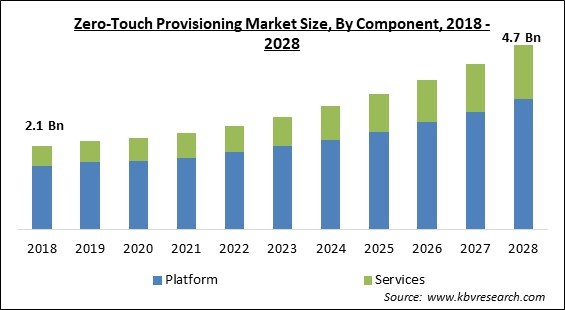

The Global Zero-Touch Provisioning Market size is expected to reach $4.7 billion by 2028, rising at a market growth of 10.1% CAGR during the forecast period.

Device configuration that uses a switch feature automatically is known as zero-touch provisioning. The feature removes the majority of the manual work required to add network devices to a network, enabling IT teams to swiftly deploy network devices, especially in a large-scale environment. Management of the full lifecycle of network elements can be implemented with the help of zero-touch provisioning (ZTP), which offers an easy and dependable deployment solution.

After being installed and started on, new switches and routers that match the requirements for zero-touch provisioning begin the process of automatically loading system files like software version packages, configuration files, and patch files. The switches and routers do not require on-site commissioning by the network administrator. ZTP makes it possible to automatically configure, or provision managed network devices present within a network with little to no manual involvement.

Utilizing scripts linking the tools & devices and configuration management systems enables speedy deployment of network tools & devices along with automating the system advancement/updating process. ZTP can be configured on firewalls, routers, switches, and wireless access points that are part of a software-defined wide area network (SD-WAN). Switch deployment in contexts with customized configuration changes is made possible by ZTP, which combines basic configuration. As a result, it has significant advantages for automating procedures like bug fixes, patch deployment, adding new capabilities to an existing connection, and operating system updates.

The cloud-based infrastructure created to boost the effectiveness of current operations must incorporate automation. Device and network configuration are connected, facilitating and automating device administration. Zero-touch provisioning centrally delivers programs, reassigns licenses in response to changes in work, enforces password policies, encrypts critical data, and configures network equipment settings, including email and Wi-Fi.

The COVID-19 pandemic had a severe effect on the world economy, which therefore affected the roll-out and implementation of 5G infrastructure. During the initial phases of the pandemic, governments in various nations enacted complete or strict lockdowns to curb the virus's spread. The culture of remote work and distance learning accelerated the uptake of 5G services and the implementation of 5G networks. The market for zero-touch provisioning was driven by the urgent demand for automating tasks like installation, software upgrades, and configuration due to the rise in connected network services and devices.

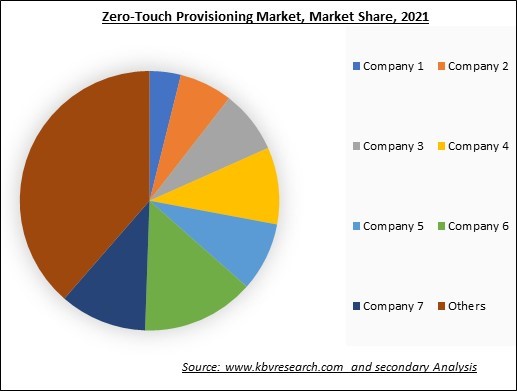

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Manual configuration is time-consuming, expensive, labor-intensive, and prone to errors. Before the configuration can be finished from the central management system, someone on site with some basic configuration knowledge and a laptop needs to set up the device for basic functionality. As a substitute, the device could be delivered to a staging area before being delivered to the installation location. This is also expensive because it calls for sending the item through customs twice and delivering it both times. In addition, this can send an appliance with an IP address intended for one site to any other site by accident.

The Internet of Things (IoT) is essential to automation technology because it facilitates the development of productive, cost-efficient, and responsive system architectures. Solutions for the industrial internet of things (IIoT) help connect industrial devices rapidly, generate transparency, and boost efficiency. The full lifecycle of device management, as well as shop floor software, is made simpler by edge computing and IIoT solutions. In order to streamline the manufacturing process and improve the customer experience, businesses are rapidly implementing IIoT technologies.

Certain organizational and technological obstacles must be addressed before the successful adoption of ZTP. The organizational customer experience structure that communication service providers (CSPs) presently use, typically supported by back-office sales-support workers, needs to be adjusted operationally. For instance, it frequently requires CSP relationship managers' consent for changes to current services, the introduction of new products, and the modification of account information, which clearly impedes the creation of an efficient multi-party ecosystem. It's crucial to authenticate the device and ensure it's connected to the right administration domain.

Based on component, the zero-touch provisioning market is categorized into platform and services. The platform segment garnered the highest revenue share in the zero-touch provisioning market in 2021. ZTP platforms provide businesses with numerous benefits, including streamlined configuration & deployment, increased dependability, improved network visibility, and lower deployment costs and management. These factors are further responsible for the expansion of the segment.

Based on network complexity, the zero-touch provisioning market is segmented into multi-vendor environment, complex network architecture, and dynamic network environment. The dynamic network environment segment procured a remarkable growth rate in the zero-touch provisioning market in 2021. Organizations must update their network devices and systems per evolving technologies due to the frequent expansion and ongoing modification of network requirements. Dynamic network environments present several challenges for organizations, including the complexity of threats, compliance requirements, a lack of agility, and secure data centers.

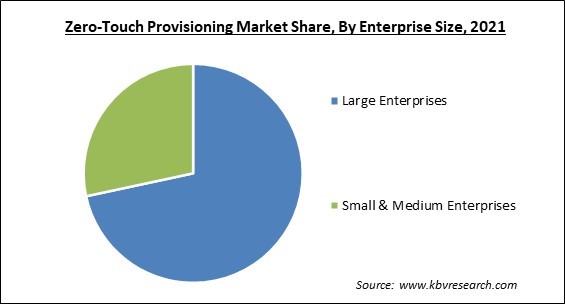

Based on Enterprise Size, the market is segmented into Large Enterprises, and Small & Medium Enterprises. The large enterprises segment acquired the highest revenue share in the zero-touch provisioning market in 2021. The development is attributable to large enterprises' growing use of network virtualization tools, zero-touch provisioning, and network automation. These are anticipated to fuel the segment's expansion.

On the basis of device type, the zero-touch provisioning market is divided into routers & switches, access points, firewalls, IoT devices, and others. The internet of things (IoT) devices segment recorded a significant revenue share in the zero-touch provisioning market in 2021. IoT service providers and device manufacturers are having trouble manually enrolling devices due to technological, security, scalability, and interoperability challenges.

Based on industry, the zero-touch provisioning market is fragmented into IT & telecommunications, manufacturing, healthcare, retail, and others. The IT and telecommunications segment witnessed the largest revenue share in the zero-touch provisioning market in 2021. The expansion of the segment is linked to the rise of network automation, the adoption of cutting-edge technology, and the expansion of connected consumer products. In the IT & telecom industries, zero-touch provisioning is crucial because it reduces operating expenses, time spent on manual labor, and human error.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 2.4 Billion |

| Market size forecast in 2028 | USD 4.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.1% from 2022 to 2028 |

| Number of Pages | 346 |

| Number of Tables | 553 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic, Competitive Landscape, Market Share Analysis, Developments, Company Profiling |

| Segments covered | Component, Network Complexity, Enterprise Size, Device Type, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the zero-touch provisioning market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured the maximum revenue share in the zero-touch provisioning market in 2021. The development is attributable to the region's rising connected devices proportion, the quick adoption of zero-touch provisioning by large businesses and SMEs, and the growing adoption of network automation solutions. Rising investments in smart city infrastructure and new product releases contribute considerably to regional market expansion.

Free Valuable Insights: Global Zero-Touch Provisioning Market size to reach USD 4.7 Billion by 2028

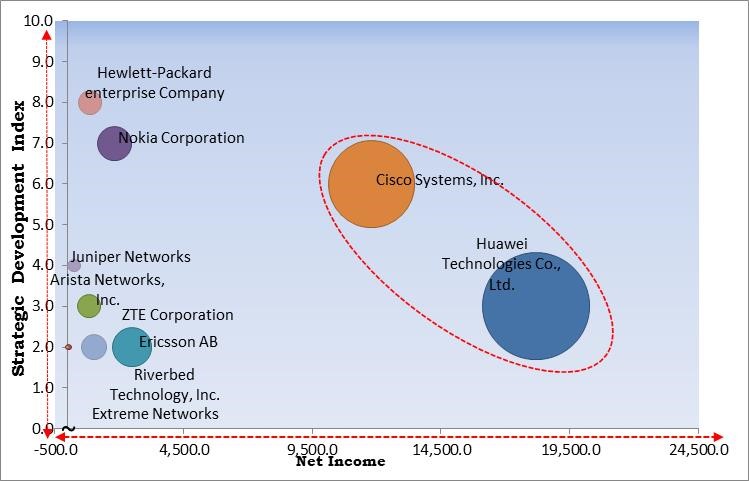

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Huawei Technologies Co., Ltd. and Cisco Systems, Inc. are the forerunners in the Zero-Touch Provisioning Market. Companies such as Hewlett-Packard enterprise Company, Ericsson AB, Nokia Corporation are some of the key innovators in Zero-Touch Provisioning Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Hewlett-Packard enterprise Company (HP Development Company L.P.), Nokia Corporation, Ericsson AB, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Extreme Networks, Inc., ZTE Corporation, Cisco Systems, Inc., Juniper Networks, Inc., Arista Networks, Inc. and Riverbed Technology, Inc. (Thoma Bravo)

By Component

By Network Complexity

By Enterprise Size

By Device Type

By Industry

By Geography

The global Zero-Touch Provisioning Market size is expected to reach $4.7 billion by 2028.

Rising need for eliminating manual configuration are driving the market in coming years, however, Technical and organizational obstacles to a zero-touch implementation restraints the growth of the market.

Hewlett-Packard enterprise Company (HP Development Company L.P.), Nokia Corporation, Ericsson AB, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Extreme Networks, Inc., ZTE Corporation, Cisco Systems, Inc., Juniper Networks, Inc., Arista Networks, Inc. and Riverbed Technology, Inc. (Thoma Bravo)

The Routers & Switches market is generating high revenue in the Global Zero-Touch Provisioning Market by Device Type in 2021; thereby, achieving a market value of $1.9 billion by 2028.

The Complex Network Architecture market is leading the segment in the Global Zero-Touch Provisioning Market by Network Complexity in 2021; thereby, achieving a market value of $2.2 billion by 2028.

The Asia Pacific market dominated the Global Zero-Touch Provisioning Market by Region in 2021; thereby, achieving a market value of $1.7 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.