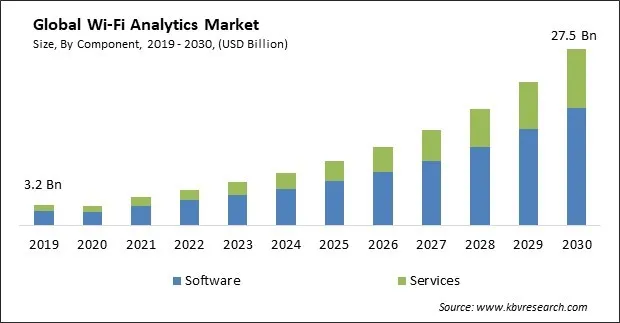

The Global Wi-Fi Analytics Market size is expected to reach $27.5 billion by 2030, rising at a market growth of 22.2% CAGR during the forecast period.

Wi-Fi analytics in retail enables businesses to engage with customers more effectively. Therefore, the retail segment acquired $1,295.4 million in 2022. Retailers use insights from Wi-Fi analytics to understand customer behaviors, preferences, and shopping patterns, allowing for personalized interactions and targeted promotions. It enables retailers to deliver personalized marketing messages and promotions to customers in real-time. By understanding customer preferences and behaviors, retailers can tailor promotions to individual shoppers, increasing the relevance of marketing communications and driving engagement. It assists retailers in optimizing inventory management. By analyzing customer traffic and product popularity, retailers can adjust stocking strategies, ensure product availability, and minimize stockouts or overstock situations, improving overall inventory efficiency. Some of the factors impacting the market are advancements in wireless technologies, proliferation of connected devices, and data privacy and security concerns.

Ongoing advancements in wireless technologies, such as the deployment of 5G networks, improve Wi-Fi networks' overall capabilities and performance. This, in turn, enhances the potential for Wi-Fi analytics to deliver faster and more efficient data processing. Wi-Fi 6, the most recent Wi-Fi standard, provides considerable advances in speed, capacity, and efficiency. Wi-Fi 6 offers technologies that improve user experience and facilitate more effective data handling, such as Target Wake Time (TWT) and Orthogonal Frequency Division Multiple Access (OFDMA). It leverages these improvements to provide more accurate and detailed insights. Multi-User Multiple Input Multiple Output (MU-MIMO) technology allows Wi-Fi routers to communicate with numerous devices simultaneously rather than sequentially. This enhances network efficiency and reduces latency, making it beneficial for applications requiring real-time data, such as those supported by Wi-Fi analytics platforms. Additionally, the increasing number of connected devices, like smartphones, tablets, IoT devices, and smart appliances, contributes to the growth of Wi-Fi analytics. Organizations leverage Wi-Fi analytics to manage and optimize the performance of these devices within their networks. The increasing number of connected devices necessitates efficient utilization of network resources. Its solutions help organizations optimize network configurations, allocate bandwidth appropriately, and ensure a seamless connectivity experience for users across various devices. The proliferation of connected devices extends to smart homes, where Wi-Fi analytics enhances the management of various smart devices. Analyzing data from smart thermostats, security cameras, and other connected devices contributes to an integrated and efficient smart home experience. This integration is valuable for smart city initiatives, where data from various sources, including transportation, public safety, and utilities, can be analyzed for improved urban living. Proliferation of connected devices has been a pivotal factor in driving the growth of the market.

However, one of the primary challenges is the need to address data privacy and security concerns. Wi-Fi analytics involves collecting and analyzing data related to user behavior, which raises issues regarding protecting sensitive information. Heightened awareness of data privacy issues has led to increased scrutiny and stringent regulations globally. Failure to comply with these standards can result in legal implications, fines, and damage to the reputation of Wi-Fi analytics providers. This regulatory landscape can slow down the market as providers navigate compliance challenges. Its solutions that operate across borders may encounter challenges related to differing data protection laws and regulations. Data privacy and security concerns may slow down the expansion of the market.

Based on type, the market is classified into Wi-Fi presence analytics, Wi-Fi marketing analytics, and Wi-Fi advertising analytics. In 2022, the Wi-Fi presence analytics segment dominated the market with maximum revenue share. Wi-Fi presence analytics enable businesses to deliver personalized marketing messages and advertisements based on Wi-Fi-connected devices' real-time location and behavior. This targeted approach improves the relevance of promotions and increases the likelihood of customer engagement. Public spaces like airports, transportation hubs, and city centers leverage Wi-Fi presence analytics for crowd management, security, and infrastructure optimization. Insights into people flow, and congestion help authorities make data-driven decisions to improve public space efficiency.

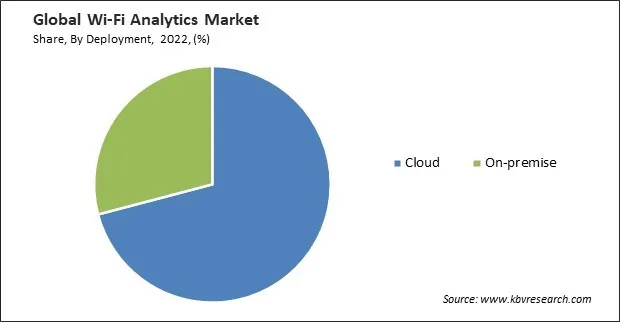

On the basis of deployment, the market is divided into on-premise and cloud. The on-premise segment recorded a remarkable revenue share in the market in 2022. On-premise deployment facilitates low-latency data processing and real-time analytics. This is particularly important for applications where timely insights are critical, such as retail environments, where real-time data can drive personalized customer experiences and optimize operations on the shop floor. On-premise Wi-Fi analytics solutions offer a high degree of customization and flexibility. Organizations can tailor the analytics platform to meet specific requirements, integrate it seamlessly with existing IT infrastructure, and adapt the solution to unique use cases and industry needs.

By component, the market is categorized into software and services. The services segment covered a considerable revenue share in the market in 2022. Training services are essential for organizations to maximize the benefits of Wi-Fi analytics. Service providers offer training sessions to IT administrators, network engineers, and end-users to ensure a deep understanding of the analytics platform. Knowledge transfer empowers organizations to manage and leverage the capabilities of Wi-Fi analytics independently. Service providers conduct network assessments to evaluate Wi-Fi networks' performance, coverage, and efficiency. Through optimization services, organizations receive recommendations for improving network configurations, addressing bottlenecks, and enhancing the overall performance of Wi-Fi infrastructure.

By end-use, the market is fragmented into retail, restaurants/hospitality, travel & transportation, smart cities & communities, education, and others. In 2022, the restaurants/hospitality segment led the market by generating highest revenue share. Offering Wi-Fi access to guests has become a standard expectation in the hospitality sector. It allows restaurants and hotels to provide secure and seamless internet access, enhancing the overall guest experience and satisfaction. It enables personalized customer engagement. Restaurants and hotels can use insights from guest Wi-Fi usage to tailor promotions, send personalized offers, and create targeted marketing campaigns, enhancing guest satisfaction and loyalty. In hotels and conference venues, It assists in managing conferences and events. Understanding attendee movements, preferences, and connectivity needs helps optimize event layouts, improve attendee experiences, and provide reliable internet access during events.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 5.6 Billion |

| Market size forecast in 2030 | USD 27.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 22.2% from 2023 to 2030 |

| Number of Pages | 289 |

| Number of Tables | 450 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter's 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Type, Deployment, End-use, Region |

| Country scope |

|

| Companies Included | Cisco Systems Inc., Aruba Networks (Hewlett Packard Enterprise Company), Fortinet, Inc., Extreme Networks, Inc., Hughes Network Systems, LLC (EchoStar Corporation), Singtel (Temasek Holdings (Private) Limited), MetTel, GoZone WiFi LLC, Bloom Intelligence LLC, and Cloud4Wi, Inc. |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. North America has a high connectivity and internet penetration level, making Wi-Fi ubiquitous. The region boasts advanced technological infrastructure, supporting the deployment of Wi-Fi analytics solutions. With a significant presence in North America, the retail and hospitality sectors have embraced Wi-Fi analytics to enhance customer experiences. The education sector in North America has witnessed technology integration in classrooms and campuses.

Free Valuable Insights: Global Wi-Fi Analytics Market size to reach USD 27.5 Billion by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Cisco Systems Inc., Aruba Networks (Hewlett Packard Enterprise Company), Fortinet, Inc., Extreme Networks, Inc., Hughes Network Systems, LLC (EchoStar Corporation), Singtel (Temasek Holdings (Private) Limited), MetTel, GoZone WiFi LLC, Bloom Intelligence LLC, and Cloud4Wi, Inc.

By Component

By Type

By Deployment

By End-use

By Geography

The Market size is projected to reach USD $27.5 billion by 2030.

Advancements in wireless technologies are driving the Market in coming years, however, Data privacy and security concerns restraints the growth of the Market.

Cisco Systems Inc., Aruba Networks (Hewlett Packard Enterprise Company), Fortinet, Inc., Extreme Networks, Inc., Hughes Network Systems, LLC (EchoStar Corporation), Singtel (Temasek Holdings (Private) Limited), MetTel, GoZone WiFi LLC, Bloom Intelligence LLC, and Cloud4Wi, Inc.

The Software segment is generating the highest revenue in the Market, By Component in 2022; thereby, achieving a market value of $18.3 billion by 2030.

The Cloud segment is leading the Market, By Deployment in 2022; thereby, achieving a market value of $20.4 billion by 2030.

The North America region dominated the Market, By Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.