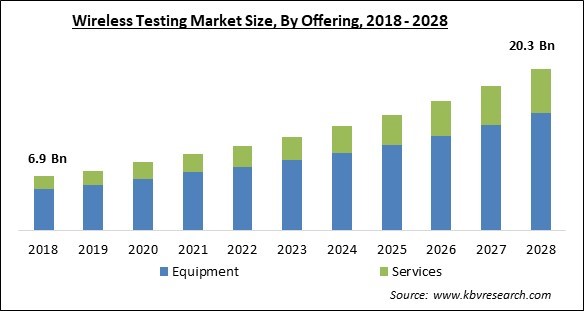

The Global Wireless Testing Market size is expected to reach $20.3 billion by 2028, rising at a market growth of 11.4% CAGR during the forecast period.

Electric devices that are designed to work wirelessly, such as laptops, electric toothbrushes, and industrial applications using wireless components, are evaluated during wireless testing. Manufacturers adhere to laws and regulations on how wireless goods operate for security, health, and safety reasons in accordance with various governments throughout the multiple regions.

Wireless testing's main goal is to assess a product's quality and safety in order to reassure consumers that a manufacturer has complied with national and international laws as well as industry regulations, which guarantee the quality of the product, environmental protection, public health, and safety. Additionally, wireless testing provides consumers with the assurance that tested devices are secure, safe to use, and meet all performance standards. Prior to deployment, products must be wirelessly tested to assure their quality; as a result, there is a clear growth in demand for wireless testing services.

Some of the key reasons propelling the growth of the wireless testing market include the adoption of the cutting-edge product. Along with that, there is continued development of wireless technologies including Near-Field Communications, Bluetooth, and Wi-Fi. Expanding technological advancements in areas like AI and IoT are anticipated to create a number of market possibilities for wireless testing.

The outbreak of the COVID-19 pandemic has impacted various sectors of the business domain, including wireless testing market. This is owing to the implementation of remote working methods brought on by the lockdowns implemented in numerous nations throughout the world in 2021. The number of improvements in the wireless testing market, therefore, grew in 2021. The COVID-19 situation is anticipated to be quickly resolved, and rapid technological advancements in wireless testing technologies are anticipated over the next few years.

Particularly in technologically savvy workplaces, a surge in linked devices has resulted in a need for high-speed internet access. Comprehensive efforts are being made on a large scale for the development of the 5G technology, with 3G becoming outdated and 4G rapidly expanding its prospects all over different applications. For instance, according to numerous top network providers, including AT&T, Sprint, and T-Mobile, among others, the 5G network infrastructures should deliver a connection of about 1 Gbps.

The need for wireless testing has expanded in the automotive industry, owing to the widespread demand for advanced electrical systems in luxury cars & sport utility vehicles (SUVs). For testing wireless equipment used in autos, automotive manufacturers utilize sophisticated electronic systems like radars, cameras, and LIDAR. Mobile connectivity is the main advantage of embedded wireless technology in automobiles. Also, OTA testing is conducted on a variety of wireless devices utilized in the automotive industry.

It is necessary to properly define common communication standards for smart devices since they establish intelligent networks, communicate, and share data with one another. The rapid interchange of data and information across various connected devices is essential for the expansion of the wireless connectivity business. The interoperability problems cannot be resolved by the current connection infrastructures because there are no comprehensive communication standards. Organizations and businesses are working to create a complete standard that will cover a variety of IoT platforms, applications, and devices.

Based on the Offering, the Wireless Testing market is bifurcated into Equipment and Services. Equipment segment procured the highest revenue share in the wireless testing market in 2021. It is due to the growing investing by the market players in the development of advanced devices and equipment. In addition, rise in the expenditure of the companies on the adoption of numerous devices would also create numerous lucrative opportunities for the key market players during the forecast period.

Based on the Equipment Type, the Wireless Testing market is bifurcated into Wireless device testing and Wireless network testing. The Wireless devices testing segment acquired the highest revenue share in the wireless testing market in 2021. This is owing to the integration of several technologies, including 2G, 3G, 5G, and Wi-Fi, wireless devices have grown heterogeneous and extremely complicated. The adoption of wireless testing equipment is essential for the efficient optimization and management of networks, the reduction of interference and traffic in 4G and future 5G networks, and the simplification of administrative activities.

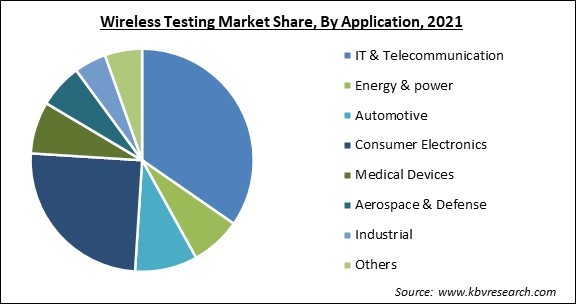

Based on the Application, the Wireless Testing market is fragmented into IT & Telecommunication, Energy & power, Automotive, Consumer Electronics, Medical devices, Aerospace & Defense, Industrial, and Others. The Automotive segment procured a substantial revenue share in the wireless testing market in 2021. Along with security concerns, managing more sophisticated electronic systems and industry standards like automotive ethernet add to the demands placed on-vehicle testing. Without the development of inventive automobile test solutions that facilitate the transfer of road tests to the test rig for reproducibility and test automation, such difficulties would be insurmountable.

Based on the Connectivity Technology, the Wireless Testing market is classified into Wi-Fi, Bluetooth, 2G/3G, 4G/LTE, and 5G & Others. The Wi-Fi segment procured the highest revenue share in the wireless testing market in 2021. It is important to perform wireless testing of the wi-fi network, in order to ensure the safety of complete path of WLAN network. The aim is to identify and eliminate any kind of vulnerabilities in the wi-fi network. Therefore, the wireless testing has great prospects in Wi-Fi network.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 9.6 Billion |

| Market size forecast in 2028 | USD 20.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 11.4% from 2022 to 2028 |

| Number of Pages | 289 |

| Number of Tables | 493 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, Application, Connectivity Technology, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on the Region, the Wireless Testing market is analyzed in North America, Europe, Asia Pacific, and LAMEA. North America emerged as the leading region in the wireless testing market with the largest revenue share in 2021. This is due to the acceptance of new technologies throughout various industries. Advanced technologies like IoT and M2M are likely to heavily rely on 5G networks. Owing to its simultaneous connectivity to numerous devices and low latency, the 5G network is regarded as essential for smart cities and industrial automation, which enhances system performance. Businesses are working to create 5G technologies

Free Valuable Insights: Global Wireless Testing Market size to reach USD 20.3 Billion by 2028

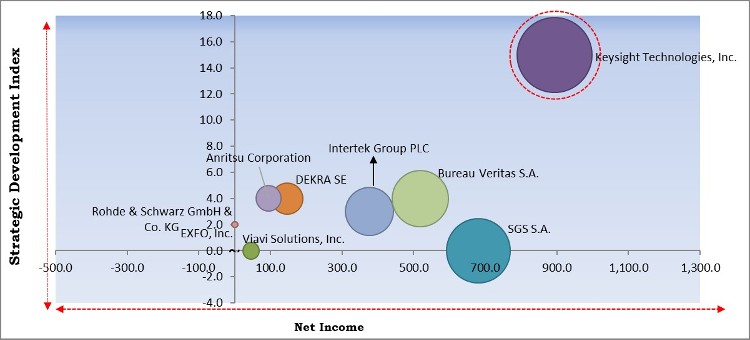

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Keysight Technologies, Inc. is the major forerunner in the Wireless Testing Market. Companies such as Intertek Group PLC, DEKRA SE and Anritsu Corporation are some of the key innovators in Wireless Testing Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Keysight Technologies, Inc., SGS S.A., TÜV Rheinland AG, Rohde & Schwarz GmbH & Co. KG, Intertek Group PLC, DEKRA SE, Anritsu Corporation, EXFO, Inc., Viavi Solutions, Inc., Bureau Veritas S.A.

By Application

By Offering

By Connectivity Technology

By Geography

The global wireless testing market size is expected to reach $20.3 billion by 2028.

Increase in the Need for Interlinked Vehicles to Fuel the Market are driving the market in coming years, however, Shortage of Standardization in Internet Protocols limited the growth of the market.

Keysight Technologies, Inc., SGS S.A., TÜV Rheinland AG, Rohde & Schwarz GmbH & Co. KG, Intertek Group PLC, DEKRA SE, Anritsu Corporation, EXFO, Inc., Viavi Solutions, Inc., Bureau Veritas S.A.

The expected CAGR of the wireless testing market is 11.4% from 2022 to 2028.

The IT & Telecommunication market is leading the Global Wireless Testing Market by Application in 2021, achieving a market value of $6.4 billion by 2028.

The North America market region shows high growth rate in the Wireless Testing Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $6.8 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.