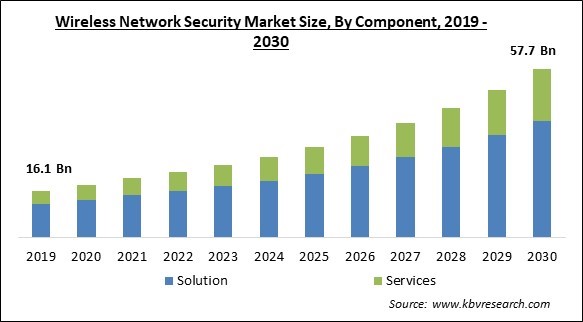

The Global Wireless Network Security Market size is expected to reach $57.7 billion by 2030, rising at a market growth of 12.8% CAGR during the forecast period.

The usage of digital solutions, connected devices, and IT systems is rising due to global technological improvement. Many businesses use software to handle and keep sensitive data in the cloud. The encryption segment acquired $3,029.4 million revenue in 2022 as the organizations employ encryption software to safeguard data transfers from one remote location and overcome the risk of cyber-attacks. The fundamental objective of encryption software is to improve data security from unauthorized users.

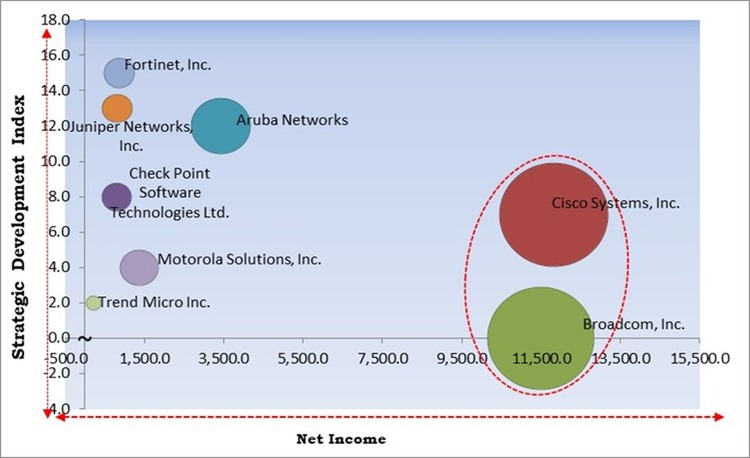

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2022, Aruba, a Hewlett Packard Enterprise company formed a partnership with Siemens to support clients by providing customers with data networks that are highly dependable, secure, and insightful, ensuring high plant and network availability. Additionally, In February, 2023, Juniper Networks expanded its partnership with IBM to empower communications service providers (CSPs) in the delivery improved experience to mobile users through advanced automation.

Based on the Analysis presented in the KBV Cardinal matrix; Cisco Systems, Inc. and Broadcom, Inc. are the forerunners in the Market. In February, 2023, Cisco entered into collaboration with STC for accelerating the rollout of the newest wave of safe, nimble digital services. Companies such as Aruba Networks, Motorola Solutions, Inc., Fortinet, Inc. are some of the key innovators in the Market.

Customers who buy wireless security camera systems can use their smartphones and tablets to remotely access safety, security, video, audio, and alarm systems. The device also contains a wide-angle lens, night vision, and two-way audio. Several aspects of everyday life in the home, such as pet feeding and lighting control, are intended to be automated via the Internet of Things. Options are available for the camera's hardware and software. The security camera will immediately identify any breach or intrusion within the home. There are numerous varieties of security cameras. The cameras' in-built light sensors aid in both accident and intruder prevention. With this wide adoption of smart home appliances, risk of security arises which open growth prospects for the market.

In the past few years, the retail sector has expanded substantially due to the rapid globalization of the e-commerce sector. Therefore, to acquire a competitive edge, retailers are implementing IoT solutions to boost operational effectiveness and improve the consumer experience. The demand for wireless security is anticipated to rise during the expected time frame due to the growing use of IoT in the retail sector. Many European stores are installing small, programmable IoT-connected dashboards or buttons to collect client input and use the results to improve customer experiences. The market is projected to develop as more retailers adopt IoT technologies.

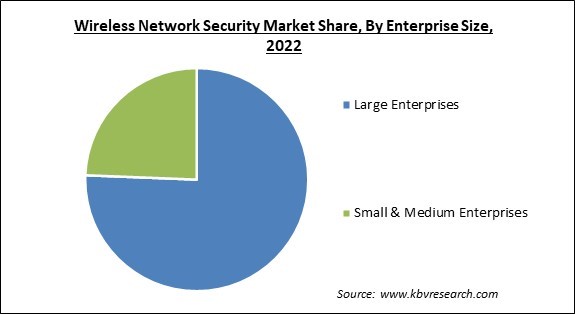

Almost all businesses struggle to deal with threats and lack real data security. Despite this, businesses continue to neglect network security solutions. Additionally, these solutions have a high initial setup cost and requires ongoing maintenance, which is predicted to delay its acceptance for a short while. Small & medium businesses can implement cost-effective security solutions depending on their requirements and company operations, despite the high cost of solutions and rising instances of assaults. Due to a lack of adequate IT security infrastructures caused by their lower financial capacity, these businesses slowly implement new technologies and enterprise security solutions. Small enterprises must properly manage budget funds set aside for various operational issues and business continuity planning, diverting attention away from adopting wireless network security solutions.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

On the basis of component, the market is segmented into solution, and services. The services segment acquired a substantial revenue share in the market in 2022. The significant rise of the segment may be attributable to the increase in end-user companies' desire for managed & professional services to deploy, upgrade, and maintain wireless network security systems at the lowest possible cost. Advanced investigating, advising, routine maintenance, cloud migration, network administration, and unified communications are some of the service's primary strengths.

Under solution type, the market is further divided into encryption, firewall, identity & access management, Intrusion Prevention System (IPS)/Intrusion Detection System (IDS), united threat solutions, and others. The united threat solution segment covered a considerable revenue share in the market in 2022. United threat solution provides solutions to threats and is considered an improvement over the conventional firewall in a security product capable of carrying out many different security tasks, including content filtering, load balancing, network firewalling, data leak prevention, and network hacking prevention.

On the basis of enterprise size, the market is categorised into large enterprises, and small and medium-sized enterprises. In 2022, the large enterprise segment registered the highest revenue share in the market. The wireless network is a target for several cyberattacks, data breaches, and other harmful acts against large businesses. These businesses may suffer large financial losses because of data theft. In order to prevent this, the majority of large enterprises utilize wireless network security solutions to safeguard their sensitive data & control data transfer via a variety of devices, hence encouraging the segment's expansion.

Based on deployment type, the market is classified into cloud, and on-premises. The cloud segment garnered a significant revenue share in the market in 2022. Due to numerous benefits, including low maintenance costs, increased flexibility, centralized data protection, and rapid application development, cloud-based wireless network security solutions are expanding significantly. Eliminating extra software or hardware requirements for managing wireless network security solutions with cloud-based solutions creates a bright outlook for the segment's growth.

By end-use, the market is segmented into BFSI, retail, IT & telecom, healthcare, manufacturing, government & defense, and others. The retail segment projected a prominent revenue share in the market in 2022. The enormous development of the global e-commerce business is impacting the retail sector. As a result, retailers use IoT solutions to boost operational effectiveness and customer satisfaction to gain a competitive advantage. During the forecast period, the retail sector will likely use the Internet of Things more frequently, which will likely lead to a boost in demand for wireless security.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 22.3 Billion |

| Market size forecast in 2030 | USD 57.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 12.8% from 2023 to 2030 |

| Number of Pages | 373 |

| Number of Table | 573 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Enterprise Size, Deployment Type, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating highest revenue share. The growing acceptance of the BYOD concept, increased security breaches, and the presence of experienced market players are driving factors in the North American market. Additionally, numerous end-user businesses from numerous industries, including BFSI, retail, and healthcare, are investing in cybersecurity to safeguard their corporate data from growing digital threats in this region, favourably impacting the market.

Free Valuable Insights: Global Wireless Network Security Market size to reach USD 57.7 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Check Point Software Technologies Ltd., Aruba Networks (Hewlett Packard Enterprise Company), Kaspersky Lab, Cisco Systems, Inc., Fortinet, Inc., Juniper Networks, Inc., Motorola Solutions, Inc., Sophos Group PLC (Thoma Bravo), Broadcom, Inc. (Symantec Corporation) and Trend Micro Inc.

By Component

By Enterprise Size

By Deployment Type

By End-use

By Geography

The Market size is projected to reach USD 57.7 billion by 2030.

Retail is anticipated to contribute significantly to market growth are driving the Market in coming years, however, Low security budgets by businesses may impact the market restraints the growth of the Market.

Check Point Software Technologies Ltd., Aruba Networks (Hewlett Packard Enterprise Company), Kaspersky Lab, Cisco Systems, Inc., Fortinet, Inc., Juniper Networks, Inc., Motorola Solutions, Inc., Sophos Group PLC (Thoma Bravo), Broadcom, Inc. (Symantec Corporation) and Trend Micro Inc.

The Solution segment acquired the highest revenue in the Market by Component in 2022; thereby, achieving a market value of $39.9 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $20.6 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.