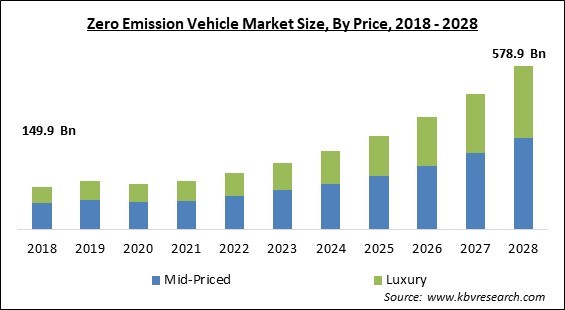

The Global Zero Emission Vehicle Market size is expected to reach $578.9 billion by 2028, rising at a market growth of 19.4% CAGR during the forecast period.

A zero-emission vehicle (ZEV) is one that uses its on-board power source to generate no exhaust pollutants. These vehicles operate on alternative energy sources such as natural gas, battery electricity, and solar power and have significant emission reductions over traditional vehicles. It is primarily intended to replace traditional modes of transportation because they cause pollution. It has become more well-known as a result of several technical developments.

It performs better than a traditional car due to its higher fuel economy, less carbon emissions, ease of home charging, smoother ride, and diminished engine noise. Nitrogen oxides (NOx), volatile organic compounds, and other pollutants like particulate matter and surface ozone are some of the main pollutants encountered in emissions. The deteriorating effects of air pollution include asthma, lung cancer, and cardiovascular illness. The increase in health concerns connected with hazardous substances has gained attention from various government and non-government organisations' the need to revise emission limits.

The market for zero emission vehicles is expanding as a result of factors as rising environmental concerns, strict government rules on vehicle emission standards, and rising demand for high-performance & fuel-efficient cars. Due to clean fuel use and pollution-free operation, ZEVs are predicted to eradicate the pollution that fuel-powered vehicles are responsible for. So, government entities are motivating individuals and organizations to adopt these vehicles by providing substantial subsidies and exemptions for ZEVs.

Customers are preferring ZEVs more frequently as a result of growing consciousness of global warming and increased awareness of electric vehicles. Additionally, the demand for ZEVs is also being propelled by sharp climb in fuel prices, drop in ZEV pricings, increase in ZEV capacity, and a rise in per-capita income. For this market, the move toward electric vehicles is anticipated to present future development prospects. Some automobile manufacturers (OEMs) have already shifted to zero emission vehicles as a result of the enforcement of strict pollution standards.

Numerous small and large participants in the automobile industry experienced problems like suspended production, forced plant closures by the government, and others. Since then, a number of industry leaders in the automotive sector have made concerted efforts to restructure their supply chains and manufacturing processes to accommodate the delivery of essential medical supplies during the pandemic. In order to handle the issue, zero-emission vehicles are used to maintain medical supplies as they offer convenient, affordable transportation and has excellent manoeuvrability. In conclusion, the COVID-19 epidemic has harmed the automotive sector as a whole and consequently the zero emission car sector as well.

The growing trend toward automation in transportation has compelled automakers to use technology that are less harmful to the environment. The ecology is significantly worsened by emissions from internal combustion engines of vehicles since these engines release toxic substances like chlorofluorocarbons and other air pollutants through their tailpipes. In the meanwhile, zero emission vehicles (ZEVs), which generate no pollutants as exhaust gas, offer a solution to these problems. Additionally, they use solar energy to generate electricity, which is expected to lessen their reliance on fossil fuels.

Governments and environmental organisations throughout the world are passing strict emission standards and rules to minimise car emissions in response to growing environmental concerns. Strict emission objectives for the reduction of nitrogen oxides (NOx) and carbon dioxide (CO2) in the air are major regulatory actions. The United States' federal and state governments have increased their efforts to make transportation more environmentally friendly as a result of high levels of greenhouse gas emissions from vehicles.

Although zero emission vehicles (ZEVs) have advantages over regular automobiles, they are more expensive. The high cost of the battery is primarily responsible for the additional expense of purchasing a ZEV as opposed to a fuel-powered car. In addition, compared to vehicles powered by gasoline, diesel, or compressed natural gas, zero emission vehicle production requires far larger upfront investments. The main causes of the high cost of zero emission vehicles are the use of pricey raw materials and the expensive production process. Additionally, these vehicles are anticipated to cost almost twice as much to buy as conventional gasoline-powered vehicles.

By vehicle class, the Zero Emission Vehicle Market is segmented into Passenger Cars, Commercial Vehicles and Two Wheelers. The Passenger Cars segment acquired the highest revenue share in the zero emission vehicle market in 2021. The solar-powered vehicles market has a sizable portion made up of passenger cars. Many automakers are displaying concept vehicles and working prototypes of vehicles that may soon go into production. The "Lightyear One," created by Dutch firm Lightyear is a solar-powered electric automobile with charging panels on the roof and hood.

On the basis of price, the Zero Emission Vehicle Market is divided into Mid-Priced and Luxury. Luxury segment procured a significant revenue share in the zero emission vehicle market in 2021. It is because there are many high-income people who prefer luxurious vehicle, which emits zero pollutant in the atmosphere. Since people are becoming more aware of the environmental problems, they are opting products that support their mission.

Based on vehicle type, the Zero Emission Vehicle Market is fragmented into BEV, PHEV, FCEV and Others. The PHEV (Plug-in Hybrid Electric Vehicles) segment registered a significant revenue share in the zero emission vehicle market in 2021. Developing nation governments are implementing measures to encourage the use of electric vehicles. Additionally, large corporations like the Volkswagen Group are focusing on boosting their sales of plug-in electric vehicles.

By Vehicle drive type, the Zero Emission Vehicle Market is classified into Front Wheel Drive, Rear Wheel Drive and All Wheel Drive. Rear-wheel drive segment recorded a promising revenue share in the zero emission vehicle market in 2021. Rear-wheel drive is a form of engine and transmission layout used in motor vehicles, where the engine drives the rear wheels only. RWD Zero Emission Vehicles guarantee excellent balance and smooth steering that is not disturbed by the need to manage power delivery.

On the basis of top speed, the Zero Emission Vehicle Market is categorized into Less Than 100 MPH, 100 to 125 MPH and More Than 125 MPH. More than 125 MPH procured the maximum revenue share in the zero emission vehicle market in 2021. Car manufacturing giants like Mercedes, Porsche, Genesis, Tesla and many more has brought this category of Zero Emission Vehicles to new heights, in context to the speed. Along with that, the battery power of such vehicles is high, which is contributing to the speed of the vehicle and hence, boosting the segment growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 170.7 Billion |

| Market size forecast in 2028 | USD 578.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 19.4% from 2022 to 2028 |

| Number of Pages | 326 |

| Number of Tables | 534 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Price, Vehicle Class, Vehicle Drive Type, Top Speed, Vehicle Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Zero Emission Vehicle Market is analyzed across North America, Europe, Asia Pacific and LAMEA. Asia Pacific acquired the highest revenue share in the zero-emission vehicle market in 2021. The desire for electric vehicles in China has been fueled by well-developed charging infrastructure, government subsidies, the existence of electric vehicle manufacturers, a drop-in vehicle pricing, an increase in gasoline prices, and increased awareness. Japan is another country with a significant number of battery electric vehicles, in addition to China.

Free Valuable Insights: Global Zero Emission Vehicle Market size to reach USD 578.9 Billion by 2028

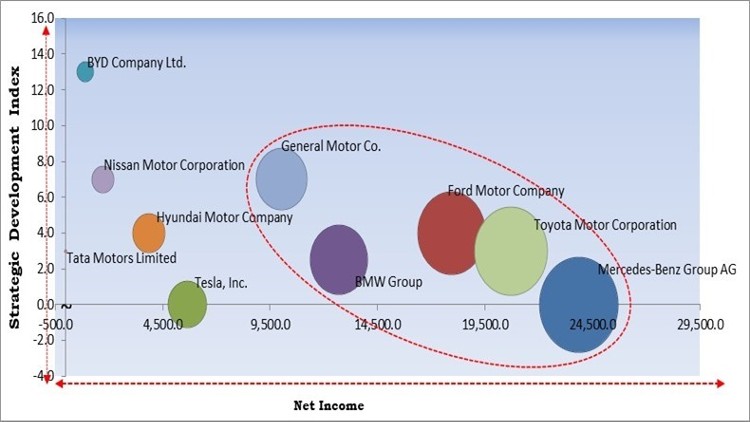

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Ford Motor Company, Toyota Motor Corporation, Mercedes-Benz Group AG, BMW Group and General Motor Co. are the forerunners in the Zero Emission Vehicle Market. Companies such as Nissan Motor Corporation, Hyundai Motor Company and Tesla, Inc. are some of the key innovators in Zero Emission Vehicle Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include General Motor Co., BMW Group, Toyota Motor Corporation, Mercedes-Benz Group AG (Daimler AG), Ford Motor Company, Hyundai Motor Company, Tesla, Inc., Nissan Motor Corporation, BYD Company Ltd., and Tata Motors Limited.

By Price

By Vehicle Class

By Vehicle Drive Type

By Top Speed

By Vehicle Type

By Geography

The Zero Emission Vehicle Market size is projected to reach USD 578.9 billion by 2028.

Increasing Environmental Problems And Rising Awareness Among Population are driving the market in coming years, however, High Cost Of Manufacturing Zero Emission Vehicles restraints the growth of the market.

General Motor Co., BMW Group, Toyota Motor Corporation, Mercedes-Benz Group AG (Daimler AG), Ford Motor Company, Hyundai Motor Company, Tesla, Inc., Nissan Motor Corporation, BYD Company Ltd., and Tata Motors Limited.

The expected CAGR of the Zero Emission Vehicle Market is 19.4% from 2022 to 2028.

The Mid-Priced segment acquired maximum revenue share in the Global Zero Emission Vehicle Market by Price in 2021 thereby, achieving a market value of $322.1 billion by 2028.

The Asia Pacific market dominated the Global Zero Emission Vehicle Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $216.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.