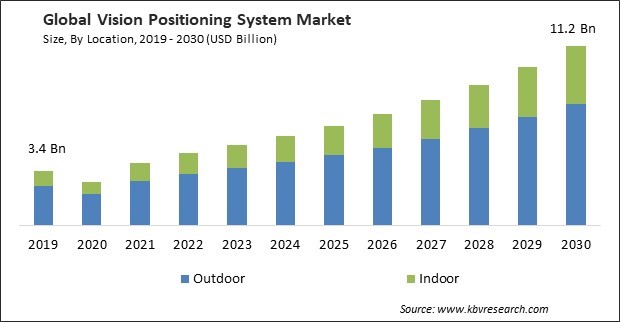

The Global Vision Positioning System Market size is expected to reach $11.2 billion by 2030, rising at a market growth of 12.2% CAGR during the forecast period.

The healthcare industry is increasingly adopting VPS technology to improve patient care, operational efficiency, and patient safety. Therefore, the healthcare segment would register approximately a 10% share in the market by 2030. VPS technology is used for precise surgical navigation, particularly in minimally invasive surgeries. It provides real-time 3D visualization and helps surgeons accurately locate and navigate within the patient's body. This improves surgical outcomes and reduces the risk of complications. Healthcare facilities can use VPS to track the location of critical medical equipment, such as infusion pumps, ventilators, and defibrillators. This ensures that equipment is readily available when needed, reducing response times.

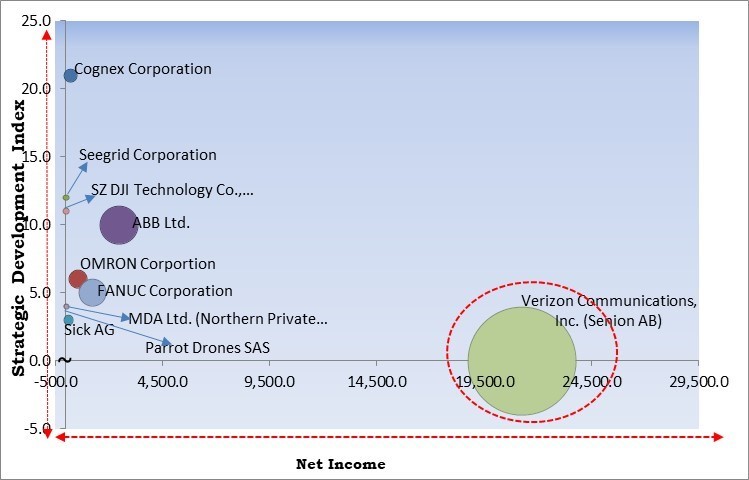

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2023, Cognex Corporation introduced the In-Sight SnAPP vision sensor, redefining standards for ease of use, accuracy, and functionality in an industrial sensor. The launched product would solve an array of common quality control challenges, consisting of presence or absence inspections, assembly verification, and defect detection. Additionally, In May, 2023, SZ DJI Technology Co., Ltd. released DJI Matrice 350 RTK, an upgraded flagship drone platform. The launched product would be more adaptable, secure, and efficient for any aerial operation in public safety, mapping, energy, infrastructure, or forestry.

Based on the Analysis presented in the KBV Cardinal matrix; Verizon Communications, Inc. (Senion AB) is the major forerunner in the Market. Companies such as ABB Ltd., OMRON Corporation and FANUC Corporation are some of the key innovators in the Market. In October, 2022, OMRON Corporation unveiled FH-SMD Series 3D Vision Sensor for Robot Arms. The launched product would mount on a robot to recognize randomly placed parts in three dimensions, allowing space-saving assembly, inspection, and pick & place that would be difficult with conventional robots, whilst enhancing productivity.

Autonomous vehicles, including self-driving cars and drones, require precise navigation and obstacle detection to operate safely. VPS technology provides real-time information about the vehicle's location and surroundings, improving navigation accuracy and safety. This is especially important in scenarios where human intervention may be limited. VPS systems use sensors, cameras, and other technologies to detect and avoid hindrances in the vehicle's path. This is vital for ensuring the safety of passengers, other road users, and property. VPS technology is crucial for ensuring safe and efficient mobility in urban environments. Governments and regulatory bodies are creating frameworks to support the testing and deploying autonomous vehicles and drones. These regulations often include safety standards that require VPS technology to ensure safe operations. As autonomous vehicles and drones become more integrated into everyday life and various industries, the demand for VPS technology will continue to rise, leading to further innovation and market expansion.

Smart cities are focused on improving transportation and reducing traffic congestion. VPS technology is integral to the operation of autonomous vehicles, electric scooters, and shared mobility services, which play a crucial role in achieving these goals. VPS enhances public transportation services, making them more efficient and user-friendly. It provides real-time location and arrival information for buses, trams, and subways, improving the overall transportation experience for residents. Many governments and municipalities are establishing regulations and standards to support developing and deploying smart city technologies, including VPS systems. The growth of smart cities is driven by the need for more sustainable and efficient urban living. VPS technology contributes to these goals by providing accurate and real-time location data, enhancing safety, and supporting the development of innovative services and applications. As smart cities expand and evolve, the demand for VPS technology will increase, further driving market growth and innovation.

Implementing VPS technology often requires a significant upfront investment in hardware, software, and infrastructure. The cost of advanced sensors, cameras, processing units, and data storage can be substantial, which can deter some potential adopters. Integrating VPS technology into existing systems, whether in manufacturing, transportation, or other industries, can be complex and costly. Customizing VPS solutions to work seamlessly with different technologies and processes may require additional resources. VPS systems generate vast data, particularly in applications like autonomous vehicles and drones. Implementing VPS technology often requires developing supporting infrastructure, such as installing sensors, cameras, and communication networks. These infrastructure costs can add to the overall implementation expenses. These factors will hinder market’s growth in the coming years.

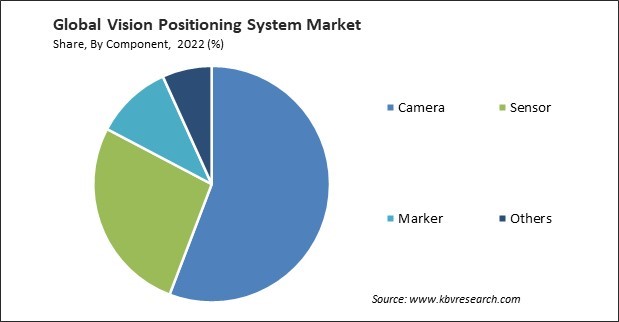

On the basis of component, the market is segmented into sensor, camera, marker, and others. In 2022, the camera segment dominated the market with the maximum revenue share. Cameras are an integral component of positioning systems because they capture images of an area or monitor the position of an automated device to provide input data for the system. Omron Corporation, Sick AG, and Menzel Vision and Robotics are significant positioning camera manufacturers. These businesses offer 2D vision and intelligent cameras with integrated optical sensors.

By platform, the market is categorised into unmanned aerial vehicle, automated guided vehicle, space vehicle, industrial robots, and others. The automated guided vehicle segment recorded a remarkable revenue share in the market in 2022. An Automated Guided Vehicle (AGV) is a mobile robot or vehicle designed for material handling and transportation tasks in various industrial settings. AGVs have navigation and control systems to autonomously move items, products, or materials within a facility. They are commonly used in manufacturing, warehousing, distribution, and other industries to streamline and automate the movement of goods.

On the basis of application, the market is classified into retail, healthcare, defense, industrial, transportation & logistics, hospitality, and others. The defense segment acquired the maximum revenue share in the market in 2022. Vision positioning systems provide real-time visual information, allowing military personnel to gain a better understanding of their surroundings. This enhanced situational awareness is crucial for making informed decisions during missions, whether it involves surveillance, reconnaissance, or combat. In combat scenarios, the ability to accurately locate and target enemy positions is vital. Vision positioning systems can help military units pinpoint targets with precision, reducing the risk of collateral damage and minimizing the time to neutralize threats.

Based on location, the market is fragmented into indoor and outdoor. In 2022, the indoor segment garnered a significant revenue share in the market. Indoor location services are valuable in retail environments, helping customers navigate large shopping malls and stores. Retailers can also use this technology for proximity marketing, personalized offers, and optimizing store layouts. VPS-based indoor location technology is crucial in warehouses and logistics for tracking the movement of goods, optimizing inventory management, and guiding robots and automated guided vehicles (AGVs).

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.5 Billion |

| Market size forecast in 2030 | USD 11.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 12.2% from 2023 to 2030 |

| Number of Pages | 335 |

| Number of Table | 503 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Location, Component, Platform, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region witnessed the largest revenue share in the market. Many North American e-commerce behemoths, including Amazon and UPS, are investigating drone delivery services. VPS is required for these drones to deliver packages to clients' doors, navigate complex urban areas, and avoid obstacles. Manufacturing and logistics businesses in North America rely significantly on industrial robots and automated guided vehicles (AGVs). Furthermore, VPS technology improves these robots' navigation and safety, enhancing efficiency in factories and warehouses. Several North American communities are implementing smart city programs that use VPS technology.

Free Valuable Insights: Global Vision Positioning System Market size to reach USD 11.2 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB LTD., Sick AG, Cognex Corporation, Omron Corporation, FANUC Corporation, MDA Ltd. (Northern Private Capital Inc.), SZ DJI Technology Co., Ltd. (iFlight Technology Company Limited), Parrot Drone SAS, Seegrid Corporation, and Verizon Communications, Inc. (Senion AB)

By Location

By Component

By Platform

By Application

By Geography

This Market size is expected to reach $11.2 billion by 2030.

Growing demand for autonomous vehicles and drones are driving the Market in coming years, however, High cost of integrating VPS technology restraints the growth of the Market.

ABB LTD., Sick AG, Cognex Corporation, Omron Corporation, FANUC Corporation, MDA Ltd. (Northern Private Capital Inc.), SZ DJI Technology Co., Ltd. (iFlight Technology Company Limited), Parrot Drone SAS, Seegrid Corporation, and Verizon Communications, Inc. (Senion AB)

The expected CAGR of this Market is 12.2% from 2023 to 2030.

The Outdoor segment is leading the Market by Location in 2022; thereby, achieving a market value of $7.6 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $3.9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.