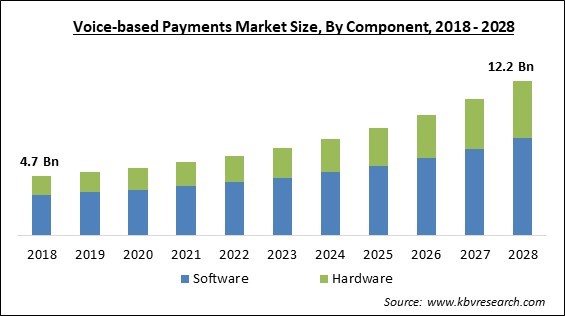

The Global Voice-based Payments Market size is expected to reach $12.2 billion by 2028, rising at a market growth of 11.6% CAGR during the forecast period.

Voice-based transactions are the way of the future. Voice recognition technology has progressed to the point that it can now be used to conduct a payment. All of the benefits of using a card are available with these payments, plus enhanced simplicity and security. Nobody can wrongly take someone’s money, and the transaction is completely secret and safe. Without sacrificing privacy, voices can be modified to avoid discovery on public transportation or in crowds.

These kinds of payment services are getting increasingly popular. This payment mechanism is intended for use with mobile devices or voice assistants. It's no secret that the world is rapidly moving toward the digital age. Credit cards and cash are becoming less popular as individuals increasingly use their phones to make transactions. People are increasingly utilizing their phones instead of their wallets in restaurants, grocery stores, apparel stores, and even to pay for gas. MasterCard announced the launch of a new technology termed "voice-based payments" in October 2017.

Smartphone users are already accustomed to using voice assistants and issuing voice commands. Most iPhone users have used Siri, while a significant proportion of Android users have talked with a virtual assistant through their phone. People utilize voice assistants for two main reasons: ease of use and time savings. Millions of people in the United States have tried paying by voice, and many banks and financial organizations provide it to their customers.

The key driver of voice-enabled technologies is personalization. Voice interactions can provide banks and FinTech companies with important insights into consumer wants and behaviors, allowing them to provide personalized services with a distinct brand touch. Voice payments are now limited to small eCommerce purchases, but machine learning algorithms for voice technology are constantly improving. Customers will soon feel confident enough to use speech to make more expensive and intricate transactions.

During the next few years, the effects of the COVID-19 pandemic are expected to play a significant role in driving the market growth. Contactless payment options are becoming more popular as individuals around the world place a greater emphasis on preventing potential coronavirus infection through contaminated surfaces. During the pandemic, the increased inclination for contactless payment systems is opening up new potential for voice-based payments. Several retail businesses are also implementing voice-based payments as part of their attempts to provide customers with a safe and secure method of payment.

Voice-based payments for online purchasing are on the rise, which bodes well for market growth. Traditional credit card transactions are being phased out in favor of voice-based payments, which require the customer to speak into a microphone on their smartphone to authorize a purchase. When checking out online, the user can choose "pay with voice" and enter the transaction amount. Since it eliminates the need to punch in credit card information or sign up for other apps, this method is growing increasingly popular. This method makes the life of the consumer even more convenient.

Many countries are employing ICT technology to boost digital economies around the world. Several governments are attempting to digitize the payment process. Digital payment solutions are one of the most important components of any country's economic success. It contributes to increased productivity and economic growth, as well as increased tax income, increased transparency, financial inclusion, and new options for end-users. The Indian government has launched a number of efforts to aid in the development of digital payments. Digital India, the implementation of the Unified Payments Interface (UPI), and the 14444-helpline number all contribute to the shift to digital payments. These types of projects aid in the promotion of digitalization and boost awareness of the advantages of modern technology utilization.

Consumers may be unaware that their speech is being captured by computer software, which subsequently transforms the input into digital data, raising privacy and security concerns about voice-based payments. Mobile devices receive voice commands via Bluetooth, Wi-Fi, or cellular networks, all of which are subject to hacking. Consumers have no idea what information is recorded through the app's microphone when they engage with mobile payment apps. When other people are around, voices may be exchanged unintentionally.

Based on Component, the market is segmented into Software and Hardware. The software segment acquired the largest revenue share in the voice-based payments market in 2021. The category is likely to be driven by the increased integration of virtual assistants such as Google Assistant, Alexa, and Siri into voice-based payment systems for traditional banking. The strong efforts being made by numerous voice-based payment providers to improve their products also augur well for the segment's growth. For example, Google announced the availability of speech-to-text functionalities in November 2021, allowing users to add their account details to the app and initiate payments using voice input.

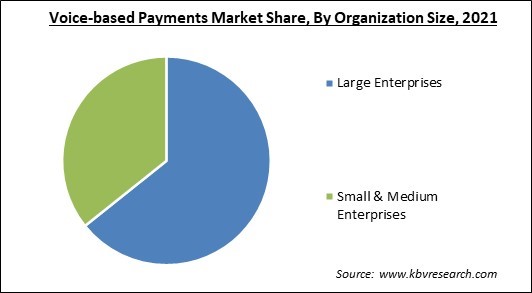

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium Enterprises. The small and medium enterprises segment procured a substantial revenue share in the voice-based payments market in 2021. Small banks are frequently attempting to digitize their services and improve client satisfaction. Small banks are increasingly using paperless services for account opening, necessitating the use of voice-based payments. Various banks' efforts to achieve a competitive advantage and strengthen their market position are projected to propel the category forward.

Based on End-use, the market is segmented into BFSI, Retail, Automotive, Government & Defense, Healthcare & Life Sciences, and Others. The BFSI segment acquired the largest revenue share in the voice-based payments market in 2021. This is because several banks around the world are implementing voice assistants as part of their efforts to streamline operations and improve customer service. For example, NatWest, a retail banking company, revealed plans to test voice banking with 500 of its customers in August 2019. The pilot involved allowing bank customers to use Google Assistant to do a variety of simple banking chores.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 5.8 Billion |

| Market size forecast in 2028 | USD 12.2 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 11.6% from 2022 to 2028 |

| Number of Pages | 218 |

| Number of Tables | 368 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Organization Size, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America acquired the largest revenue share in the voice-based payments market in 2021. The regional market is projected to be boosted by the growing preference for contactless payments. According to MasterCard Contactless Consumer Polling, a considerable number of U.S. customers utilize some sort of contactless payment method, and that these people make cashless payments on a regular basis, not just in the aftermath of the pandemic.

Free Valuable Insights: Global Voice-based Payments Market size to reach USD 12.2 Billion by 2028

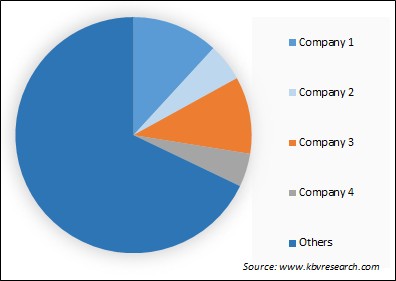

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Google LLC, Amazon.com, Inc., Alibaba Group Holding Limited, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Cerence, Inc., PCI Pal PLC, Paysafe Limited, NCR Corporation, PayPal Holdings, Inc., and Vibe Group (Vibe Pay Limited).

By Component

By Organization Size

By End-use

By Geography

The voice-based payments market size is projected to reach USD 12.2 billion by 2028.

Government initiatives to promote digital payments are increasing are driving the market in coming years, however, apprehension regarding privacy and security of voice-based payments growth of the market.

Google LLC, Amazon.com, Inc., Alibaba Group Holding Limited, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Cerence, Inc., PCI Pal PLC, Paysafe Limited, NCR Corporation, PayPal Holdings, Inc., and Vibe Group (Vibe Pay Limited).

The Large Enterprises segment acquired maximum revenue share in the Global Voice-based Payments Market by Organization Size in 2021, thereby, achieving a market value of $7.5 billion by 2028.

The Automotive segment has shown growth rate of 12.7% during (2022 - 2028).

The North America market dominated the Global Voice-based Payments Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $4.4 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.