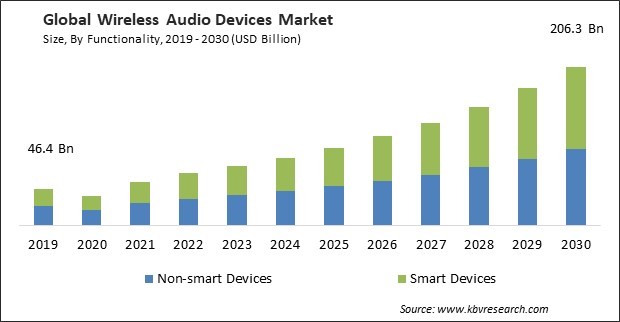

The Global Wireless Audio Devices Market size is expected to reach $206.3 billion by 2030, rising at a market growth of 15.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 3,77,022.6 thousand units, experiencing a growth of 15.0% (2019-2022).

True wireless earbuds are compact, lightweight, and easily portable. Therefore, the true wireless earbuds acquired $24,137.3 million in 2022. Their small form makes them convenient for everyday use, allowing users to carry them in pockets or small cases. This portability has significantly contributed to the popularity of true wireless earbuds. True wireless earbuds eliminate the need for any connecting wires between the earpieces, providing users with complete freedom of movement. This design appeals to individuals who want a hassle-free and tangle-free audio experience, whether for workouts, commuting, or daily activities.

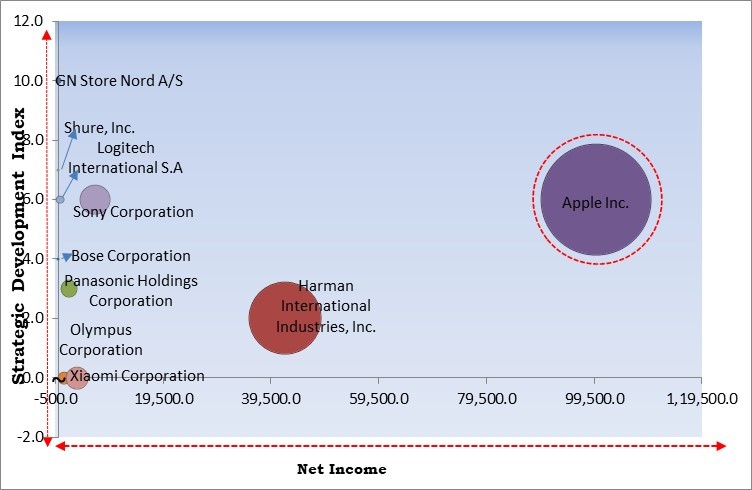

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In, October, 2023, Logitech International S.A. launched Zone Wireless 2 to provide an exceptional, two-way noise-free calling experience. Zone Wireless 2 represents Logitech's premium headset offering tailored for professional users seeking advanced technology. Additionally, In, October, 2023, Sony Corporation launched Pulse Explorer wireless earbuds and Pulse Elite Wireless headset, the audio devices designed for immersive sound and seamless connectivity, catering to different audio needs and preferences.

Based on the Analysis presented in the KBV Cardinal matrix; Apple, Inc. is the forerunner in the Market. In September, 2023, Apple Inc. unveiled Gen 2 AirPods Pro, a wireless audio technology that enables the transmission of high-quality 20-bit, 48 kHz lossless audio. Additionally, apple is also providing magSafe Charging (USB-C) for fast charging solutions. and Companies such as Harman International Industries, Inc, Sony Corporation, Panasonic Holdings Corporation are some of the key innovators in Wireless Audio Devices Market.

The widespread adoption of smartphones, tablets, laptops, and other portable devices has fueled the need for wireless audio accessories, as these devices serve as primary audio content sources. Wireless audio devices provide a convenient and cable-free audio experience that complements the mobility of smartphones. Users can enjoy audio content on the go without being tethered to their devices, which is especially important for commuting, exercising, and traveling. The proliferation of smartphones has led to a parallel demand for improved audio quality. Wireless devices offer high-definition audio, noise cancellation, and immersive sound, enhancing the listening experience. The market is expanding significantly due to the growing adoption of smartphones and devices.

Smart homes have various connected devices, and wireless audio devices can seamlessly integrate with these systems. This integration allows users to control audio playback and customize their audio experience through voice commands or centralized smart home hubs. Smart speakers with integrated voice assistants have become popular in smart homes. Users can control wireless audio devices using voice commands, making it easy to play music, adjust volume, or change tracks hands-free. Multi-room audio allows users to create customized listening zones where different rooms or areas can play different audio content simultaneously. This feature enhances user flexibility and personalization. They can be used for streaming music, making calls, and even as part of a security or intercom system. As a result of the expansion of multi-room audio and smart homes, the market is anticipated to increase significantly.

The proliferation of counterfeit and low-quality wireless audio devices can harm consumers and tarnish the industry's reputation. Ensuring authenticity and quality control is an ongoing challenge. The proliferation of counterfeit products can negatively impact the reputation of legitimate manufacturers. Consumers associate subpar experiences with a particular brand, even if they unknowingly purchase counterfeit products. The presence of counterfeit and low-quality products erodes trust in the market. Consumers may become hesitant to make purchases or extensively research products, slowing down the buying process. Counterfeit and low-quality products can create unfair competition, as they are often priced lower than genuine products. Counterfeit and low-quality products is a significant challenge that hamper the growth of market.

By functionality, the market is categorized into non-smart devices and smart devices. The smart devices segment covered a considerable revenue share in the market in 2022. Smart devices, like smartphones, tablets, and smart speakers, come equipped with wireless connectivity technologies like Bluetooth and Wi-Fi. This seamless connectivity makes it easy for users to connect wirelessly to audio devices, driving the demand for wireless headphones, earbuds, and speakers. Smart devices facilitate the creation of multi-room audio systems, allowing users to synchronize and control audio playback in different rooms simultaneously. This capability has increased demand for wireless speakers and audio systems that seamlessly integrate with smart home ecosystems.

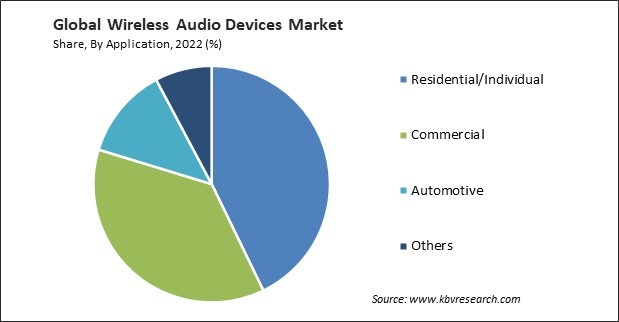

Based on application, the market is classified into residential/individual, commercial, automotive, and others. In 2022, the residential/individual segment witnessed the largest revenue share in the market. These devices are commonly integrated into home entertainment systems. This includes wireless speakers, soundbars, and home theatre systems. Users can create a surround sound experience without complex wiring, enhancing the overall audio quality of their home entertainment setup. These devices enable the creation of multi-room audio systems in residential settings. Users can synchronize audio playback across different rooms or have individual control over each room's audio. This feature enhances the overall flexibility and customization of the audio experience within a home.

On the basis of technology, the market is divided into Bluetooth, Wi-Fi, bluetooth + Wi-Fi, airplay, and others. The Wi-Fi segment garnered a significant revenue share in the market in 2022. Wi-Fi provides high data transfer rates, allowing high-quality audio content streaming without compression. This capability is especially important for audiophiles and users prioritizing premium sound quality. Wi-Fi provides high data transfer rates, allowing high-quality audio content streaming without compression. This capability is especially important for audiophiles and users prioritizing premium sound quality.

By product, the market is segmented into true wireless hearables/earbuds, headsets, speaker systems, headphone, earphone, soundbars, and others. The speaker systems segment projected a prominent revenue share in the market in 2022. Speaker systems have evolved to incorporate advanced voice recognition and control features. Users can interact with their speakers using voice commands, enabling hands-free operation, and contributing to a more intuitive user experience. Wireless speaker systems have become integral components of home theatre setups. The evolution of these systems includes compatibility with surround sound formats, Dolby Atmos, and other technologies to deliver immersive audio experiences in home entertainment environments.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 67.3 Billion |

| Market size forecast in 2030 | USD 206.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 15.2% from 2023 to 2030 |

| Number of Pages | 531 |

| Number of Table | 993 |

| Quantitative Data | Volume in units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Functionality, Product, Technology, Application, Region |

| Country scope |

|

| Companies Included | Apple Inc., Bose Corporation, GN Store Nord A/S (GN Hearing A/S), Harman International Industries, Inc. (Samsung Electronics Co., Ltd), Logitech International S.A, Olympus Corporation, Sony Corporation, Xiaomi Corporation, Panasonic Holdings Corporation, Shure, Inc. |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region led the market by generating the highest revenue share. The Asia Pacific region is home to a large and rapidly growing population, particularly in urban areas. This urbanization has increased consumer demand for portable and convenient audio solutions. The region has a significant youth population, and younger consumers are more likely to embrace technology trends, including wireless audio devices.

Free Valuable Insights: Global Wireless Audio Devices Market size to reach USD 206.3 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Apple Inc., Bose Corporation, GN Store Nord A/S (GN Hearing A/S), Harman International Industries, Inc. (Samsung Electronics Co., Ltd), Logitech International S.A, Olympus Corporation, Sony Corporation, Xiaomi Corporation, Panasonic Holdings Corporation, Shure, Inc.

By Functionality (Volume, Thousand Units, USD Billion, 2019-2030)

By Application (Volume, Thousand Units, USD Billion, 2019-2030)

By Technology (Volume, Thousand Units, USD Billion, 2019-2030)

By Product (Volume, Thousand Units, USD Billion, 2019-2030)

By Geography (Volume, Thousand Units, USD Billion, 2019-2030))

This Market size is expected to reach $206.3 billion by 2030.

Growing adoption of smartphones and devices are driving the Market in coming years, however, Counterfeit and low-quality products restraints the growth of the Market.

Apple Inc., Bose Corporation, GN Store Nord A/S (GN Hearing A/S), Harman International Industries, Inc. (Samsung Electronics Co., Ltd), Logitech International S.A, Olympus Corporation, Sony Corporation, Xiaomi Corporation, Panasonic Holdings Corporation, Shure, Inc.

In the year 2022, the market attained a volume of 3,77,022.6 thousand units, experiencing a growth of 15.0% (2019-2022).

The Bluetooth segment is leading the Market by Technology in 2022;there by, achieving a market value of $76.6 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030;there by, achieving a market value of $79.5 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.