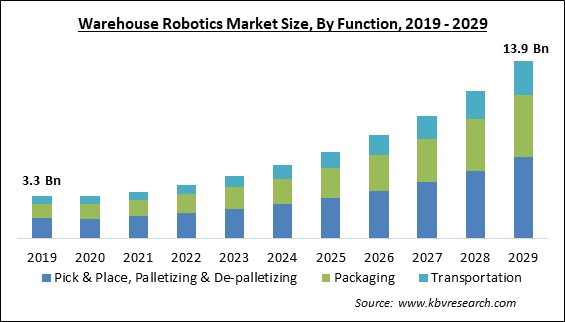

The Global Warehouse Robotics Market size is expected to reach $13.9 billion by 2029, rising at a market growth of 19.0% CAGR during the forecast period.

Warehouse robotics describes the use of robotics, automated systems, and certain specialized software to transfer various duties around and streamline warehouse operations. Robotics has become more well-known recently in the supply chain, warehouse management, and distribution center fields. It continues to be important for warehouse automation.

Modern warehouses are being compelled to give the usage of robotics some serious thought due to technological improvements and a more competitive business environment. Robots for warehouses are no longer just nice-to-have extras; they are now essential to effective warehouse operations due to their capacity to boost productivity, precision, and operational efficiency. The execution of mundane, repetitive jobs can be automated by warehouse automation, which brings value to numerous warehousing operations by freeing up human workers to work on more challenging duties.

Robots in warehousing handle the labor-intensive, demanding, and risky portions of warehouse operations, like delivering merchandise and removing it from heights. As a result, warehouse robots relieve the physical and emotional stress on human workers by assuming some hazardous and demanding activities. Reduced stress on employees also boosts morale, which increases productivity and improves the working environment. With the proper robots, warehouses may improve operational effectiveness, reduce error rates, and deliver orders more precisely.

The robotics industry can now explore the unexplored opportunities in various warehousing tasks while achieving an optimal flow of operation and logistics efficiency across the different industry verticals. This is feasible because of significant technological advancements that enable improved object perception and a precise positioning system. The market has been expanding due to factors such as the expansion of warehouses, increasing expenditures in warehouse automation, an increase in labor expenses globally, and the accessibility of scalable technology solutions.

The development of COVID-19 boosted the number of consumers who wanted to purchase online, forcing retailers to turn to automated systems to fulfill the rising demand. Additionally, businesses adopted automated solutions to protect themselves against unexpected supply chain disruptions. As a result, the market's growth was stimulated by the escalating demand from the food and beverage industry as well as e-commerce. After the pandemic, the manufacturing shifts for semiconductors & electronics also lowered but remained constant. Therefore, the market is expected to experience a slow recovery throughout the forecast period.

Due to the continual introduction of new items, an expanding SKU (stock-keeping unit) count is relatively typical in the sector. In addition, the convenience of customization and the expanding range of consumer options offered by the e-commerce platform drove the need for a larger inventory, with various options and styles at the disposal of online retailers for delivery upon request. The number of large-pallet orders received by distributors is declining due to just-in-time ordering, direct-to-consumer distribution, and changing retailer-wholesaler relationships. Therefore, the rise in modest, multiple-SKU shipments puts pressure on warehouses to automate. These factors are propelling the growth of the warehouse robotics market.

The customer experience is enhanced behind the scenes by advancements in everything from fulfillment capabilities and supply chains to digital payments, further influencing shifts in consumer behavior. Additionally, important factors include the use of the internet and better connectivity, especially in emerging markets where more young people spend more time online. Additionally, the budgets for fulfillment centers and warehouses have not been increased to accommodate the increased volume. Due to these circumstances, warehouses must move products from positions to loading docks more quickly than ever. Hence, the rise of e-commerce, along with the need for faster deliveries, is also proving to be beneficial for the expansion of the market.

Robots are a huge asset in smart manufacturing because they reduce downtime, save time, and eliminate repetitious manual labor. However, deploying highly efficient robots is expensive. As a result, installing warehouse robots in industries demands substantial financial resources. Startups believe that deploying robots in factories is impractical due to their small operations. The costs of upkeep and repairs for robotic devices are also very significant. Furthermore, there is still work on the customization required for robots to be useful for specific businesses. Because of the high implementation costs and lack of compatibility, the market for warehouse robotics isn't expanding as quickly as it could.

Based on product, the warehouse robotics market is characterized into mobile robots, articulated robots, cylindrical robots, scara & parallel robots, and cartesian robots. The mobile robots segment garnered the highest revenue share in the warehouse robotics market in 2022. The development of better mobile robots is aided by developments in artificial intelligence, computer vision, and machine learning in the worldwide warehouse and logistics sector. Mobile robot adoption has been sparked by the growing demand for efficient and affordable solutions in the warehouse and logistics industries to boost productivity and profitability.

On the basis of function, the warehouse robotics market is classified into pick & place, palletizing & de-palletizing, transportation, and packaging. The pick & place, palletizing & de-palletizing segment recorded the largest revenue share in the warehouse robotics market in 2022. Robots are becoming more effective, precise, and adaptable for pick-and-place tasks because of ongoing technical improvements, which are responsible for this growth. In addition, the price of pick-and-place warehouse robots has also come down over time, making them more affordable for smaller factories and businesses, which has led to a rise in the use of robots for pick-and-place tasks.

By payload capacity, the warehouse robotics market is divided into below 10 kg, 11 kg to 80 kg, 81 kg to 400 kg, and 400 kg & above. The 11 kg to 80 kg segment procured a remarkable growth rate in the warehouse robotics market in 2022. Their proficiency in managing medium to heavy-weight objects is credited with the growth. In addition, warehouses for various industries, including manufacturing, healthcare, food, drinks, and more, are calling for robots with bigger payload capacities. Therefore, it is anticipated that market expansion will be aided by ongoing technology advancements and an increased need for automation in warehouse and logistics operations.

Based on component, the warehouse robotics market is segmented into hardware and software. The hardware segment recorded the highest revenue share in the warehouse robotics market in 2022. Robotics technology is advancing, and some of the most well-liked examples are foldable robots that are able to alter size and shape to become more adaptable. Additionally, the development of the hardware segment is anticipated to be fueled by the increasing utilization of collaborative robots across a variety of industries due to their numerous advantages over traditional robots.

By application, the warehouse robotics market is classified into e-commerce, automotive, consumer electronics, food & beverage, healthcare, and others. The automotive segment recorded a significant revenue share in the warehouse robotics market in 2022. The automotive industry is extremely competitive, and the businesses there always strive to provide differentiated value through better warehousing automation. In its storage and manufacturing operations, the automotive industry uses robots more than any other industry. Robotic material handling in warehouses has improved productivity and sped up product launch times.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.2 Billion |

| Market size forecast in 2029 | USD 13.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 19% from 2023 to 2029 |

| Number of Pages | 361 |

| Number of Table | 594 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Function, Application, Product, Payload Capacity, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the warehouse robotics market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment garnered the highest revenue share in the warehouse robotics market in 2022. The presence of the automotive and manufacturing industries in the region is advantageous. The use of warehousing robots is expanding quickly in nations including China, Japan, and India. The warehousing robots business has also grown in the region owing to government backing for improving the infrastructure for these technologies in a variety of sectors, including e-commerce, pharmaceuticals, and machinery.

Free Valuable Insights: Global Warehouse Robotics Market size to reach USD 13.9 Billion by 2029

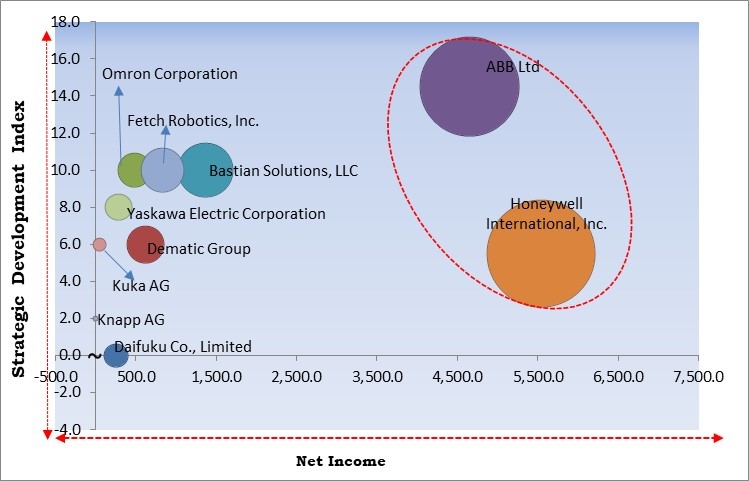

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Honeywell International, Inc., and ABB Ltd are the forerunners in the Warehouse Robotics Market. Companies such as Bastian Solutions, LLC, Fetch Robotics Inc., and Omron Corporation are some of the key innovators in Warehouse Robotics Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Ltd, Bastian Solutions, LLC (Toyota Advanced Logistics Group) (Toyota Industries Corporation), Daifuku Co., Limited, Dematic Group (Kion Group AG), Fetch Robotics, Inc. (Zebra Technologies Corporation), Honeywell International, Inc., Knapp AG, Kuka AG (Swisslog Holding AG), Omron Corporation and Yaskawa Electric Corporation.

By Function

By Application

By Product

By Payload Capacity

By Component

By Geography

The Market size is projected to reach USD 13.9 billion by 2029.

Rapidly expanding e-commerce sector are driving the Market in coming years, however, Constrained adoption of robots in startups owing to high investments restraints the growth of the Market.

ABB Ltd, Bastian Solutions, LLC (Toyota Advanced Logistics Group) (Toyota Industries Corporation), Daifuku Co., Limited, Dematic Group (Kion Group AG), Fetch Robotics, Inc. (Zebra Technologies Corporation), Honeywell International, Inc., Knapp AG, Kuka AG (Swisslog Holding AG), Omron Corporation and Yaskawa Electric Corporation.

The expected CAGR of this Market is 19.0% from 2023 to 2029.

The E-commerce segment acquired maximum revenue share in the Global Warehouse Robotics Market by Application in 2022 thereby, achieving a market value of $4.4 billion by 2029.

The Asia Pacific market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $5.1 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.