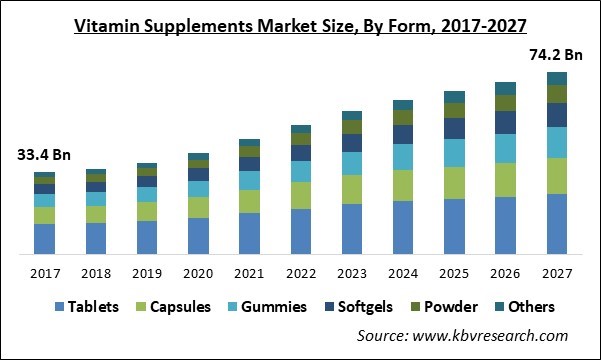

The Global Vitamin Supplements Market size is expected to reach $74.27 billion by 2027, rising at a market growth of 8.0% CAGR during the forecast period.

The purpose of consuming supplements is mainly to improve the presence of required nutrition and vitamins in the human body. Factors such as major transition towards preventive health management practices in the midst of growing healthcare costs, and the rise in the burden of lifestyle diseases are acting as growth catalysts for the overall vitamin supplements market.

The nutraceutical industry is constantly transforming and the industry is planning its R&D activities by considering the shift in consumer interest towards health-giving products. In addition, the industry also focuses on the monitoring of emerging consumer trends and relationships with mass distributors; hence the products which are being created in the sector are in line with the demand and trend of the consumers.

The need and awareness to consume vitamins have been intensified due to the outbreak of the COVID-19 pandemic. The National Institute for Health and Care Excellence (NICE) of the U.K. noted that vitamin D plays a crucial role in bone as well as muscle health and boosts the immunity of the body to fight against respiratory viruses. In addition, it is also suggested that adults, children, and young people above the age of 4 years should consume 10 micrograms of vitamin D on the daily basis.

People with low immunity are expected to be at a greater risk of COVID-19 infection, whereas vitamins are helpful in boosting the immunity which can minimize the possibility of COVID-19 infection. Hence, the outbreak of the COVID-19 pandemic has played a pivotal role in increasing the demand for vitamin supplements. As per the U.S. National Health and Nutrition Examination Survey, above half of the U.S. population has consumed these products throughout the pandemic.

With the increasing health-consciousness, the consumers are looking for unique and healthy-giving products that are filled with essential nutrients to prevent symptoms related to COVID-19 and other severe infections & virus, which include chest pain, tiredness, shortness of breath, and others. Therefore, the nutraceuticals sector is witnessing a massive demand for pediatric nutrition, multivitamins, protein, sports nutrition, and others that are expected to decrease the health concerns among the consumers.

In the last couple of years, the spending of consumers on dietary supplements has been increased significantly due to the rising health awareness and the growing birth rate. Currently, the market has become highly competitive in nature due to the fact that various supportive mandates for the food industry and governments are changing the approvals & norms for the overproduction of vitamin supplements.

Technology and science are playing crucial roles to assist individuals to recognize foods that are beneficial in weight and health management. However, vitamin supplements are high-priced which may discourage many people, especially from under-developed countries to consume such products, thereby hampering the growth of the industry. In addition, industry players like Amway provide supplements under the Brand name Nutrilite, which is extremely costly for some consumers. Additionally, to bring the ideal composition in vitamin supplements, a significant amount of customization and research is required, which further adds to the overall cost of the final product.

Based on the Form, the Vitamin Supplements market is segmented into Tablets, Capsules, Gummies, Softgels, Powder, and Others. The gummies segment is expected to display the fastest growth rate during the forecasting period. In addition, it is a sweet jelly-like form, is easy to carry, and provides superior taste, better mouthfeel, and required nutrients. Kids as well as the geriatric population highly prefer gummies due to their softness and broad flavor profile.

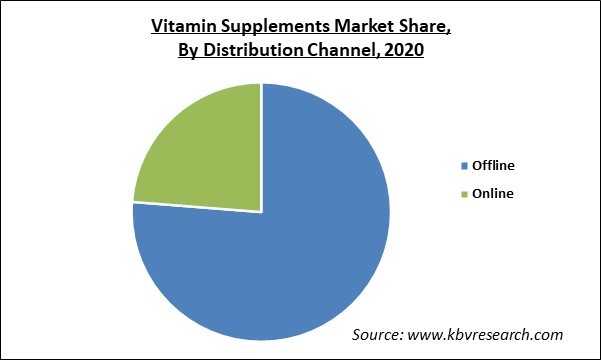

Based on the Distribution Channel, the Vitamin Supplements market is divided into Offline and Online. The online segment is expected to exhibit a promising growth rate in the market during the forecasting period. This is attributed to the benefits offered by the online platforms including high convenience, attractive discounts, and availability of a large number of products, easy return policy, and free home delivery.

Based on the Type, the Vitamin Supplements market is segregated into Multivitamin, Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, and Others. Vitamin A is useful in promoting the health of digestive organs. In addition, Vitamin A plays a crucial role in healthy vision, immune system, and cell development. In the last couple of years, there has been a drastic rise in the consumption of Vitamin A in the form of supplements to maintain body health and wellbeing, due to the hectic & sedentary lifestyles.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 41.07 Billion |

| Market size forecast in 2027 | USD 74.27 billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 8.0% from 2021 to 2027 |

| Number of Pages | 237 |

| Number of Tables | 412 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Form, Distribution Channel, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America emerged as the leading region in the overall vitamin supplement market. Factors such as rising cases of obesity and lifestyle-associated diseases because of the unhealthy diet and lifestyles, rising disposable income, and easy accessibility to several processed and ready-to-eat foods are responsible for the growth of the regional market.

Free Valuable Insights: Global Vitamin Supplements Market size to reach USD 74.27 billion by 2027

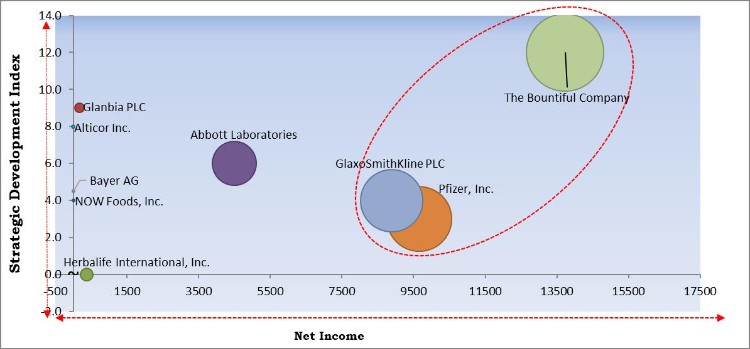

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; The Bountiful Company, GlaxoSmithKline PLC (GSK), and Pfizer, Inc. are the forerunners in the Vitamin Supplements Market. Companies such as NOW Foods, Inc., Glanbia PLC, and Alticor Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abbott Laboratories, Alticor Inc. (Amway Corporation), NOW Foods, Inc., Glanbia PLC, GlaxoSmithKline PLC (GSK), Pfizer, Inc., Bayer AG, Good Health New Zealand, Herbalife International, Inc., and The Bountiful Company (Nestlé SA).

By Form

By Distribution Channel

By Type

By Geography

The vitamin supplements market size is projected to reach USD 74.27 billion by 2027.

Growing demand for vitamin supplements to increase immunity are driving the market in coming years, however, vitamin supplements are not affordable for many consumers limited the growth of the market.

Abbott Laboratories, Alticor Inc. (Amway Corporation), NOW Foods, Inc., Glanbia PLC, GlaxoSmithKline PLC (GSK), Pfizer, Inc., Bayer AG, Good Health New Zealand, Herbalife International, Inc., and The Bountiful Company (Nestlé SA).

Yes, the outbreak of the COVID-19 pandemic has played a pivotal role in increasing the demand for vitamin supplements. As per the U.S. National Health and Nutrition Examination Survey, above half of the U.S. population has consumed these products throughout the pandemic to boost their immunity.

The Tablets market dominated the Global Vitamin Supplements Market by Form 2020, thereby, growing at a CAGR of 6.7% during the forecast period.

The North America market dominated the Global Vitamin Supplements Market by Region 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $27.33 billion by 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.