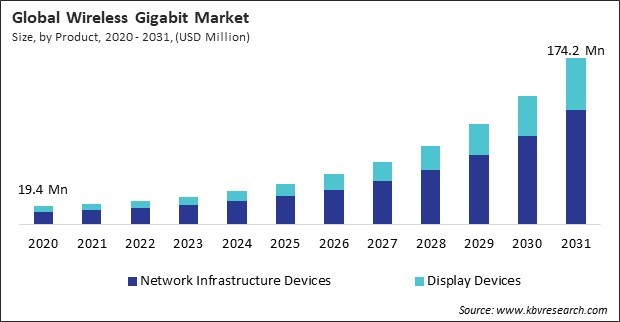

“Global Wireless Gigabit Market to reach a market value of USD 174.2 Million by 2031 growing at a CAGR of 25.8%”

The Global Wireless Gigabit Market size is expected to reach $174.2 million by 2031, rising at a market growth of 25.8% CAGR during the forecast period.

Europe's emphasis on digital transformation in a variety of industries and its robust regulatory support for technological advancements further fuelled the growth of WiGig technology. In Europe, sectors like healthcare, manufacturing, and telecommunications increasingly adopt high-speed wireless solutions to improve efficiency and connectivity, further driving demand for WiGig-enabled devices. Consequently, the European region would acquire nearly 25% of the market share by 2031.

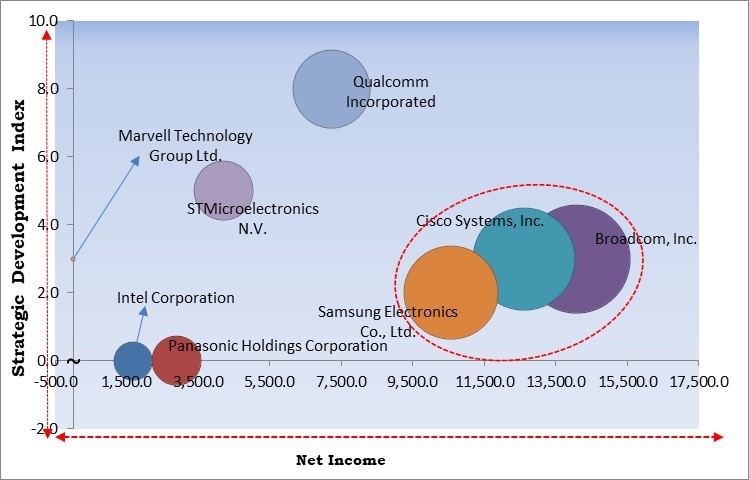

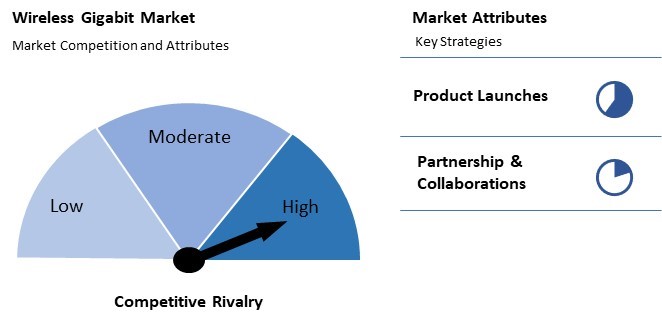

The major strategies followed by the market participants are Product launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2024, Qualcomm released the Snapdragon 4s Gen 2, designed to bring affordable 5G access to entry-level smartphones. Key features include Gigabit 5G connectivity, all-day battery life, and enhanced camera capabilities. Moreover, in August, 2023, Marvell Technology unveiled its 5nm multi-gigabit copper Ethernet PHY platform, designed to meet the high performance and energy efficiency demands of next-generation networks like Wi-Fi 7. The new technology, including the Alaska M 3610 PHY, delivers 10 Gbps speeds at half the power of previous devices, supporting advanced applications and improved enterprise network capabilities.

Based on the Analysis presented in the KBV Cardinal matrix; Broadcom, Inc., Cisco Systems, Inc., Samsung Electronics Co., Ltd. are the forerunners in the Market. In November, 2020, Broadcom released the BCM8989X multigigabit Ethernet PHY transceiver and BCM8957X multilayer Ethernet switch for automotive applications. Both support 802.1AE MACsec for secure in-vehicle data communication, addressing the growing need for bandwidth, security, and time-sensitive networking (TSN) in autonomous driving, 5G, AI, and vehicle-to-everything (V2X) communications. Companies such as Qualcomm Incorporated, STMicroelectronics N.V., Panasonic Holdings Corporation are some of the key innovators in Market.

The adoption of WiGig technology is significantly driven by the growing demand for high-speed internet, particularly in light of the exponential growth of the number of devices that require internet access. Furthermore, the growing number of connected devices in homes and offices is straining traditional Wi-Fi networks. Consequently, the market's expansion will be fueled by the growing demand for high-speed internet throughout the forecast period.

Devices such as smartphones, tablets, laptops, and gaming consoles increasingly incorporate WiGig to meet consumers' needs, requiring high-speed data transfer, low latency, and seamless wireless connectivity. Moreover, the consumer electronics industry, characterized by its rapid innovation cycles and constant evolution, is a key enabler of WiGig technology’s expansion. Thus, the growth of WiGig in consumer electronics is propelled by the need for high-speed data transmission and the industry's rapid pace of innovation.

Deploying WiGig technology requires more advanced and sophisticated hardware than traditional wireless solutions like Wi-Fi. This higher cost can deter businesses, especially in sectors with tight profit margins, such as retail or consumer electronics. Hence, the high implementation costs have slowed down the broader adoption of WiGig technology.

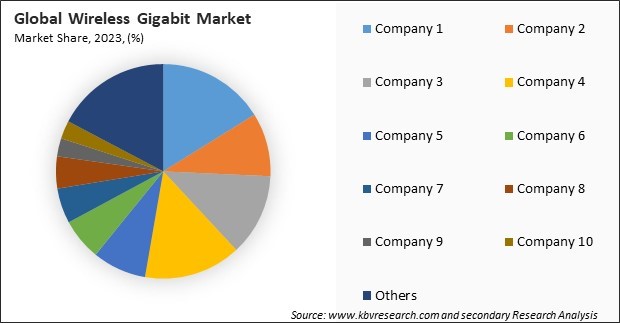

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

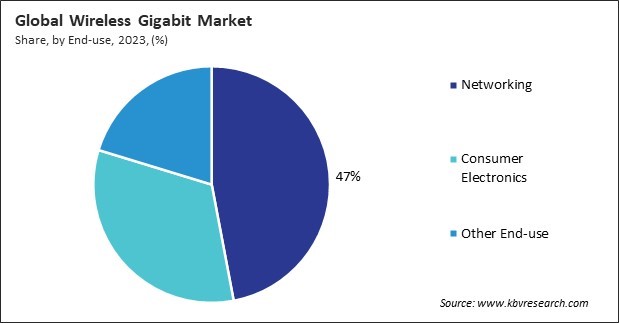

By end-use, the market is divided into networking, consumer electronics, and others. The consumer electronics segment garnered 33% revenue share in the market in 2023. With consumers demanding faster data transfer speeds for activities such as 4K video streaming, wireless gaming, and large file transfers, WiGig’s high-speed connectivity meets these needs by providing seamless, lag-free experiences.

Based on product, the market is bifurcated into display devices and network infrastructure devices. The display devices segment procured 29% revenue share in the market in 2023. Display devices such as wireless docks, adapters, and VR/AR headsets leverage WiGig’s ability to transmit high-quality audio and video content with minimal latency.

On the basis of technology, the market is classified into system-on-chip (SoC) and integrated circuit chip (IC chip). The integrated circuit chip (IC chip) segment recorded 37% revenue share in the wireless gigabit market in 2023. IC chips are fundamental in enabling devices to communicate on the 60 GHz frequency band used by WiGig technology.

Free Valuable Insights: Global Wireless Gigabit Market size to reach USD 174.2 Million by 2031

Region-wise, the wireless gigabit market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 36% revenue share in the wireless gigabit market in 2023. The region's dominance is based on its sophisticated technological infrastructure, the high demand for high-speed connectivity among consumers, and the strong adoption of emerging technologies such as IoT, VR, and AR.

The Wireless Gigabit Market is highly competitive, driven by rapid advancements in technology and increasing demand for high-speed wireless communication. Key players focus on innovation in chipset design, network infrastructure, and device integration. Companies compete on performance, scalability, and cost-efficiency to capture market share and differentiate their offerings.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 29.0 Million |

| Market size forecast in 2031 | USD 174.2 Million |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 25.8% from 2024 to 2031 |

| Number of Pages | 235 |

| Number of Tables | 332 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product, End-use, Technology, Region |

| Country scope |

|

| Companies Included | Broadcom, Inc., Cisco Systems, Inc., Intel Corporation, Panasonic Holdings Corporation, Qualcomm Incorporated (Qualcomm Technologies, Inc.), Samsung Electronics Co., Ltd. (Samsung Group), STMicroelectronics N.V., Marvell Technology Group Ltd., PERASO INC. and Tensorcom, Inc. (NantWorks, LLC) |

By Product

By End-use

By Technology

By Geography

This Market size is expected to reach $174.2 million by 2031.

Increasing demand for high-speed internet are driving the Market in coming years, however, High costs of implementation of wireless gigabit restraints the growth of the Market.

Broadcom, Inc., Cisco Systems, Inc., Intel Corporation, Panasonic Holdings Corporation, Qualcomm Incorporated (Qualcomm Technologies, Inc.), Samsung Electronics Co., Ltd. (Samsung Group), STMicroelectronics N.V., Marvell Technology Group Ltd., PERASO INC. and Tensorcom, Inc. (NantWorks, LLC)

The expected CAGR of this Market is 25.8% from 2024 to 2031.

The Networking segment led the Market by End-use in 2023; thereby, achieving a market value of $78.5 Million by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $60.3 Million by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges