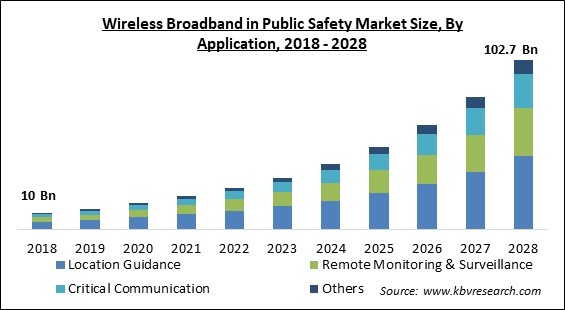

The Global Wireless Broadband in Public Safety Market size is expected to reach $102.7 billion by 2028, rising at a market growth of 26.4% CAGR during the forecast period.

This implementation of fast broadband services for seamless connectivity among public safety groups, federal agencies, local and state governments, and private companies is referred to as wireless broadband in public safety. The bandwidth connections are used to respond to emergencies and accidental circumstances, as well as to improve public readiness in the face of adversity.

For increased communication and interoperability, the service utilizes real-time data transfer applications, long-term evolution (LTE) mobile transmitters, wireless mobile networks, and radio management systems. It's often used in automatic vehicle tracking, integrated device monitoring, video surveillance, and monitoring, real-time incident management, and data device monitoring to capture real-time important information. As a result, police, highway patrol, area security, disaster management, and medical emergency services agencies all use wireless broadband.

The methods of public safety officials’ communication is changing. Data is becoming more important to first rescuers and other emergency professionals as they work to protect lives and property. In last ten years, public safety has seen a surge in wireless broadband use, as well as a massive increase in software, equipment, and data accessible to help them run their operations more effectively and efficiently.

The decision to use a broadband service provider is made at the organization and individual and team levels. Each organization has its own set of requirements and priorities. While choosing a provider, device, coverage, cost, reliability, capacity, and customer service is considered. Similarly, the commercial internet provider landscape is shifting drastically as carrier’s rush to deploy 5G technologies and expand their service throughout the state. In 2016, First Net launched a set of specialized capabilities for the public safety community, and other carriers have subsequently followed suit.

The COVID-19 has prompted a surge in user activity for numerous entertainment and streaming services. Broadband traffic has increased dramatically in the United States since the start of COVID-19. Because US broadband networks have been quicker than many peer countries', they were able to meet the increased demand. COVID-19 has established a new standard, with millions of individuals using far more network capacity than ever before. Tactile robotics to assist medical doctors and nurses in artificial intelligence, drones to monitor crowds, health facilities, and machine learning to evaluate and design healthcare patterns, the Internet of Things (IoT) for logistics operations, and virtual learning for education are just a few of the applications of digital technologies.

The increased use of mobile phones is one of the key causes for the expansion of wireless broadband. People have begun to use the internet for a variety of reasons, including safety and necessity. As per the Mobile Economy Report 2019, mobile services were used by 5.2 billion individuals or 67 percent of the world's population. Fixed wireless broadband network operators often provide users with equipment and install a tiny antenna or dish on the roof. Typically, this equipment is provided as a service and is managed by the company that provides that service. Fixed wireless internet services have grown in popularity in many rural locations where cable, DSL, and other traditional home internet services are unavailable.

The advancement of next-generation technologies is critical for all regions, particularly in post-pandemic situations. Many businesses have adjusted their working strategies as a result of the outbreak, and many employees have taken advantage of the opportunity to relocate to more rural areas. This has led to a reasonable increase in wireless broadband connectivity in rural areas. It is a big economic possibility for rural towns, but only in certain places where residents have access to high-speed internet. Increased broadband usage would enhance the widespread adoption of public safety applications, making high-speed internet a game-changer for rural economies in terms of safety.

Despite developments in wireless security procedures and encrypting approaches for overall public safety, wireless communications are vulnerable to surveillance and security breaches. This is a matter of concern in providing security incorporating Wi-Fi networks and general populace spaces. First responders and data center operators, for example, frequently share critical data and information during evacuation and rescue. If their communication is intercepted, the intruder will gain access to crucial information and disrupt their continuing rescue and management attempts.

Based on Technology, the market is segmented into WI-FI and Cellular M2M. The cellular M2M segment registered a substantial revenue share in the wireless broadband in public safety market in 2021. Machine to machine, or M2M, is the interaction between two devices from any location with activated SIMS, or Subscribers Identity Module Service. These machines can be linked together using wireless or cable connections. Mobile assets, electric meters, fleet automobiles, and fixed assets are just a few of the services that can be used with M2M. Machine-to-machine (M2M) connections are appropriate for linking devices that are already online. The widespread adoption of M2M technologies will further propel the growth of the market.

Based on Application, the market is segmented into Location Guidance, Remote Monitoring & Surveillance, Critical Communication, and Others. The location guidance segment acquired the highest revenue share in the wireless broadband in public safety market in 2021. The location guidance service of a power production storage facility first interprets latitude/altitude coordinates from a smartphone's GPS sensor and transmits them to the power generation facility management server, which calculates the linear distance between the power generation facility location stored in the server and guides location by transmitting power generation facility location to the site manager through a stage of transmission.

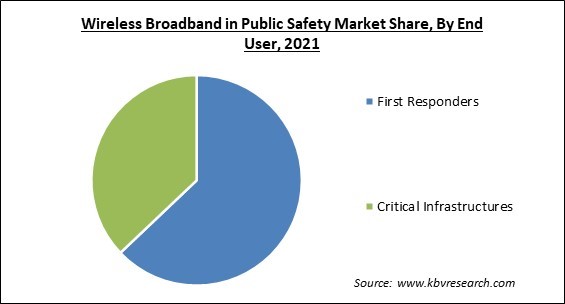

Based on End User, the market is segmented into First Responders and Critical Infrastructures. The critical infrastructures segment acquired a substantial revenue share in the wireless broadband in public safety market in 2021. Wireless broadband plays a key role in the protection of critical infrastructure. Wireless broadband enables businesses to install cameras wherever they are needed, rather than just where a fiber optic cable or copper is accessible. Security groups can utilize applications such as centralized gate access security and remote Internet access, letting remote security personnel and other field employees access the most up-to-date information and alerts with more detail, by providing more broadband capacity deeper and wider in large-scale operations.

Based on Offering, the market is segmented into Hardware, Software, and Services. Based on Hardware Type, the market is segmented into Access Point & Range Extender, Wireless Adapter, and Others. The hardware segment garnered the largest revenue share in the wireless broadband in public safety market in 2021. A wireless broadband network is made up of many components that enable communication over an air medium utilizing radio or light waves. Adapters, routers and access points, antennas, and repeaters are some of the most important hardware components of a wireless broadband network.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 20.3 Billion |

| Market size forecast in 2028 | USD 102.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 26.4% from 2022 to 2028 |

| Number of Pages | 312 |

| Number of Tables | 523 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Offering, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The North American region procured the largest revenue share in the wireless broadband in public safety market in 2021. Following the terrorist attacks of September 11, 2001, government leaders in North America have taken significant steps to improve the safety of the public by investing in wireless broadband technologies. Several measures have been done to expand wireless spectrums, indicating a large pool of possibilities in the compatible wireless network for public safety. Despite the widespread use of TETRA in RoW, the P25 technology is frequently used in North America because of its technical characteristics.

Free Valuable Insights: Global Wireless Broadband in Public Safety Market size to reach USD 102.8 Billion by 2028

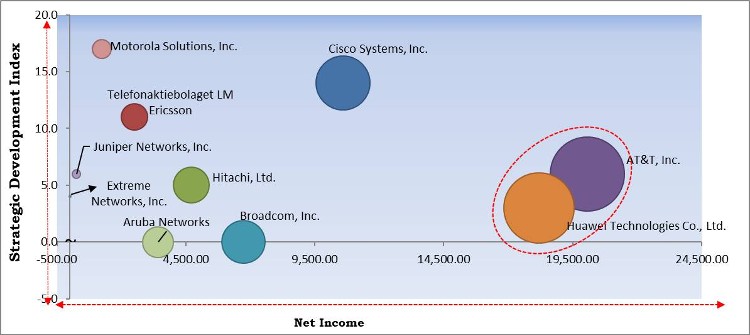

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; AT&T, Inc., Huawei Technologies Co., Ltd. are the forerunners in the Wireless Broadband in Public Safety Market. Companies such as Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson and Motorola Solutions, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AT&T, Inc., Broadcom, Inc., Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson, Extreme Networks, Inc., Huawei Technologies Co., Ltd., Juniper Networks, Inc., Motorola Solutions, Inc., Hitachi, Ltd., and Aruba Networks.

By Technology

By Application

By End User

By Offering

By Geography

The global wireless broadband in public safety market size is expected to reach $102.7 billion by 2028.

Increase in wireless internet availability are increasing are driving the market in coming years, however, violation of privacy and threat of interceptions growth of the market.

AT&T, Inc., Broadcom, Inc., Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson, Extreme Networks, Inc., Huawei Technologies Co., Ltd., Juniper Networks, Inc., Motorola Solutions, Inc., Hitachi, Ltd., and Aruba Networks.

The WI-FI segment is leading the Global Wireless Broadband in Public Safety Market by Technology 2021, thereby, achieving a market value of $76.2 billion by 2028.

The First Responders segment acquired maximum revenue share in the Global Wireless Broadband in Public Safety Market by End User 2021, thereby, achieving a market value of $60.2 billion by 2028.

The North America market dominated the Global Wireless Broadband in Public Safety Market by Region 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.